/Tesla%20Charging%20Station%20Plugged%20In.jpg)

Tesla Inc (TSLA) stock is down a good deal after its earnings release on Jan. 24. But TSLA stock may now have hit a bottom and its put premiums are very high. That makes them worth shorting out-of-the-money (OTM) puts as an income play.

In mid-day trading on Friday, Jan. 26, 2024, TSLA is at $184.25 per share. This is down significantly from a week ago at $220.34 and its recent peak at $260.89 on Dec. 27, 2023. However, the stock is up today and may have hit a bottom.

As a result, put option premiums in near-term expiry periods have skyrocketed. That presents a huge income opportunity for short sellers. This is especially true since Tesla is still making positive free cash flow (FCF).

OTM Puts Look Attractive

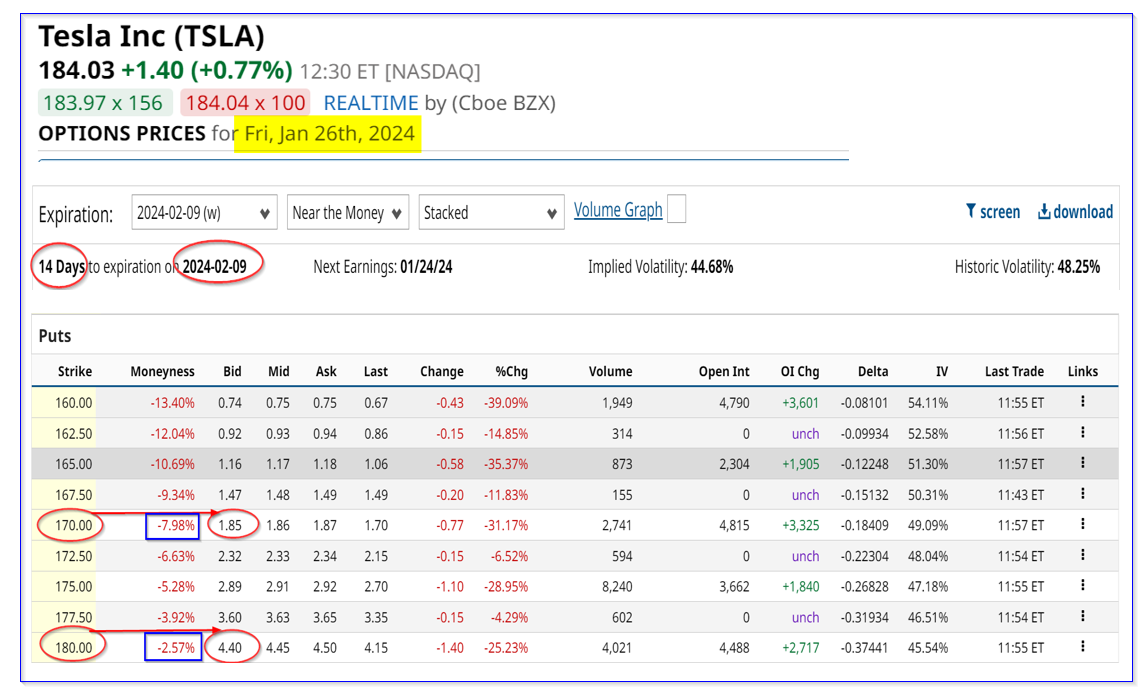

I discussed this in my last Barchart article on Jan. 21, 2024, “Tesla Stock Is Still Worth Considerably More Based on Its Free Cash Flow.” At the time I suggested shorting the $180 strike price puts for expiration on Feb. 9, 2024.

Those puts are still out-of-the-money by over 2.5%. But the premium is now very attractive at $4.40 per put. For example, anyone who shorts 1 put contract at $180 for expiration on Feb. 9 by securing $18,000 with their brokerage firm can immediately receive $440.

That works out to an immediate yield of 2.44% with just 2 weeks to go before that option expires.

Moreover, on an annualized basis, assuming the investor can theoretically replicate this trade every 2 weeks for the next 12 weeks (i.e., 6x), the expected return (ER) is $2,640. That works out to 14.67% per quarter or $26.40 per 100 shares shorted. That is a very attractive income opportunity.

It helps make up for the amount that TSLA has fallen (i.e., $184.25 +$26.40 = $210.65). It also provides good downside protection. The breakeven price is $180.00-$4.40 or $175.60, which is 4.58% below today's price.

Other Plays

Moreover, more conservative investors, including existing shareholders, might be more comfortable shorting the $170 strike price puts. Those trade for $1.85 per put contract shorted, or 1.088% in just 2 weeks. That also has a good ER for the next 12 weeks of 11.28% (i.e., 1.088% x 6), assuming the same yield can be repeated every time.

One way to hedge the $180 short put play is to buy $175 puts for $2.89. The net credit is $1.50 (i.e., $4.40 - $2.89). Therefore, the investor has limited their downside risk should the stock fall below $180.00 in the next weeks. They still end up a net credit and a potential downside unrealized loss of just $3.49 (i.e., $5.00 - $1.51).

But even in that case the investor can monitor the situation and if TSLA rises and the $175.00 put premium decays they can sell the long put. That would enhance the overall return.

The bottom line is that TSLA stock has probably hit a short-term bottom here and the stock could potentially rebound. That makes it attractive to short these high-premium OTM puts.

More Stock Market News from Barchart

- 2 EV Stocks That Look Like Better Buys Than Tesla

- Why is Big Tech Backing of AI Startups Drawing FTC Scrutiny?

- Broader Market Gains on Goldilocks U.S. Economy

- 5 Uranium Stocks With 23% or More Upside Potential

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)