Electric-vehicle upstart Fisker (NYSE:FSR) dropped as much as 12.3% in trading on Tuesday after the company announced an executive left the company. At 1 p.m. ET, shares were still down 11.9% on the day.

Fisker's chief accounting officer leaves abruptly

After the market closed on Monday, news came out that Chief Accounting Officer Florus Beuting was leaving the company, effective immediately. What's more bizarre is that Beuting took the role on Nov. 6, 2023, only two weeks ago.

This also follows the departure of Chief Technology Officer Dr. Burkhard Huhnke on Oct. 30, 2023 for what were called personal reasons. The rush of executives out of the company is alarming.

A red flag for Fisker

Executives leaving en mass is always a red flag for investors, but this case is especially strange. Beuting just took the job and is leaving immediately, leading to speculation about what may have been found in the company's financials. Any guesses would be speculation, but that's exactly what investors are doing, taking risk off the table by dumping shares.

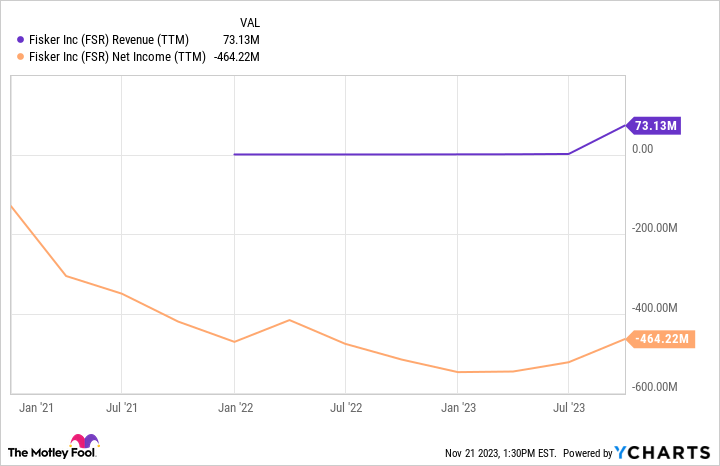

Fisker's financials aren't impressive, but that was known by investors and the company well before this week.

FSR Revenue (TTM) data by YCharts.

But if executives are leaving, it may be telling investors there isn't much of a future in the automaker. A falling stock price gives few options for raising the capital necessary to scale Fisker's operations and ultimately become a profitable company. That uncertainty is why I would avoid buying shares today.

10 stocks we like better than Fisker

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Fisker wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 20, 2023

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Image%20of%20server%20racks%20in%20modern%20server%20room%20data%20center%20by%20Sashkin%20via%20Shutterstock.jpg)