In the vast arena of global technology and e-commerce, Singapore-based Sea Limited (SE) is frequently overlooked, while larger players such as Amazon (AMZN) and Alibaba (BABA) command all the attention.

Founded in 2009, Sea Limited started as an online gaming company. The company has now evolved into a strong presence in e-commerce, digital finance, and digital entertainment. Shopee, Sea’s e-commerce arm, has become a major player in the competitive online shopping landscape. Garena, its gaming business, and SeaMoney, its digital financial business, are both expanding at a healthy pace.

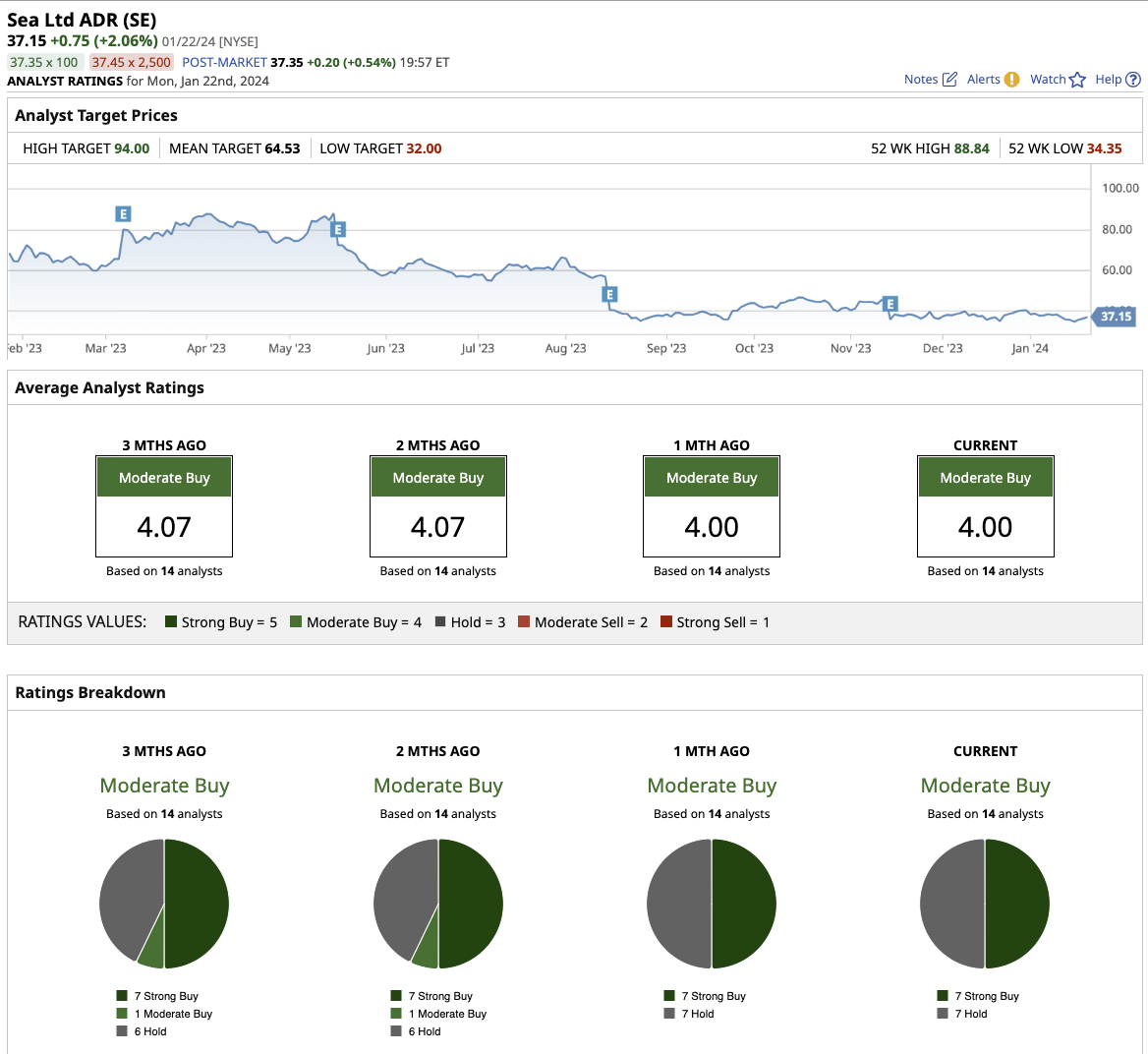

Despite the market's apparent preference for heavyweight tech stocks, Wall Street has high hopes for Sea Limited stock this year, expecting it to surge by 66%. While the mean target price of $64.53 seems a little far-fetched, some tailwinds could boost Sea's share price this year. Let’s find out.

