/shutterstock_611605280.jpg)

As stocks look set to extend their rally into the weekend this Friday, finding reasonably priced companies that are benefiting from artificial intelligence (AI) seems to be an increasingly difficult task. However, there's still at least one reasonably priced play on AI, and it has nothing to do with chips or cloud software.

Think about it - if AI is to live up to its hype, it will have to be adopted across a wide number of businesses. Companies that want to jump aboard the AI train might use an off-the-shelf generative AI product, like 365 Copilot from Microsoft (MSFT) - or they might prefer to utilize a completely customized AI product trained on the firm's own data.

Needless to say, that is not simple. First, a company needs to choose a large language model (LLM) to use. Then its proprietary data needs to be organized in a way to be able to train the AI easily.

Very few companies have that sort of expertise in-house - and that’s where digital transformation consultants come in. One large such consultant is a well-known name in the technology world - International Business Machines (IBM), with its more than 20,000 AI and data consultants.

Perhaps due to its legacy, low-margin mainframe business, many investors don't seem to have priced in IBM's business transformation. Rival digital transformation consulting firm Accenture (ACN) currently trades at nearly double IBM's price-to-cash flow valuation - even though, in recent months, IBM’s consulting business has been taking market share from Accenture.

Let’s take a look at the transformation of 112-year old IBM, and how it is benefiting from AI.

IBM’s Metamorphosis

Many investors still think of IBM as a hardware company with those old mainframe computers that would fill a room. These monster computers were key to IBM's success for a very long time. And it did have success - for decades, IBM was consistently one of the largest companies in the world by market capitalization.

But then Steve Jobs came along, and the age of PCs and microchips was born. This decentralization of computing marked the end of IBM's dominance. Although, it did try to stay on top, being one of the early movers in PCs. However, it was beaten out by companies like Dell, and was forced to eventually sell its PC business to Lenovo in 2005. That sale marked a milestone, as the company shifted away from PC hardware.

In 2002, IBM acquired the consulting business of PricewaterhouseCoopers (PWC). Then, in 2019, IBM bought open-source software business Red Hat - and its transformation was underway.

Red Hat is an open-source software business, best known for its Enterprise Linux product, as well as Red Hat OpenShift, which allows developers to use and manage apps in the cloud. This latter offering alone had $1 billion in recurring revenue at the end of 2022, helping to drive an overall 17% increase in sales for Red Hat during the fiscal year.

While Wall Street hated the Red Hat deal, it has worked out well for IBM. This can be seen in the numbers from last year, when 43% of its revenue came from software, 32% from consulting services, and just 23% from its old-line businesses. And the software and consulting were, not surprisingly, IBM's fastest-growing business segments last year, with revenues climbing by 5.8% and 4.5%, respectively, according to Melius Research.

And remember Watson? Well, it's still alive and well at IBM. There is the Watsonx.ai studio, which is a platform that provides businesses with large language models (LLMs) where they can actually build their own chatbots. Another product is Watsonx.data, which helps companies make use of their proprietary data.

IBM's consulting order book is rapidly gathering steam, with year-over-year growth accelerating to 28% in the third quarter from 7% in the first quarter. (Accenture reported flat growth for the same period.) For the fourth quarter, IBM chairman and CEO Arvind Krishna said: “Client demand for AI is accelerating and our book of business for watsonx and generative AI roughly doubled from the third to the fourth quarter."

In the fourth quarter, IBM reported consulting revenues of $5 billion, up 5.8%. Here is the breakdown: business transformation up 6%, technology consulting up 5%, and application operations up 7%.

This will translate to rising profit margins for IBM, as software will make up a larger proportion of the revenue mix. FactSet broker consensus is that its operating margins will expand to over 18% next year, but I believe that is too conservative - 20% is possible.

Why Buy IBM Stock?

IBM has focused its business in recent years on growing its hybrid cloud and AI offerings. CFO Jim Kavanaugh told analysts during the earnings conference call on Jan. 26 that software and consulting now represent 75% of IBM's revenue base, compared to 55% in 2020.

I expect IBM’s consulting revenue growth to keep accelerating over the coming years, as a growing number of companies will need help from IBM’s consultants in picking large language models, prepping data, creating apps and monitoring performance.

