For over a century, the Dow Jones Industrial Average ($DOWI) has tracked 30 blue-chip U.S. companies, stalwarts of the equity market and symbols of its resilience. The Index has rewarded long-term investors by looking beyond short-term fluctuations. It has also been a tool for investors to weather market storms, delivering an average of more than a 10% annualized return over the last 20 years. While this may seem modest, the index has returned about 350% over the past 20 years.

This year, Dow has recorded a modest return, gaining 2.45% year-to-date (YTD). We take a look at the companies that are leading the charge in the index so far this year. Industrial giants, Caterpillar (CAT) and Honeywell International (HON) have gained 22.7% and 18.36% YTD, respectively. So, these two might be solid additions to your portfolio for a little calm in the market storm, with the imposition of the tariffs and the likelihood of the Fed keeping the interest rates intact.

The Index also climbed by 1.05% on Feb. 2, more than its contemporary indices, as the Jan. ISM Manufacturing Index expanded the most in more than 3.25 years.

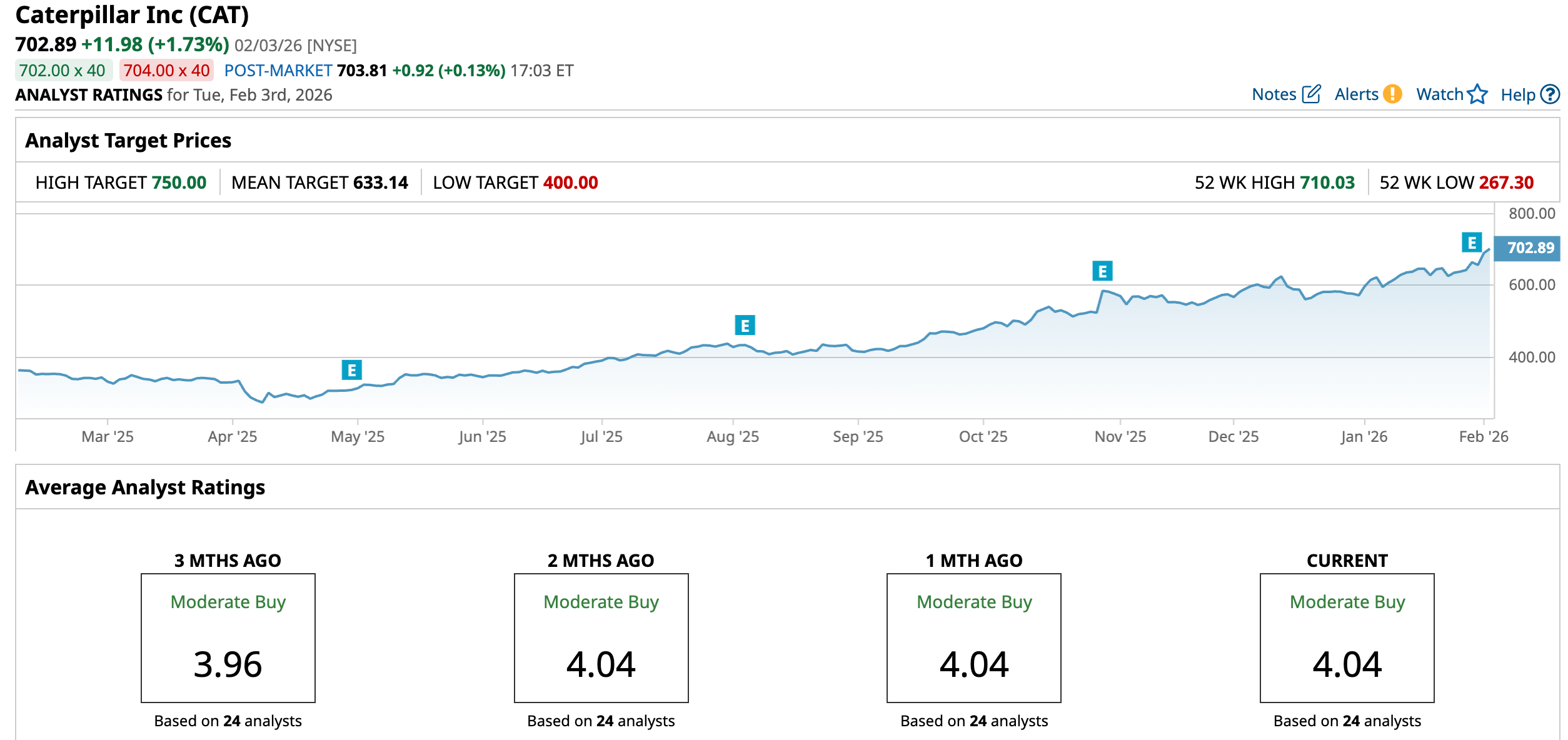

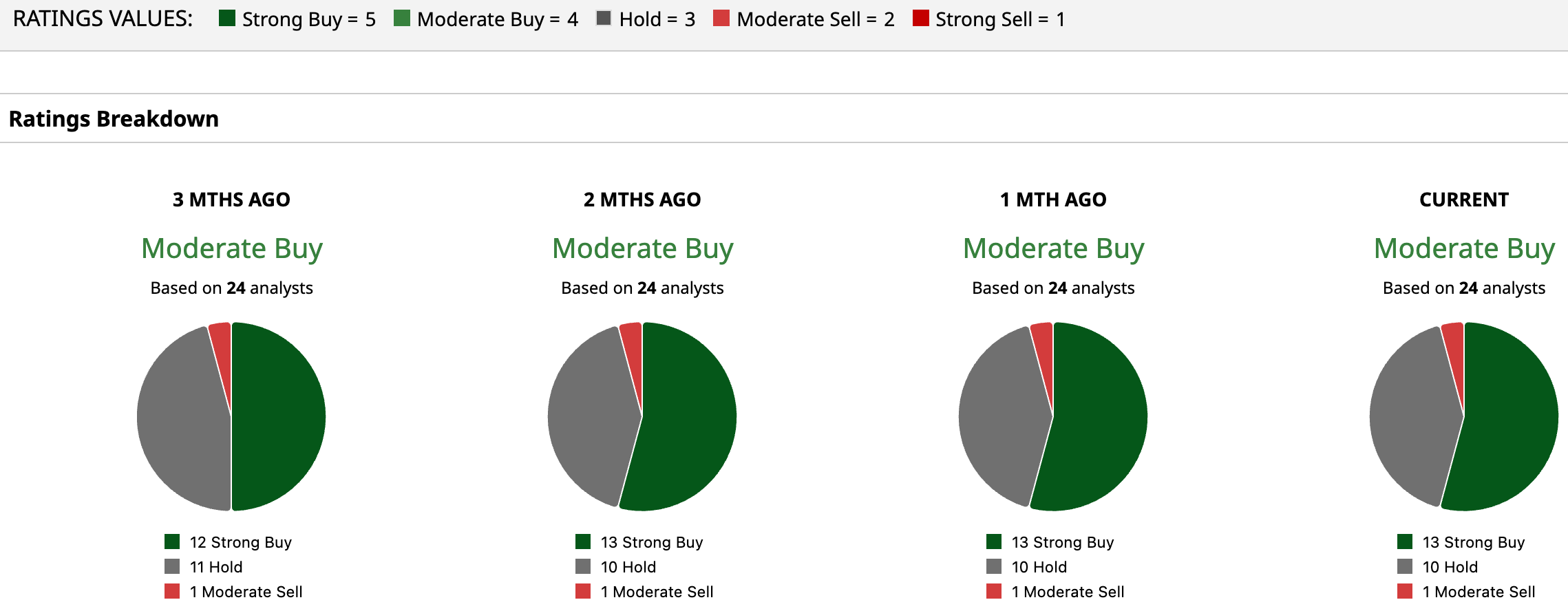

Dow Jones Stock #1: Caterpillar

Caterpillar is the world's leading manufacturer of construction and mining equipment, diesel engines, and locomotives. Headquartered in Irving, Texas, it pioneered track-type tractors and drives global infrastructure with innovative, sustainable machinery. The company has a market capitalization of $307.63 billion.

The company’s shares have rallied 94.41% over the past 52 weeks and 63.96% over the past six months, as agriculture and manufacturing markets recovered to create a robust demand for its equipment, and the digital infrastructure demand for data center buildouts remains a strong tailwind. On the news of the rebound in manufacturing activity, Caterpillar’s shares reached a high of $710.03 on Feb. 3.

On a forward-adjusted basis, Caterpillar’s stock has a price-to-earnings ratio of 29.54x. While this may seem high in itself, the company’s resurgence and strong growth prospects might justify it.

Caterpillar’s stock gained 3.4% intraday on Jan. 29 as the company’s fourth-quarter and fiscal 2025 results surged past expectations. Based on higher sales volume, its total top line for Q4 increased 18% year-over-year (YOY) to $19.13 billion (an all-time record), exceeding the $17.95 billion Street analysts expected. Of course, the majority of Caterpillar’s sales and revenues come from the sale of machinery, power & energy (MP&E), which grew 18.7% annually.