What’s Driving Sea Limited’s Growth?

Sea Limited's success can be attributed to its diverse portfolio of digital services. Its revenue has surged from $827 million in 2018 to $12.4 billion in 2022. While the top line grew drastically, the company remained unprofitable during the period.

However, the shift to e-commerce and digital services is helping the company stand by its principle of maximizing long-term profitability to generate returns for shareholders in the long run.

Sea operates in three main business segments. Let's look at how each segment performed in the third quarter of 2023.

Shopee: E-commerce Platform

Shopee's GAAP (generally accepted accounting principles) revenue in the quarter increased 16.2% year-on-year to $2.2 billion, accounting for the largest share of total revenue of $3.3 billion.

The Shopee division faces stiff competition in Southeast Asia from Alibaba Group's Lazada, and popular short video app TikTok has also entered the e-commerce space now. Chinese tech giant ByteDance-owned TikTok Shop allows merchants, brands, and creators to display and sell their goods to users.

According to CNBC, Blue Lotus Research Institute predicts that TikTok's gross merchandise value (GMV) will be roughly 20% of Shopee's in 2023. Shopee's GMV was $73.5 billion in 2022. The GMV for the third quarter of 2023 stood at $20.1 billion.

Furthermore, the company has made significant investments in Shopee Live, which it believes will "become a sizable and profitable part" of Sea's platform, extending its long-term growth potential. The company is focusing on higher user engagement categories, such as health, beauty, and fashion, which have the potential to generate better margins.

In the third quarter, Sea formed strategic partnerships with content creators, live-streaming sellers, and new buyers. This is most likely why its total daily hours streamed, average daily unique streamers, and daily stream sessions tripled in October compared to June.

SeaMoney: Digital Financial Services

Revenue at Sea's digital financial services business, SeaMoney, jumped 36.5% year-over-year to $446.2 million, driven by growth in its credit business.

GAAP EBITDA (earnings before interest, tax, depreciation, and amortization) came in at $165.7 million, compared to a loss of $67.7 million in the prior-year quarter. Gross loans receivable, or the money the company expects to receive in the future, increased 5.3% sequentially to $2.4 billion.

Sea Money also offers digital banking services in Singapore, Indonesia, and the Philippines. In the third quarter, many users chose direct debit services, which allow them to make Shopee payments through their banks.

Garena: Gaming Platform

Sea’s gaming business, Garena, offers a wide array of games, connecting millions of users across Southeast Asia, Taiwan, and Latin America. While Garena’s sales declined year-over-year, the segment’s revenue grew 11.9% sequentially to $592.2 million. Adjusted EBITDA of $234 million represented 52.2% of bookings for Q3.

Free Fire, a battle royale game, has contributed significantly to Garena's success and Sea Limited's overall growth. While its launch in India got delayed to November 2023 due to data security concerns, it could generate revenue in the coming quarters. Management also stated that in the third quarter, Free Fire became the "most downloaded mobile game" worldwide.

Furthermore, the company has added fresh, new content to its existing games, Arena of Valor and Call of Duty: Mobile, which have seen healthy quarterly bookings.

