As concerns over environmental sustainability and the need for cleaner energy alternatives intensify, electric vehicles (EV) are still a hot topic on Wall Street - even as industry leader Tesla (TSLA) has been struggling mightily this year, thanks to concerns over declining margins as it battles rising costs and stiff competition from Chinese rivals. The company's recent fourth-quarter results also disappointed, with investors rattled by management's forecast of lower delivery volumes, along with a lack of detail on the timeline for next-generation platform vehicles.

Meanwhile, two rising EV players - Blink Charging (BLNK) and ChargePoint Holdings (CHPT) - are gaining Wall Street’s attention, and these stocks just might be a better bargain buy than Tesla now. Although both stocks saw sharp declines in 2023, compared to Tesla’s gain of over 100%, analysts predict these two EV stocks will soar in 2024 as macroeconomic headwinds fade. Let’s find out more.

EV Stock #1: Blink Charging

Blink Charging is committed to offering innovative EV charging solutions. The company continues to expand the EV charging infrastructure globally through Level 2 AC charging stations and DC fast chargers, catering to the needs of both individual EV owners and commercial businesses.

With a market cap of just $165 million, Blink Charging is nowhere comparable to EV giant Tesla. The stock fell 69% last year, compared to the S&P 500 Index’s ($SPX) gain of 25%. While it might appear to be a volatile stock, Blink has enormous opportunities to capitalize on the growing global EV charging station market, which is projected to be valued at $141.08 billion by 2030.

Recently, the company highlighted its strategic collaborations and initiatives in 2023, which it hopes will lead to a prosperous 2024. Blink began 2023 on a strong note with an exclusive agreement with Mitsubishi, where all 323 Mitsubishi dealerships nationwide will use Blink’s EV charging stations and services. The company raised $100 million in capital through this deal.

Additionally, the business introduced its EQ 200 charger technology in the UK and Ireland, which it claims is compatible with about 90% of current EVs. Likewise, Blink truck several other agreements with Hertz (HTZ) and the United States Postal Service that will help boost its revenue going forward.

Blink’s Strengthening Financials

The company's finances are already improving due to strong demand for its products and services. In the third quarter, revenue grew a staggering 152% year-over-year to $43.4 million. In Q3, vertical integration also resulted in a 29.5% gross margin. There were "5,956 charging stations contracted, deployed, or sold" as of the third quarter.

Although the EV market has been pressured by higher interest rates, Blink's revenue for the nine months ended in September 2023 came in at $98 million, significantly more than the $61.1 million for the full year 2022.

While the company has yet to report a profit, it has reduced its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) losses from $17.6 million in the prior-year quarter to $11.7 million in the most recent quarter. Management also aims to achieve adjusted EBITDA breakeven by December of this year. Furthermore, based on the strong quarterly performance, management now expects full-year revenue to be in the $128 million to $133 million range, with a gross margin of more than 30% for the year.

