Streaming platform specialist Roku (ROKU) is back in the spotlight, and this time, it’s not hype driving the buzz. It’s hard numbers. The company’s fiscal 2025 fourth-quarter results, released last week, didn’t just top Wall Street’s expectations - it staged a powerful turnaround and provided an optimistic financial outlook. Roku swung from a loss in the year-ago quarter to posting a meaningful profit in Q4, marking a major shift in momentum.

Of course, the market has taken notice. Since delivering that blockbuster quarter, investors and analysts alike have begun warming up to the streaming player once again, with sentiment steadily shifting in its favor. And yet, despite the strong results and improving fundamentals, Roku shares are still down 18.66% so far this year. Considering this, as profitability returns and fundamentals improve, should investors consider stepping in while the stock is still trading at a discount?

About Roku Stock

California-based Roku helped usher streaming onto the television screen and has since built a broad platform that serves viewers, content publishers, and advertisers alike. It connects users to streaming content, enables publishers to scale and monetize their audiences, and offers advertisers data-driven tools to reach consumers. The company generates revenue through a mix of hardware and platform operations.

Its portfolio includes Roku-branded TVs, Roku TV models produced through licensing partnerships with OEM brands, streaming players, and TV-related audio devices sold across multiple countries. Roku also sells Smart Home products in the U.S. In addition, Roku operates The Roku Channel, a free and premium streaming service featuring exclusive Roku Originals.

The channel ranks as the No. 2 app on Roku’s U.S. platform by streaming hours and is available in the U.S., Canada, Mexico, and the U.K. With a market capitalization of about $13.3 billion, Roku saw its shares jump nearly 8.6% on Feb. 13, fueled by optimism a day after its stronger-than-expected Q4 results.

The sharp move reflected a wave of renewed confidence in the company’s turnaround story. But step back from the one-day rally, and the picture looks less celebratory. Even after the post-earnings surge, Roku stock is still down 17.45% in 2026, a notable laggard compared to the broader S&P 500 Index ($SPX), which has declined only marginally this year.

Inside Roku’s Q4 Earnings Results

When Roku released its fiscal 2025 fourth-quarter earnings on Feb. 12, it delivered a set of numbers that clearly impressed investors, sending the stock higher the very next day. Total net revenue came in at $1.39 billion, marking a 16% year-over-year (YOY) increase and comfortably beating Wall Street’s $1.35 billion estimate. The growth was largely powered by an 18% jump in high-margin platform revenue, which rose to $1.22 billion and accounted for approximately 88% of total revenue.

Meanwhile, devices revenue reached $171 million in Q4, up 3% from a year ago. Engagement continues to be a key engine behind Roku’s platform strength. Streaming hours climbed 15% YOY to roughly 145.6 billion in 2025, reinforcing the stickiness of its ecosystem and supporting monetization growth. Profitability metrics were equally encouraging.

Adjusted EBITDA surged a stunning 119% YOY to $169.4 million, while adjusted EBITDA margin expanded sharply to 12.1%, up from 6.5% in Q4 2024. Perhaps the most notable highlight was the company’s return to profitability. Roku posted net income of $80.5 million, or $0.53 per share, a dramatic turnaround from the net loss of $35.5 million, or $0.24 per share, in the year-ago quarter. The reported bottom-line figure also crushed the Street estimate of $0.28 per share.

Management summed it up by stating, “We delivered excellent results in 2025, driven by consistent execution and the differentiation of our leading TV streaming platform. By expanding our Platform monetization over the last two years, we’ve unlocked new growth engines and achieved record-breaking financial performance.”

Looking ahead to the first quarter of fiscal 2026, Roku expects to generate $1.2 billion in revenue and has projected full-year revenue of $5.5 billion, signaling confidence that momentum can continue.

How Are Analysts Viewing Roku Stock?

Roku’s strong quarter didn’t go unnoticed. On Feb. 13, Rosenblatt Securities upgraded the stock to “Buy” from “Neutral,” citing the standout Q4 results, optimistic guidance, and a lineup of near-term growth opportunities. The firm underscored Roku’s powerful position in the U.S. streaming ecosystem, where roughly half of all TV streaming traffic flows through Roku devices. That scale gives the company meaningful leverage, especially as it sharpens its monetization strategy.