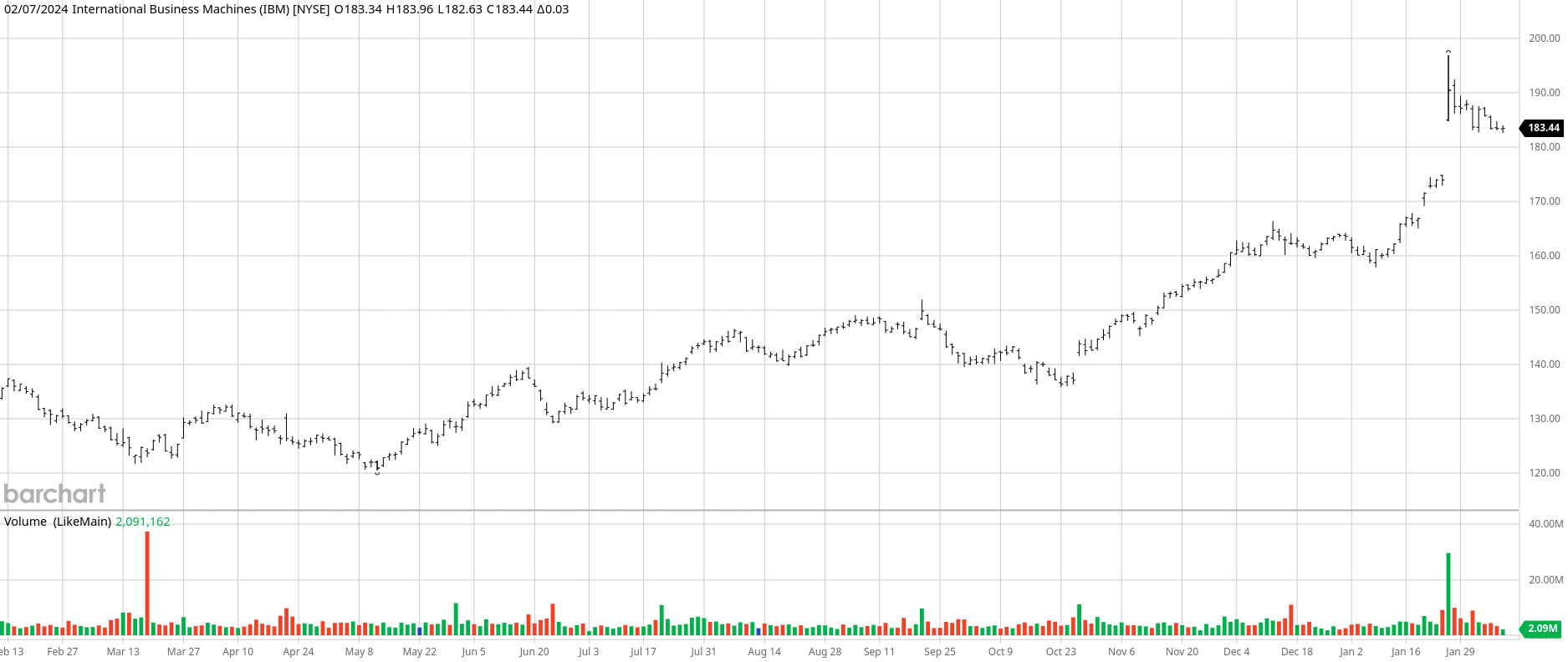

The market is beginning to notice IBM. Its share price is up by 39% over the past 52 weeks, with nearly all of that gain occurring since it hit its 52-week low on Oct. 23, and is now trading at its highest level since the middle of 2013.

However, it still lags other AI-related companies. IBM trades at 17.31 times 2024 earnings, compared to 30.16x for Accenture. And if we look at cash flow, IBM trades at a mere 12.11 times last year's operating cash flow while Accenture is at 24.25x.

IBM is still seen by many investors as a tech sector relic, with pictures of those computers that would fill a room in their mind. This is totally wrong. Much like a butterfly, IBM has undergone a metamorphosis. Buy IBM stock at $185 or lower.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)