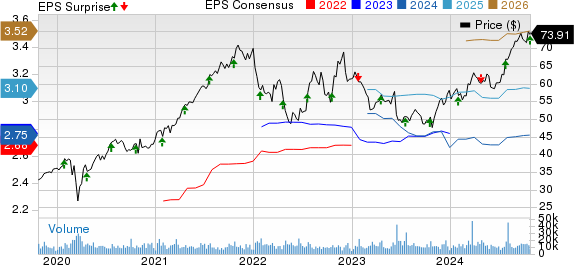

Nasdaq NDAQ reported third-quarter 2024 adjusted earnings per share (EPS) of 74 cents, which beat the Zacks Consensus Estimate by 7.3%. The outperformance came on the back of broad-based growth across three divisions and another quarter of double-digit Solutions growth. The bottom line improved 4.3% year over year.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Sarah Youngwood, executive vice president and CFO, stated, “Nasdaq’s performance continues to reflect the quality and diversity of our platforms, driving strong growth across the business with particular strength in Index and Financial Technology. The company continues to deliver ahead on deleveraging and synergies and is benefiting from significant operating leverage.”

Nasdaq’s Performance in Detail

Nasdaq’s revenues of $1.1 billion decreased 21% year over year. The top line missed the Zacks Consensus Estimate by 1.8%.

Annualized Recurring Revenue (ARR) increased 31% year over year to $2.7 billion.

Market Services net revenues were $266 million, up 13%. The upside was driven by a $15 million increase in U.S. equity derivatives and an $11 million increase in U.S. cash equities. The Zacks Consensus Estimate is pegged at $257 million. Our estimate was pegged at $234.8 million.

Revenues at the Solutions business increased 26% year over year to $872 million, reflecting strong growth from Index and Financial Technology. Organic growth was 10%.

Adjusted operating expenses were $543 million, up 21% from the year-ago period. The increase primarily reflects the inclusion of $61 million of AxiomSL and Calypso non-GAAP operating expenses. Our estimate for operating expenses was $549.7 million.

Adjusted operating margin of 54% expanded 200 basis points year over year.

The Nasdaq stock market welcomed 138 new company listings in third-quarter 2024, including 48 initial public offerings. The number of listed companies was 4,039 at the quarter end.

NDAQ's Financial Update

NDAQ had cash and cash equivalents of $440 million as of Sept. 30, 2024, down 34.9% from the 2023 end level. Long-term debt was $9.4 billion as of Sept. 30, 2024, down 7.9% from the 2023 end level.

Nasdaq generated $244 million in cash flow from operations.

Nasdaq's Capital Deployment

Nasdaq returned $138 million to shareholders in the third quarter of 2024 through dividends, bought back shares worth $88 million and repaid the $50 million of commercial paper in the third quarter of 2024.

The board of directors approved a quarterly dividend of 24 cents per share. The dividend will be paid out on Dec. 20, 2024, to shareholders of record at the close of business on Dec. 6, 2024.

As of Sept. 30, 2024, $1.7 billion remained under the board-authorized share repurchase program.

Guidance Revised by NDAQ

Nasdaq expects 2024 non-GAAP operating expenses to be in the range of $2.15-$2.180 billion compared with $2.145 billion to $2.185 billion guided earlier.

Nasdaq forecasts a 2024 non-GAAP tax rate in the range of 23.5-24.5% revised from 24.5-26.5%.

Zacks Rank

Nasdaq carries a Zacks Rank #3 (Hold) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of a Peer

CME Group CME reported third-quarter 2024 adjusted earnings per share of $2.68, which beat the Zacks Consensus Estimate by 1.1%. The bottom line increased 19.1% year over year. Revenues of $1.6 billion increased 18.4% year over year. The top line beat the Zacks Consensus Estimate by 0.7%.

Operating income increased 24.8% from the prior-year quarter to $1 billion. Our estimate was $954.4 million. ADV was 28.2 million contracts, including record non-U.S. ADV, with EMEA up 30% and Asia up 28% year over year. The total average rate per contract was 66.6 cents.

Upcoming Releases

Intercontinental Exchange ICE will report third-quarter 2024 results on Oct. 31, before market open. The Zacks Consensus Estimate for third-quarter earnings per share is pegged at $1.54, indicating an increase of 5.7% from the year-ago quarter’s reported figure.

ICE’s earnings beat estimates in three of the last four quarters and met estimates in one.

Cboe Global Markets CBOE will report third-quarter 2024 results on Nov. 1, before market open. The Zacks Consensus Estimate for third-quarter earnings per share is pegged at $2.18, suggesting an increase of 5.8% from the year-ago quarter’s reported figure.

CBOE’s earnings beat estimates in each of the last four reported quarters.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Exchange Inc. (ICE): Free Stock Analysis Report

CME Group Inc. (CME): Free Stock Analysis Report

Nasdaq, Inc. (NDAQ): Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE): Free Stock Analysis Report

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)