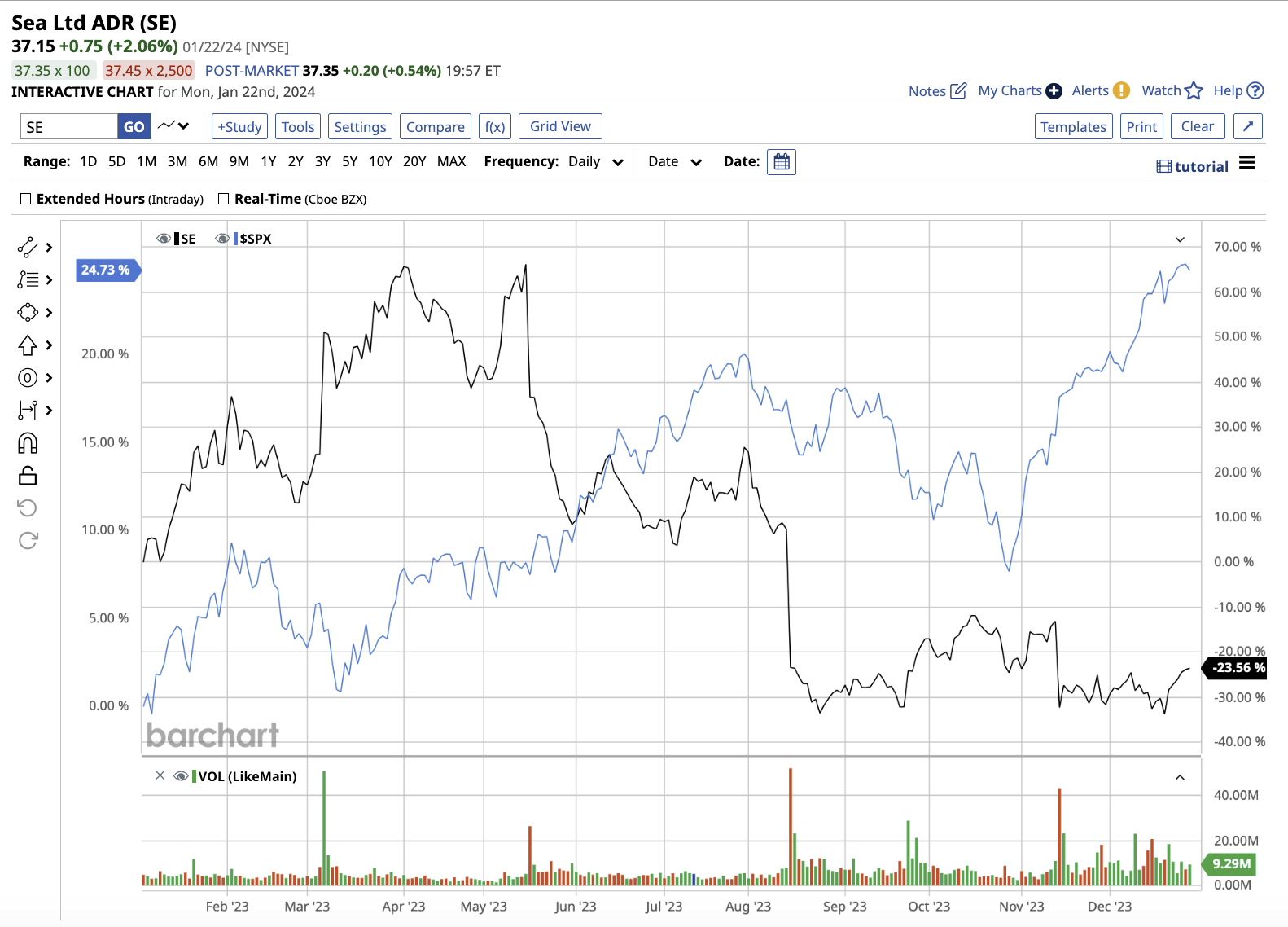

Interestingly, while all three of the company's segments are experiencing significant growth, the market does not appear to have rewarded them, which explains the 22% stock price drop last year, compared to the S&P 500's ($SPX) gain of 25%.

Shopee's deeper understanding of the markets and its diverse business gives it a competitive advantage, despite intense competition. The company also has a healthy balance sheet, ending the quarter with a cash balance of $7.9 billion, which should fuel future business investments.

Analysts predict Sea will report a profit of $1.34 per share for the full year 2023. Earnings could further rise by 2.2% in 2024, accompanied by revenue growth of 11.7%. Sea Limited stock is trading at 1.4 times forward sales, compared to its five-year historical average multiple of 8.5.

What Does Wall Street Think of Sea Stock?

Overall, the analysts community rates Sea Limited stock as a “moderate buy.” Out of the 14 analysts covering SE, seven rate it a “strong buy,” while seven rate it a “hold.” The average target price of $64.53 implies an upside potential of 66% over the next 12 months.

The Key Takeaway

Sea Limited's transition from a gaming company to a digital powerhouse shows its ability to adapt and meet changing consumer demands. Sea Limited has successfully created a synergistic ecosystem with Garena, Shopee, and SeaMoney that will take it towards profitability. However, the company faces stiff competition from stronger and larger players.

Sea's growth in 2024 and beyond will be determined by how successfully it navigates these challenges to achieve profitability. It is a wise decision to begin with a small stake in the company.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Dominos%20Pizza%20Inc%20storefront%20by-KathyDewar%20via%20iStock.jpg)