/Autonomous%20driverless%20aerial%20vehicle%20flying%20by%20Kinwunz%20vis%20Shutterstock.jpg)

Shares of Beta Technologies (BETA) are again on investors’ radars after Jefferies gave the electric aircraft manufacturer’s stock a “Buy” rating, owing to a favorable risk-reward profile due to the recent decline. As BETA stock has been trading between $17 and $18, Jefferies' $30 target implies significant potential upside from the current levels.

The positive rating for BETA stock has come at a time when the advanced air mobility segment is becoming more mature, with regulators and aerospace players pushing for commercialization. While the pre-profit aviation segment remains volatile, Beta Technologies’ strategy of combining conventional takeoff aircraft with vertical aircraft has again attracted the attention of analysts.

About Beta Technologies Stock

Beta Technologies is an electric aerospace company based in South Burlington, Vermont. The company is focused on developing electric aircraft, propulsion systems, and charging infrastructure. With a market capitalization of around $3.9 billion, the company is developing a conventional takeoff and landing aircraft, called the CX300, as well as a vertical takeoff and landing aircraft, called the ALIA 250.

The stock has made a wide range of movements during the last 52 weeks, between $15.61 and $39.50. While BETA stock has made significant movements, it has been trading at much lower levels than its historical highs, although it has gained around 5% during the last five days. While the stock has made significant movements, it has been much more volatile compared to the S&P 500 ($SPX), which has made relatively more stable movements.

From a valuation perspective, it is difficult to apply conventional metrics. The company is still unprofitable, and its price-to-sales (P/S) ratio is 134.95 times based on low revenues. However, using forward enterprise value-to-sales, Jefferies believes that Beta’s shares are trading at approximately 3.2 times forward EV-to-sales for 2028, which is at a discount to its blended AAM peers of 5.7 times.

Beta Technologies Reports Expanding Backlog, Ongoing Losses

During its recent quarterly update, Beta announced important business developments, not profitability. For instance, the company has completed its first ALIA CTOL aircraft, which will be used for demonstration flights in Norway with Bristow Group (VTOL). Another aircraft has also been shipped to New Zealand for test flights with Air New Zealand (ANZFF).

On the other hand, Jefferies estimates that Beta will generate $33 million in revenue in 2025, representing a growth of 117% over 2024. However, its adjusted EBITDA will still be negative, coming in at approximately -$306 million in 2025 as the firm continues to invest significantly in its business.

Additionally, Beta has announced important partnerships that are set to drive its growth in the coming years. For instance, it has partnered with GE Aerospace (GE), whose $300 million equity investment will be used to develop its hybrid electric turbogenerator. In addition, Beta has over $1 billion in contracted technology partnerships, including its 10-year motor supply agreement as part of its EVEX flight test program.

As of Sept. 30, 2025, Beta has a civil aircraft backlog of 891 aircraft, valued at $3.5 billion, including 289 firm orders and 602 options. Jefferies believes that Beta's revenues will grow at a compound annual rate of 156% from 2024 to 2030, reaching $4.2 billion, of which aircraft sales will comprise approximately 90%.

Most significantly, Beta closed 2025 with estimated cash of $1.74 billion, or $8 per share, to provide liquidity during the capital-intensive process of obtaining certification and ramping up.

What Do Analysts Expect for Beta Technologies Stock?

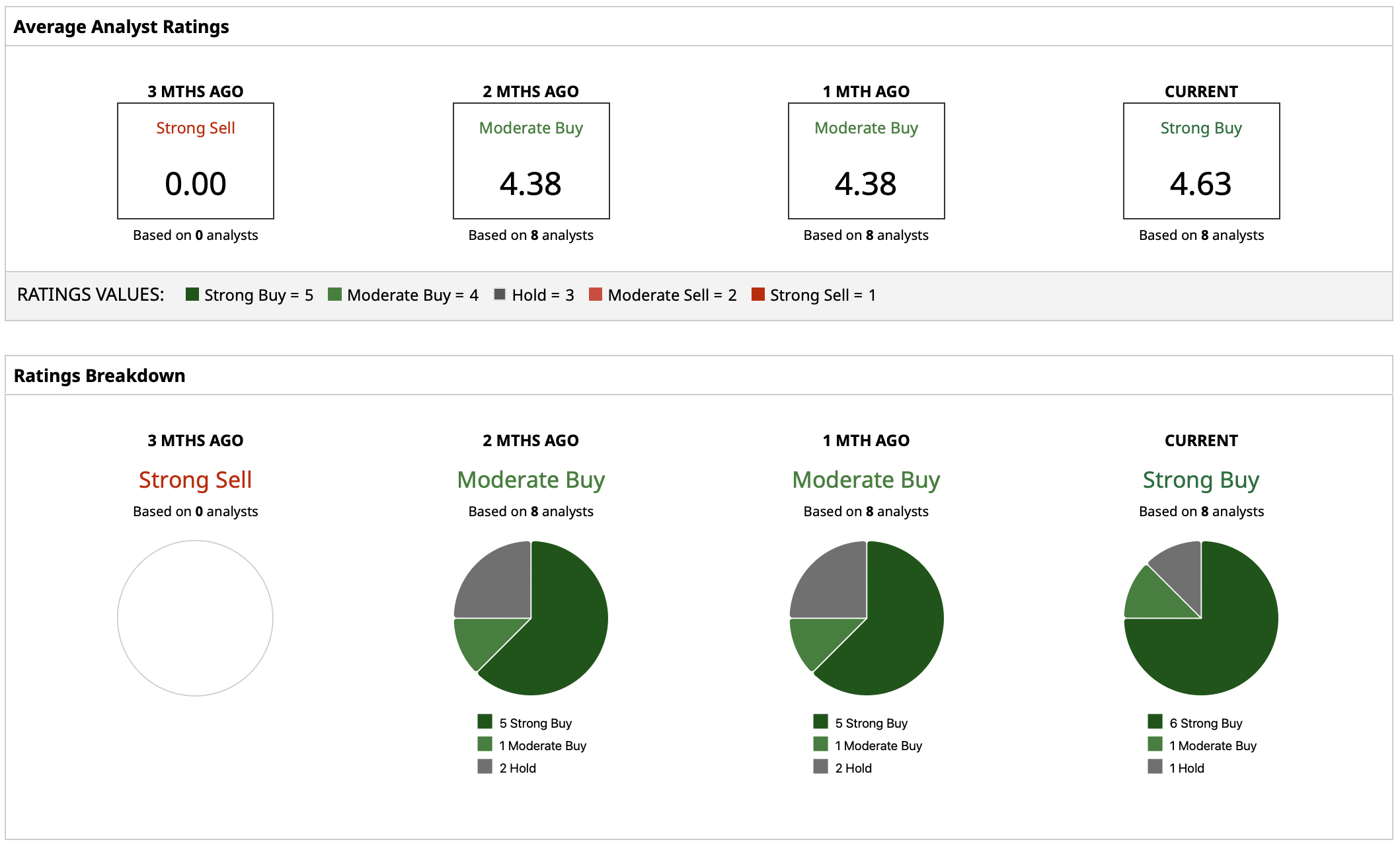

Currently, BETA stock has a “Strong Buy” rating consensus, reflecting the recent upgrade by Jefferies. Beta's high target price is $43, its low target price is $30, and its mean target price is $37.14. That mean target price translates to potential growth of 113% from current levels. Even BETA stock's lowest price target of $30 offers considerable growth potential from here.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)