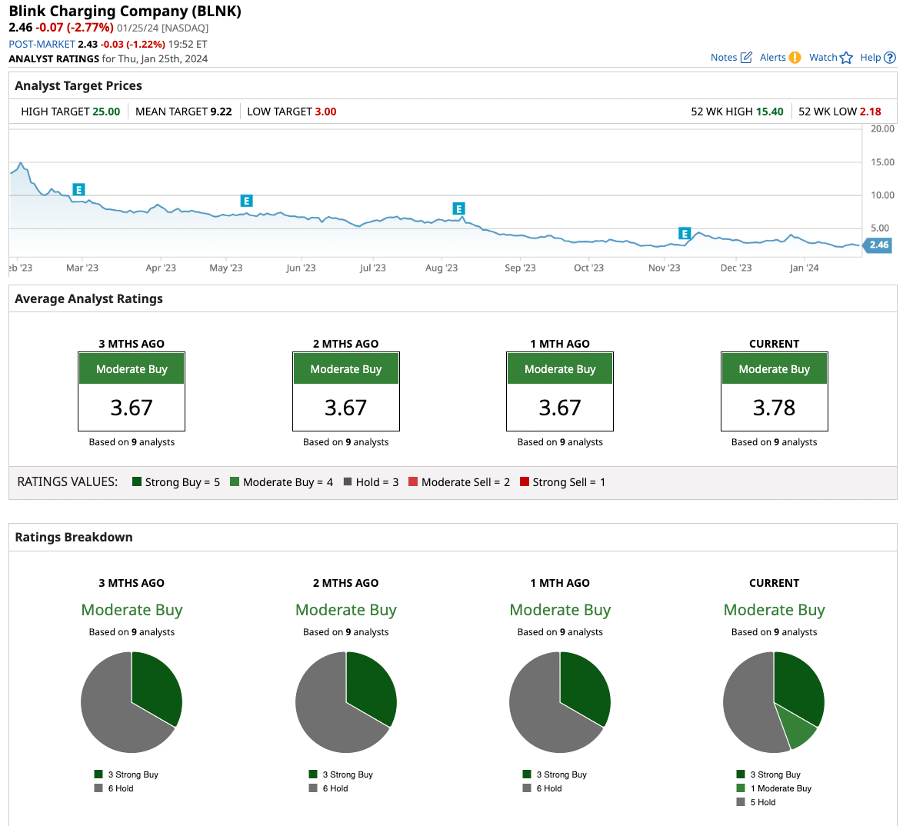

Wall Street Expects 268% Upside for Blink Charging Stock

Turning to Wall Street, analysts rate the stock a “moderate buy” right now. Out of the nine analysts covering BLNK, three rate it a “strong buy,” one rates it a “moderate buy,” and five recommend a “hold.” The average target price for the stock is $9.22, which implies a potential upside of 268% over the next 12 months.

Analysts predict that revenue will reach $132.4 million in 2023, followed by a 30% increase to $172.3 million in 2024. Blink Charging is priced at 0.99 times the projected sales for 2024, which seems absurdly low.

EV Stock #2: ChargePoint Holdings

ChargePoint manages an extensive network of charging stations worldwide that covers a wide range of areas, including public spaces, workplaces, residential neighborhoods, and commercial properties. It also offers a comprehensive cloud-based platform with features like real-time charging status, payment processing, and energy management. This platform enables EV owners, businesses, and fleet operators to effectively manage their charging needs.

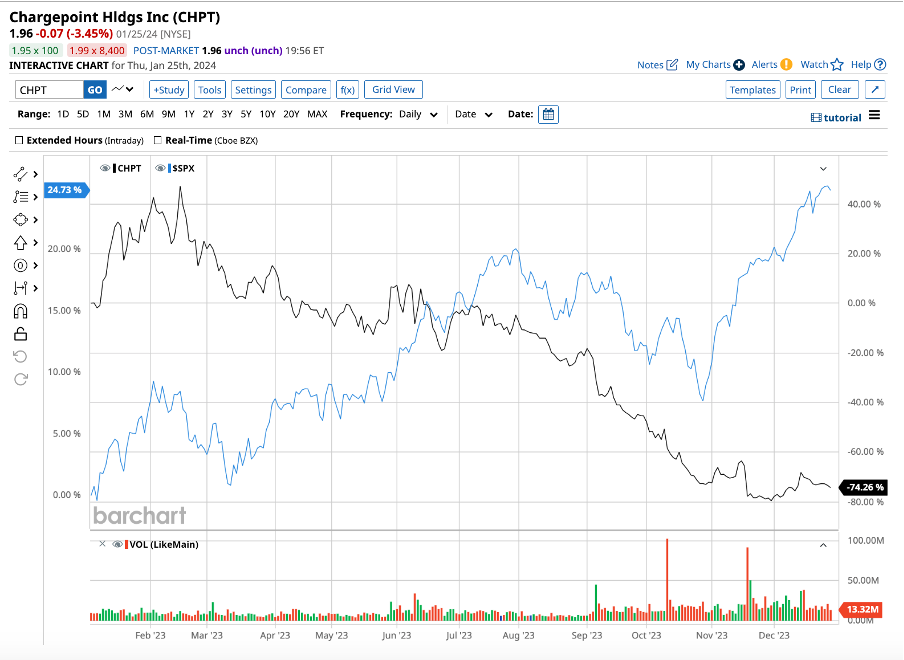

With thousands of charging stations strategically placed globally, ChargePoint has been boosting its revenue, but it remains unprofitable. ChargePoint's leadership team underwent significant changes in November of last year, with Rick Wilmer appointed as CEO and Mansi Khetan named interim CFO. Along with these abrupt shifts, a bleak third quarter dragged the stock down 75% last year.

