Space is quietly shifting from sci‑fi daydream to hard industrial plan, and Elon Musk is setting the tone. One closely watched development is a potential 2026 SpaceX initial public offering (IPO) that could value the company near $1.5 trillion, with more than $30 billion in capital potentially raised to fund everything from Starlink expansion to space‑based data centers.

That scale of planned funding signals a long campaign to build real infrastructure in space, not just conduct splashy launches. Musk has also been clear that missions to Mars and even establishing a future lunar base would be “very dangerous" and “much less comfortable than Earth,” framing the whole effort as a gritty survival project rather than a billionaire escape plan.

With that tougher, more realistic perception, Deutsche Bank has shifted attention toward companies working on the hardware and services that a functioning moon economy will actually need. Its research points to a lesser‑known, Houston‑based space firm.

The next step is figuring out whether this quietly positioned company truly deserves to be the one stock to ride the emerging lunar build‑out as that vision accelerates. Let's take a closer look.

What Intuitive Machines' Numbers Say

Based in Houston, Texas, Intuitive Machines (LUNR) is a space technology company that designs and operates lunar delivery, data transmission, and infrastructure services. LUNR stock closed at $16.62 on Feb. 17, up 13% year‑to‑date (YTD) but down roughly 10% over the past 52 weeks.

This price embeds a market value of roughly $2.99 billion and a premium valuation multiple, trading at 8.16 times sales versus a sector median 2 times and 174 times cash flow against a sector median of 15.

Intuitive Machines last posted its most recent earnings covering the quarter ended September 2025, with a per‑share loss of $0.06 versus a $0.04 loss expected. That result translated into a 50% negative earnings surprise.

The company's quarterly sales came in at $52.44 million, up 4% year-over-year (YOY), showing top‑line progress. This revenue growth sat alongside a net loss of $6.84 million, although that figure improved 73% YOY, indicating that operating leverage is slowly moving in the right direction.

Notably, operating cash flow for the same period was a -$7.02 million, a deterioration reflected in the firm's operating cash flow growth rate of -4,487%. The net cash flow line tells a different story, however, jumping to $414.4 million with a 202% increase. That kind of capital influx provides the liquidity runway to pursue ambitious lunar projects

LUNR’s Catalyst Stack

Intuitive Machines put a major marker down on Jan. 13 when it confirmed the completed acquisition of Lanteris Space Systems, formerly Maxar Space Systems. The purchase price was about $800 million before closing adjustments. The acquisition was funded with $450 million in cash and $350 million in Intuitive Machines Class A common stock. That mix matters, as Lanteris comes with a track record of building spacecraft for national security, civil, and commercial customers.

Another key support for the “moon economy” thesis is that Intuitive Machines has completed two lunar missions in less than a year, demonstrating it can repeatedly land on the moon. This operational proof supports the idea that the firm can monetize more than one‑off missions.

At the policy level, the environment has also turned more favorable for companies tied to U.S. lunar ambitions. President Donald Trump has signed executive orders aimed at ensuring U.S. “superiority” in space exploration and defense. His stated goals include returning astronauts to the moon by 2028 and building a permanent lunar outpost by the end of the decade. The Senate’s choice of former SpaceX astronaut Jared Isaacman as NASA administrator further signals a commercial‑first approach.

What Does Wall Street See in LUNR Stock?

Intuitive's next earnings release is set for March 19, covering the quarter ended December 2025, with an average EPS estimate of -$0.05 versus $0.04 a year earlier, implying -225% YOY growth. For the March 2026 quarter, the average EPS estimate improves to -$0.01 from -$0.20 a year earlier, implying 95% YOY growth. That step toward a smaller loss is what analysts are watching.

The analyst tape also shows steady conviction, even if targets differ by firm. Cantor Fitzgerald recently kept its bullish stance on LUNR stock, sticking with an “Overweight” view and a $16 price objective.

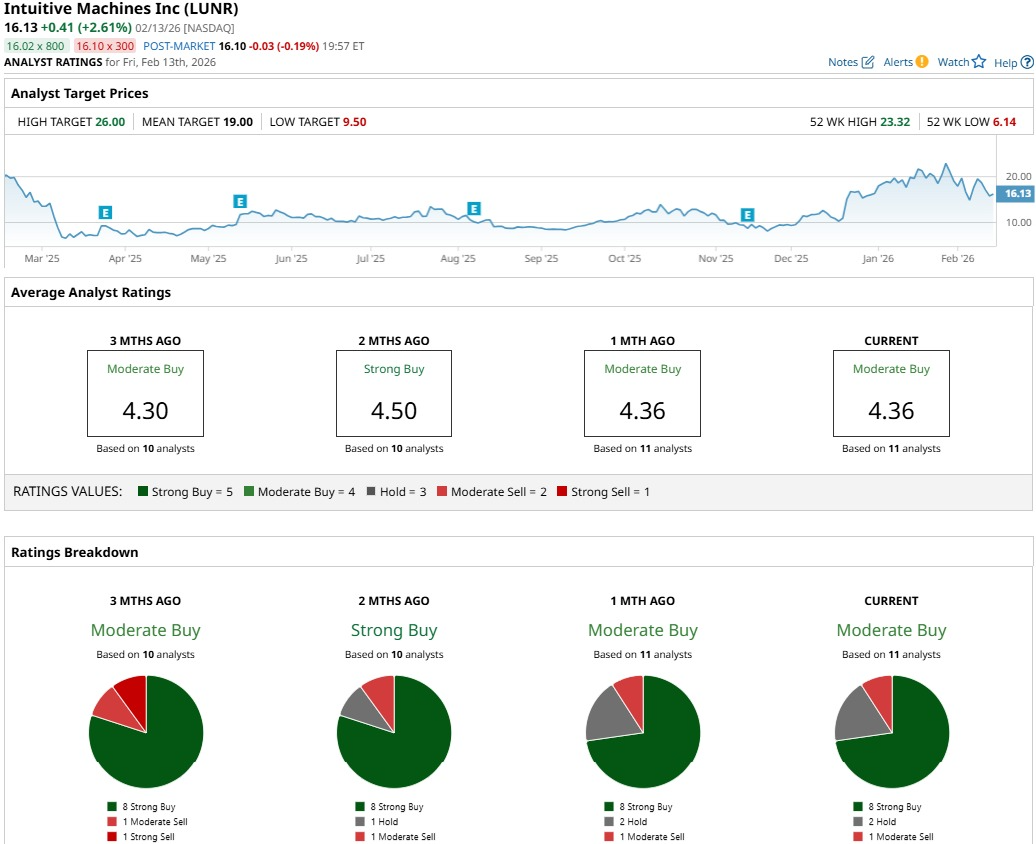

Zooming out, Intuitive’s earnings path lines up with a generally constructive consensus, as 11 analysts have a consensus “Moderate Buy” rating on LUNR stock. The average price target is $19, implying about 5% potential upside from current levels.

Conclusion

In the end, Intuitive Machines looks like a speculative but credible way to bet on the moon economy as Elon Musk and Washington push harder into space. LUNR stock may grind higher over time if management executes on missions, integrates Lanteris smoothly, and turns today’s losses into visibly shrinking red ink. The stock seems more likely to drift toward that $19 consensus target than to collapse, although meaningful volatility around launches, contracts, and earnings updates should be expected.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)