/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

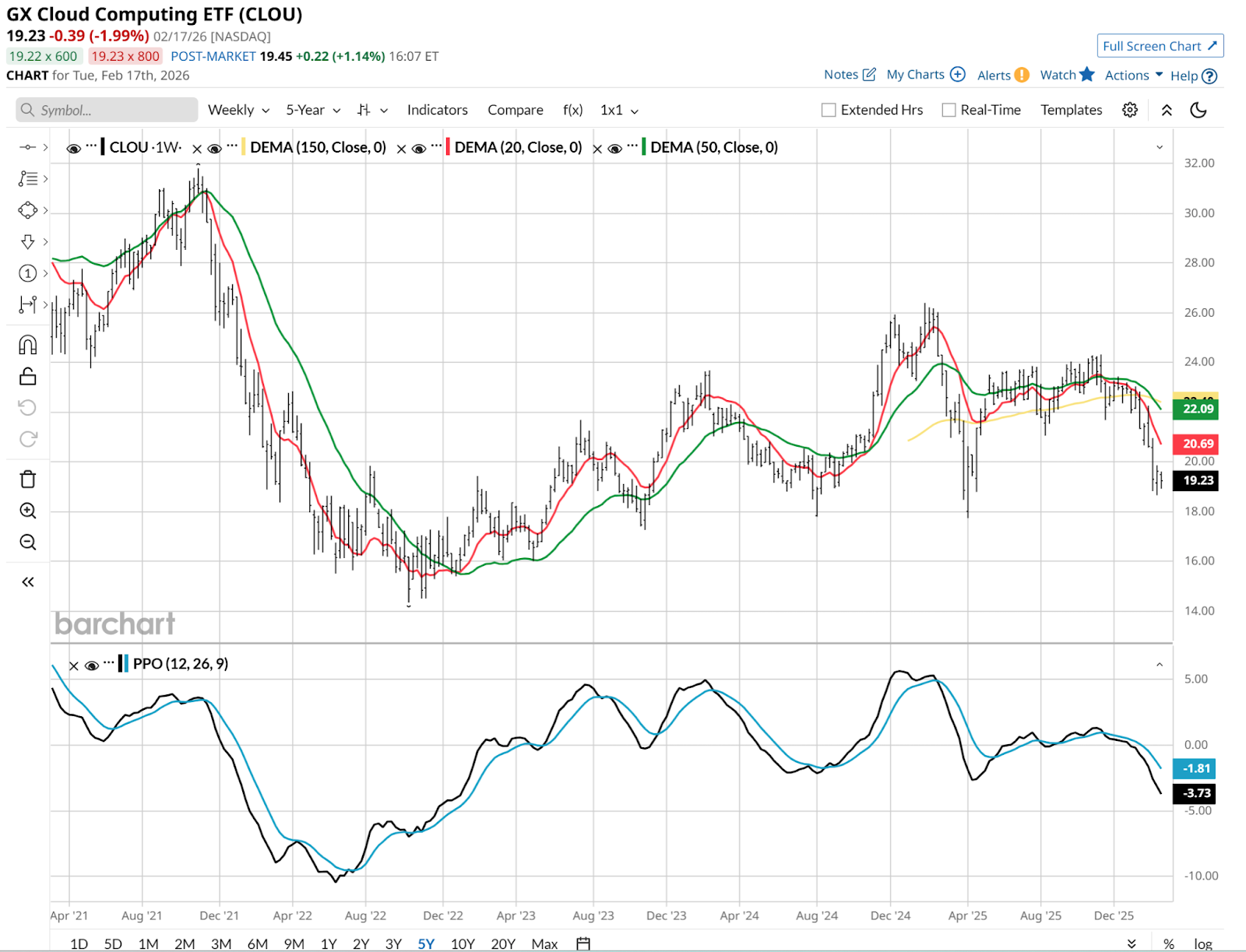

The Global X Cloud Computing ETF (CLOU) has reached its "medal round." After a grueling 12-month stretch that saw the fund shed more than 25% of its value, CLOU is currently teetering on a critical support level that will likely determine the fate of the broader software sector for the rest of 2026.

If CLOU cannot find its footing here, the market may finally confirm that the SaaS-pocalypse — the structural disruption of software by autonomous artificial intelligence (AI) — is a permanent reality.

Look at this daily chart and try to see what I see. An invisible, horizontal line, in that $18 to $19 share-price area. CLOU closed Tuesday at $19.23. It is right there. Waiting to save itself, or go quietly into the abyss. At least for a while.

I’m not a bull on CLOU, and if I were, I’d look at this chart and wonder why I was. It shows downside risk to $14. Think a formerly market-leading industry can’t drop 25% after it just fell by a similar amount? Welcome to tech, the AI cannabilization trade, and the rest of the investing scene in 2026.

The Fundamental Conflict: AI Buildout vs. Software Cannibalization

The narrative for CLOU is a tale of two cloud cities. While the infrastructure side is booming, the software side is under siege. And unlike the Magnificent 7, many companies in the CLOU basket are still trading at high price-to-earnings (P/E) ratios.

CLOU is filled with what I’d consider many of the newer household names. Several rose to significance, then prominence during the pandemic five or six years ago.

This is not a case of just a few behemoths taking up all the oxygen, and thus creating a misleading situation for investors and traders. When you have a more concentrated tech exchange-traded fund (ETF), like S&P 500 Technology Sector SPDR (XLK) or even Nasdaq QQQ Invesco ETF (QQQ), the top-heaviness can be a ticking time bomb.

But in the case of CLOU, they are all being viewed as vulnerable. And for similar macro/thematic reasons. They might not be the “terminal value” favorites they once were. Going from blue-chip-light, emerging growth stories to over the hill and obsolete in a matter of months is quite unheard of in market history. But then again, so is AI.

The challenge, as I see it, is less traditional. It is a very emotional market in 2026, because there’s a growing sense of unease about the impact of AI. Investors are choosing to sell first, and ask questions later.

A Chance for the Sun To Shine on CLOU

While that could create a massive “on sale” situation here, I think the technicals are extremely important. If CLOU doesn’t hold in this area, I believe the relative strength (balance sheets, not technical analysis, for a change!) of the biggest, best fundamental businesses — the ones spending like crazy to make AI work long-term — are the default option.

If companies like Amazon (AMZN) and Microsoft (MSFT) continue to pour $200 billion into data centers while software revenues shrink, the CLOU ETF may find that its medal round ends in, shall we say, a disqualification.

And in their place, we are likely to have a market where Mag 7 stocks, already down notably in price, will be relative winners. In a game no one is happy about. Because it will be a matter of how little or how much your stocks are down, not whether you are up or down.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. For Rob's written research, check out ETFYourself.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)