Last year, rising interest rates put pressure on many EV companies. In the third quarter of fiscal 2024, total revenue at ChargePoint declined 12% year-over-year to $110.3 million, while adjusted gross margin came in at negative 18%.

Talking about the results, the new CEO stated, “Though the quarter overall did not meet expectations, we did demonstrate how we continue to empower the entire EV ecosystem, across hardware and software, and we fortified our balance sheet, which leaves us well capitalized to execute on our strategy.”

CHPT Heads Toward Profitability

ChargePoint is growing revenue steadily. For fiscal 2024, revenue is expected to increase 9.4% to $512 million. However, profits are still not in the picture. Adjusted EBITDA losses increased to $97.4 million (including an inventory impairment charge), up from $51.5 million in the prior-year quarter. However, management remains optimistic about meeting its goal of becoming adjusted EBITDA positive by the end of 2024.

While sudden changes in C-suite leadership can be unsettling for investors, I believe they can benefit the company. A new management team with new strategies could help the company achieve profitability in the near future.

Those strategies have already begun this month, with ChargePoint's new CEO announcing a 12% reduction in its global workforce. The company anticipates that this decision will lead to annual operating expense savings of approximately $33 million. The company will elaborate on this decision during its fourth-quarter fiscal 2024 results in March.

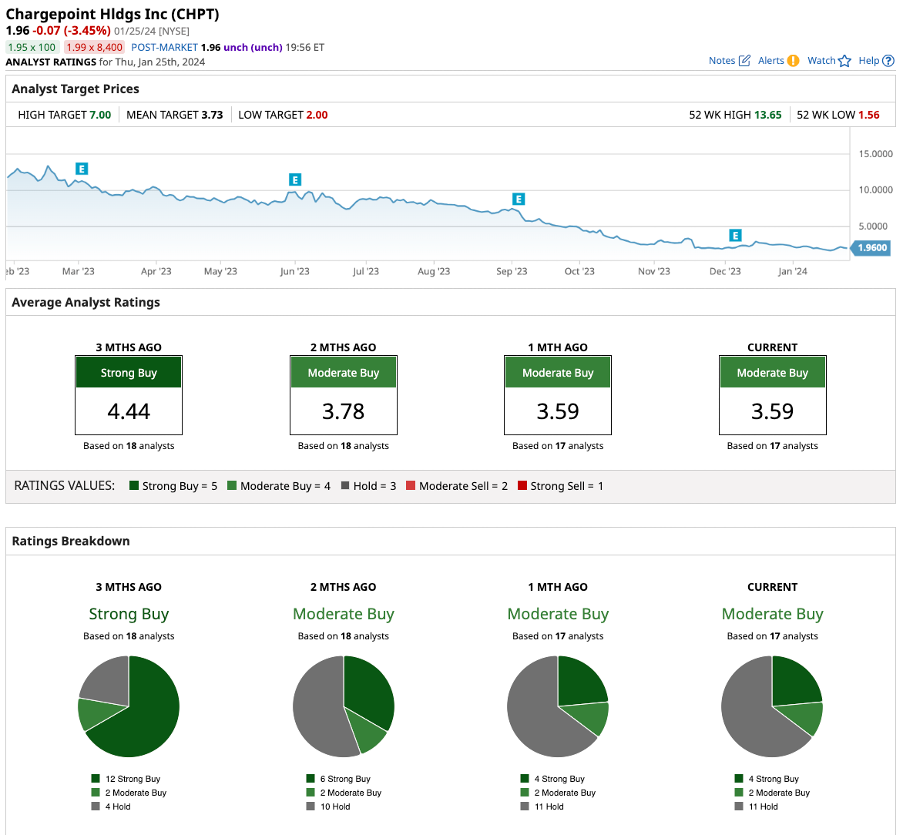

Wall Street Expects 90% Upside For ChargePoint Stock

Wall Street rates CHPT as a “moderate buy” overall. Out of the 17 analysts covering the stock, four rate it a “strong buy,” two rate it a “moderate buy,” and 11 recommend a “hold.” The average target price for the stock is $3.73, which implies a potential upside of 88% over the next 12 months.

Analysts predict ChargePoint Holdings' revenue will increase by 17.2% to $600.39 million in fiscal 2025. Priced at 1.4x 2025 projected sales, ChargePoint appears to be a cheap EV stock to buy now.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)