Off-price retail company TJX (NYSE:TJX) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 5.9% year on year to $12.48 billion. It made a GAAP profit of $0.93 per share, improving from its profit of $0.76 per share in the same quarter last year.

Is now the time to buy TJX? Find out by accessing our full research report, it's free.

TJX (TJX) Q1 CY2024 Highlights:

- Revenue: $12.48 billion vs analyst estimates of $12.47 billion (small beat)

- EPS: $0.93 vs analyst estimates of $0.88 (6.1% beat)

- Gross Margin (GAAP): 30%, up from 28.9% in the same quarter last year

- Free Cash Flow of $318 million, down 17.2% from the same quarter last year

- Same-Store Sales were up 3% year on year

- Store Locations: 4,972 at quarter end, increasing by 107 over the last 12 months

- Market Capitalization: $110.6 billion

Ernie Herrman, Chief Executive Officer and President of The TJX Companies, Inc., stated, “I am very pleased with our first quarter performance. Overall comp store sales increased 3%, at the high-end of our plan, and both profitability and earnings per share were well above our expectations. Our teams across the Company executed on our initiatives and were laser-focused on delivering consumers exciting values on great brands and fashions and a treasure-hunt shopping experience, every day. We saw comp sales growth at every division entirely driven by customer transactions, which underscores the strength of our value proposition. This also gives us confidence in our ability to gain market share across all of our geographies. The second quarter is off to a good start and we see numerous opportunities for our business for the balance of the year that we plan to pursue. Longer term, we are excited about the potential we see to drive customer transactions and sales, capture additional market share, and increase the profitability of TJX.”

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Sales Growth

TJX is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

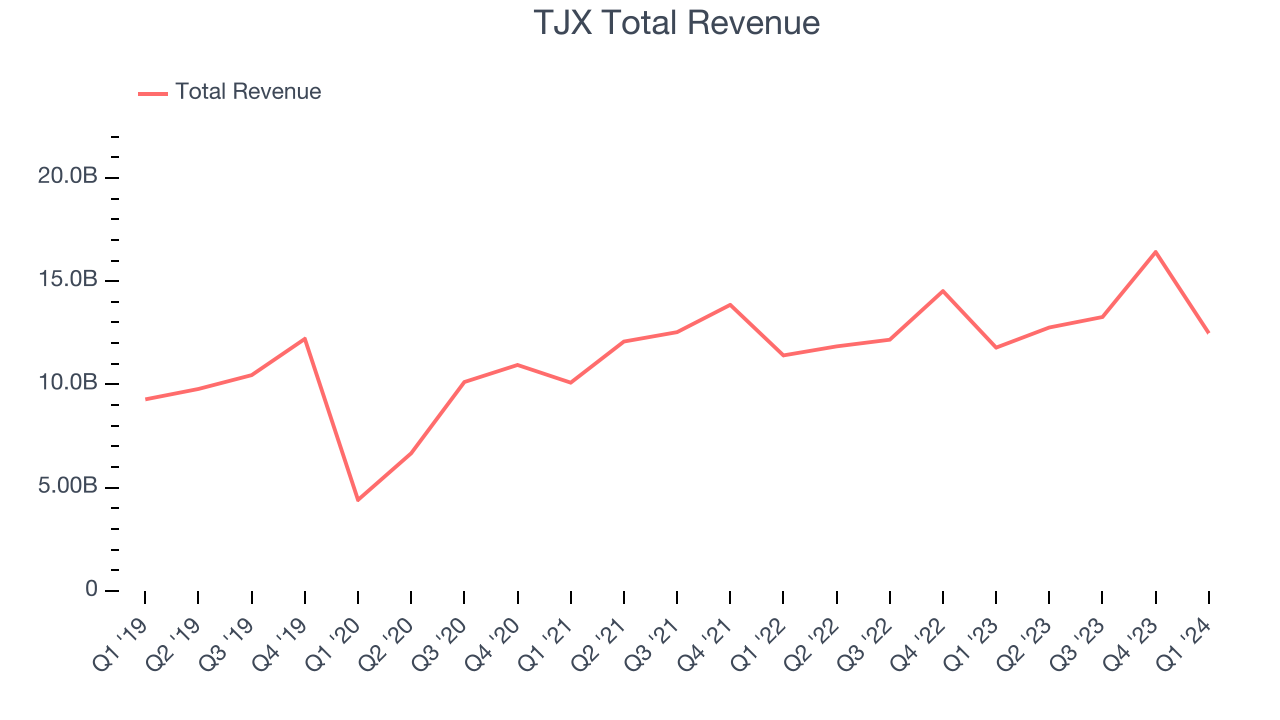

As you can see below, the company's annualized revenue growth rate of 6.8% over the last five years was weak , but to its credit, it opened new stores and grew sales at existing, established stores.