Rosenblatt also flagged several potential catalysts ahead, including deeper monetization integration with Amazon (AMZN), a new advertising platform aimed at small and medium-sized businesses, revamped home screen features designed to boost premium ad placements, and continued growth in streaming engagement. Together, these initiatives could further strengthen Roku’s platform revenue trajectory.

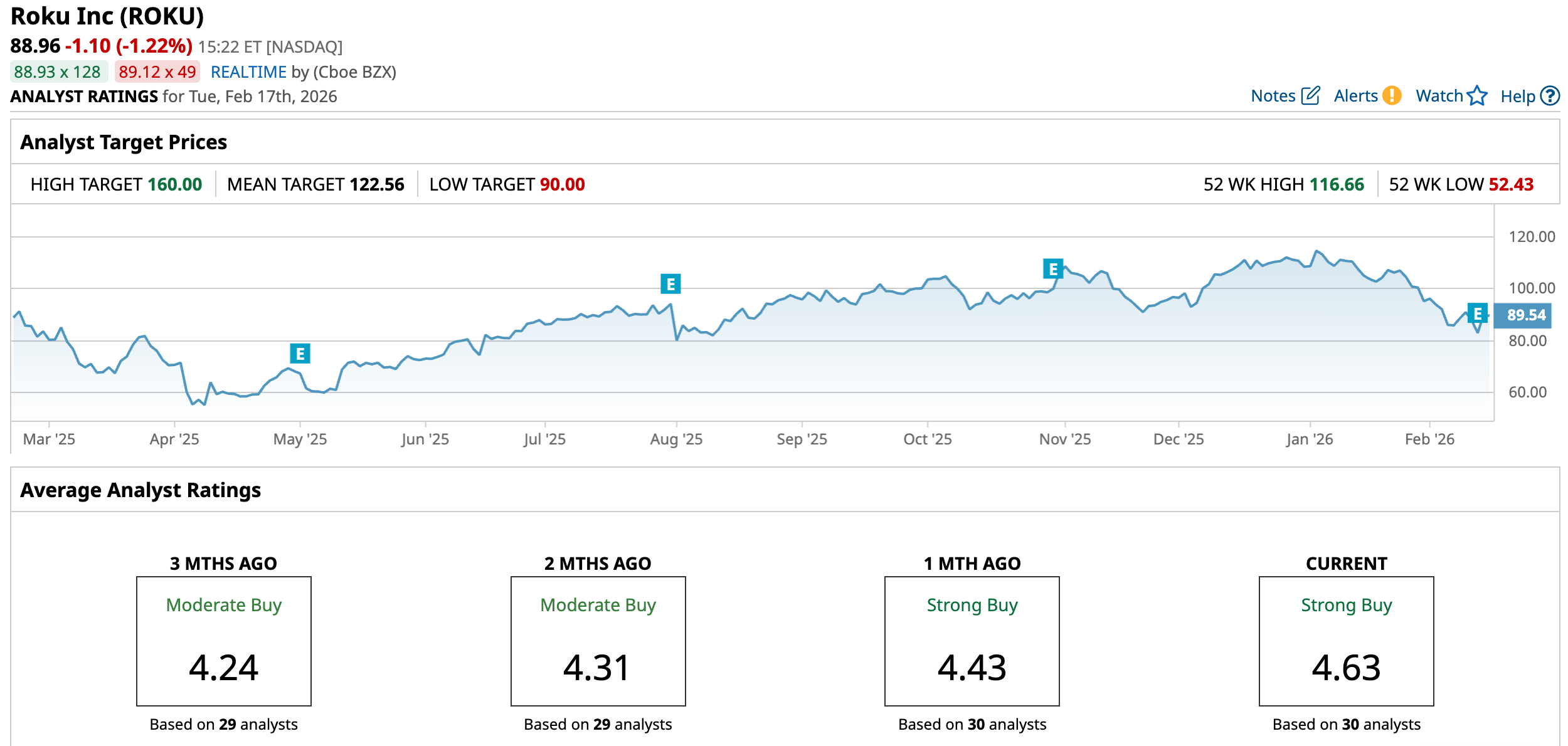

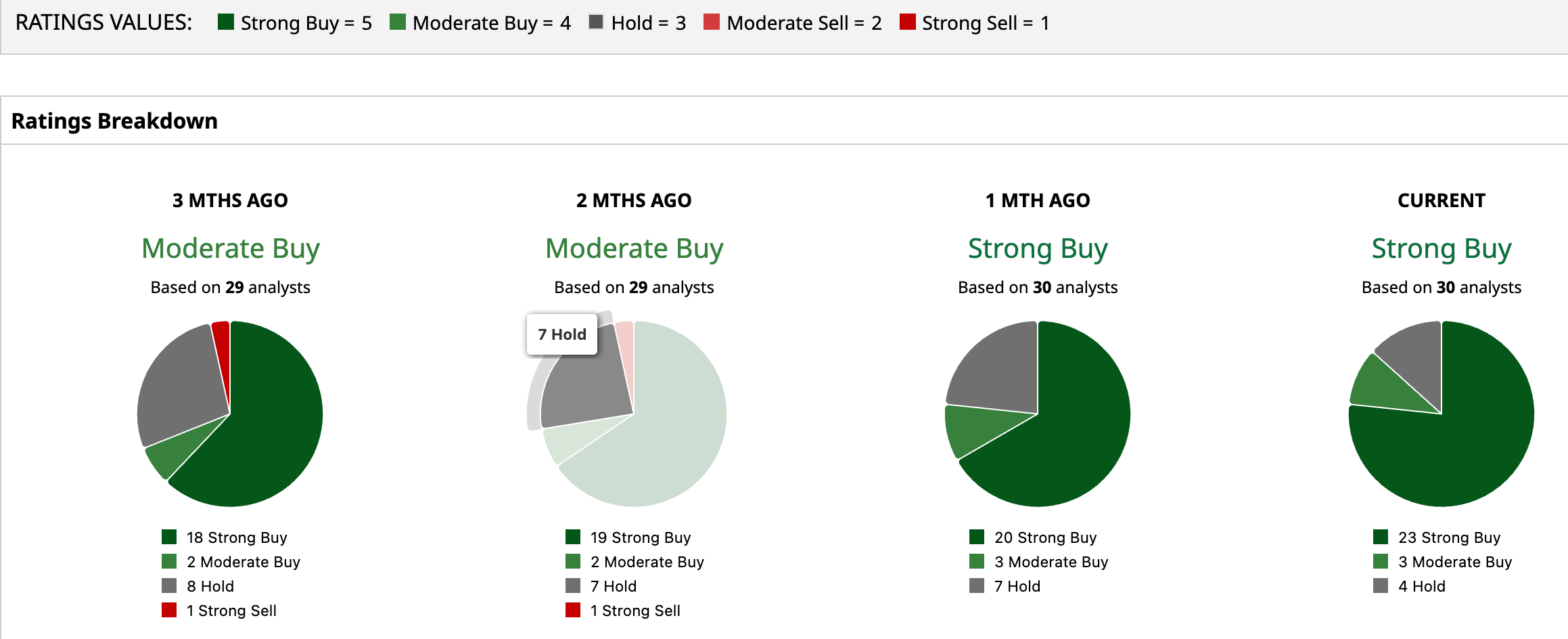

Sentiment on Wall Street has swung firmly in Roku’s favor. The stock now boasts a “Strong Buy” consensus rating, up from a consensus “Moderate Buy” rating just two months back, underscoring growing confidence in its turnaround. Of the 30 analysts covering Roku, an overwhelming 23 recommend “Strong Buy,” three rate it a “Moderate Buy,” and only four advise to “Hold” the stock.

The upside projections are equally compelling. The average price target of $122.56 suggests potential gains of 37.8% from current levels, while the most bullish target of $160 implies the stock could surge as much as 80% if execution continues to impress.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)