This quarter, TJX grew its revenue by 5.9% year on year, and its $12.48 billion in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.8% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

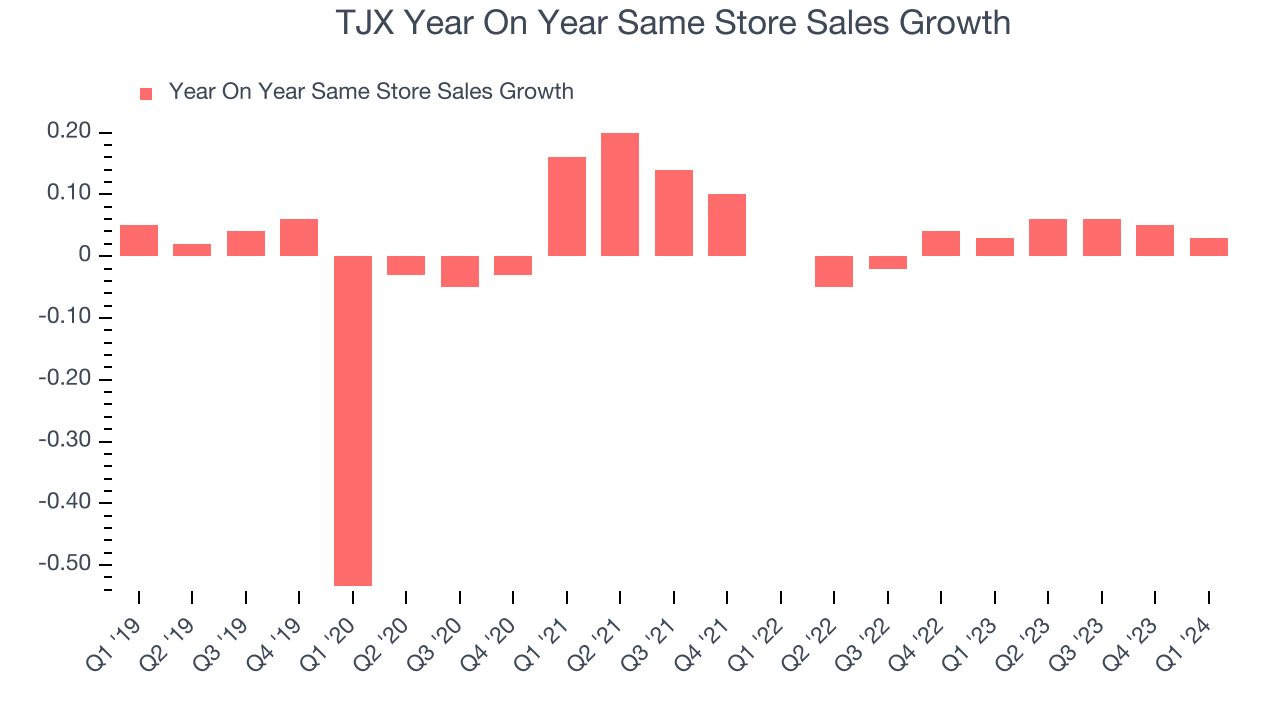

TJX's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.5% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, TJX is reaching more customers and growing sales.

In the latest quarter, TJX's same-store sales rose 3% year on year. This performance was more or less in line with the same quarter last year.

Key Takeaways from TJX's Q1 Results

It was good to see TJX beat analysts' revenue and EPS expectations this quarter. It also raised its full-year earnings guidance, but the company's projections slightly missed Wall Street's estimates. Overall, the results were decent. The stock is up 1.7% after reporting and currently trades at $99.37 per share.

So should you invest in TJX right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)