On the other hand, unfavorable manufacturing costs, largely due to tariffs, led to a 9% YOY decline in quarterly operating profit to $2.66 billion. However, on an adjusted basis, its adjusted profit increased from $5.14 to $5.16 per share, topping the $4.67 EPS expected.

Caterpillar’s MP&E FCF was $9.5 billion for 2025, slightly higher than the prior year despite the fact that it incurred an $800 million increase in CapEx. For 2026, top line growth is projected to align with the top end of its 5%-7% CAGR long-term target. For the current quarter, Street analysts expect Caterpillar’s profit to grow 2.4% YOY to $4.35 per diluted share, while for the current year, it is expected to climb 18.1% to $22.50 per diluted share.

The company is also looking to the future with greater automation and artificial intelligence (AI) operations, such as building a layer of the tech stack and expanding its partnership with NVIDIA Corporation (NVDA) to bring physical AI to heavy industries.

Caterpillar is generally gaining praise on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 24 analysts rating the stock, 13 analysts have given it a “Strong Buy,” 10 analysts are taking a middle-of-the-road approach with a “Hold” rating, and one analyst suggested “Moderate Sell.” The consensus price target of $633.14 represents an 9.9% downside from current levels. However, the Street-high price target of $750 indicates an 6.7% upside.

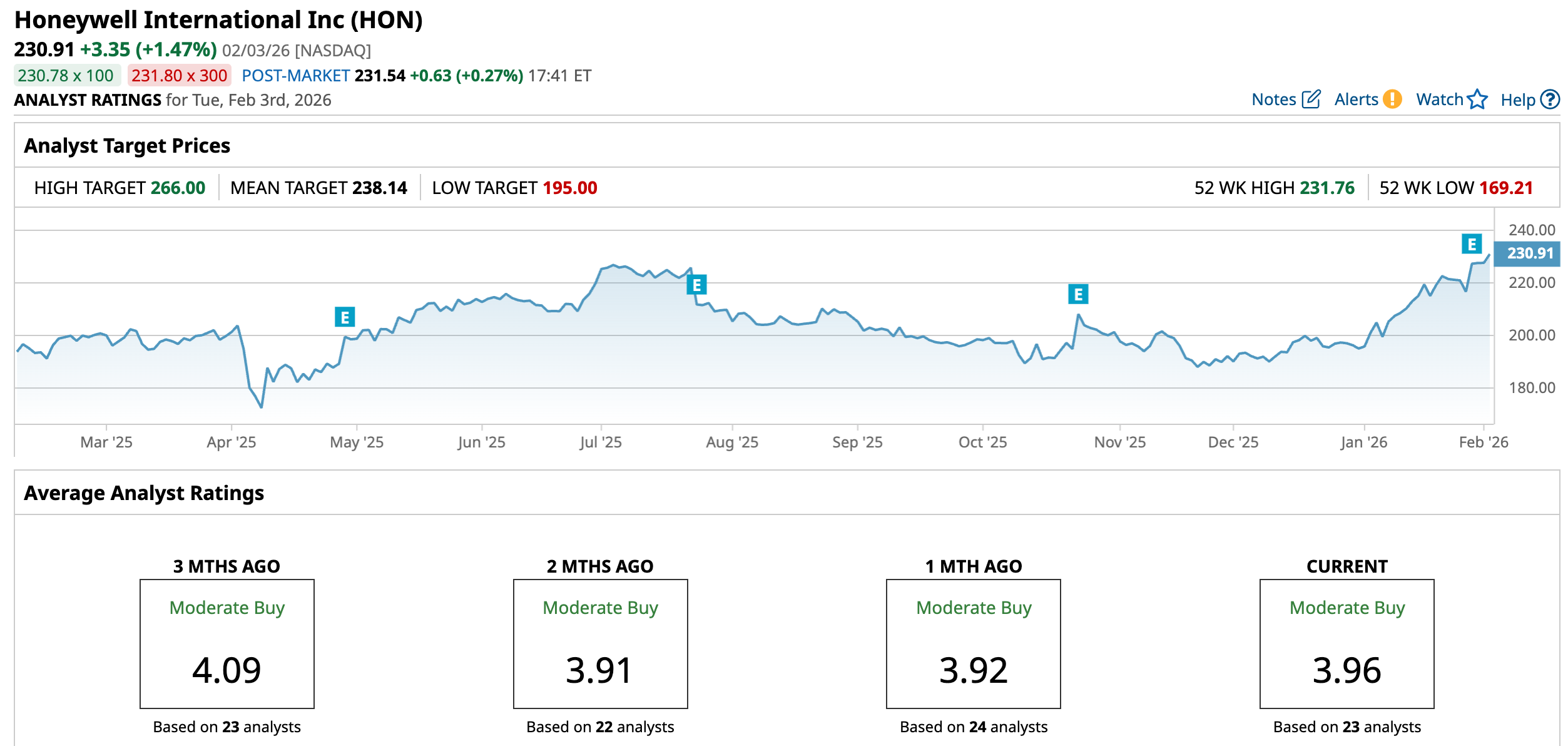

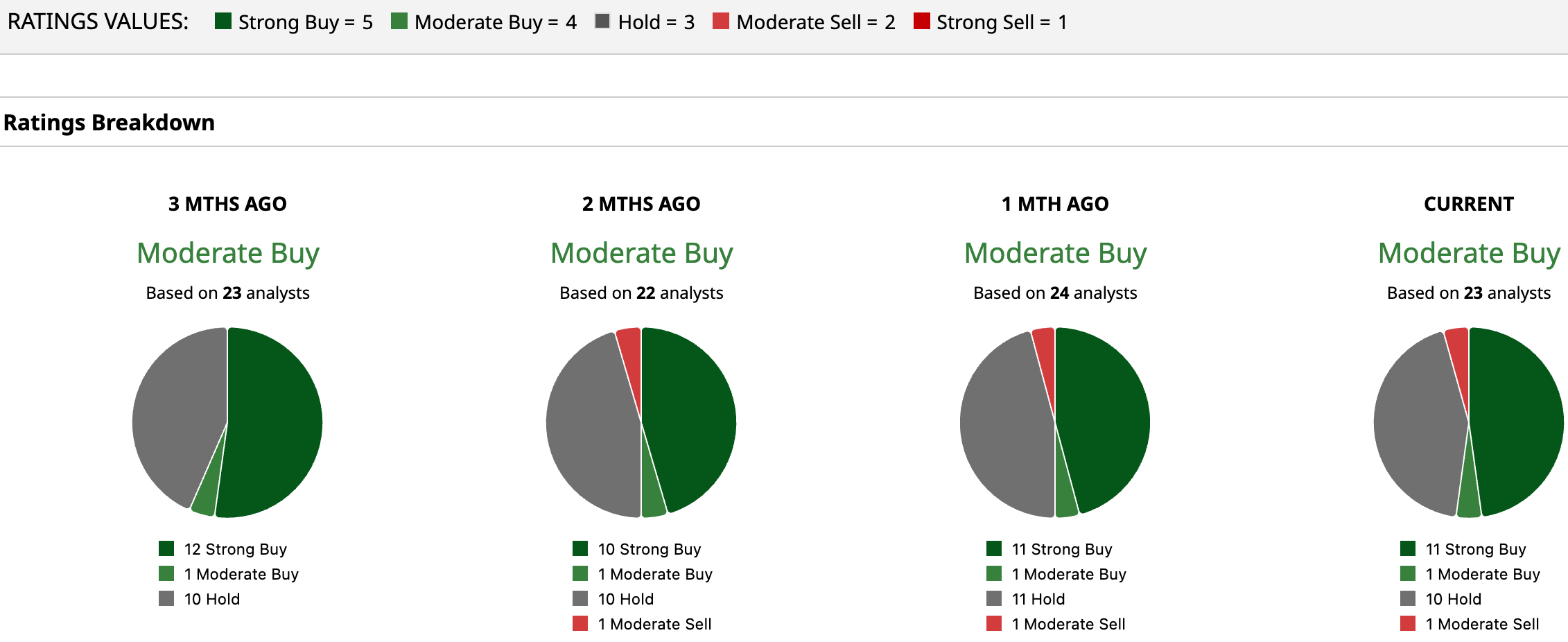

Dow Jones Stock #2: Honeywell International

Honeywell International is a multinational conglomerate headquartered in Charlotte, North Carolina. It excels in aerospace technologies, building automation, industrial automation, and energy transition solutions. The company has a market capitalization of $144.45 billion.

The stock is not very volatile. However, it also doesn’t provide skyrocketing returns. Over the past 52 weeks, Honeywell’s shares are 10.05% higher, and over the past six months, they have been up 12.43%. Following its Q4 earnings release, the stock rose to a 52-week high of $231.76 on Feb. 3 and is only marginally down from that level.

On a forward-adjusted basis, Honeywell’s price-to-earnings ratio is 21.72x. While this may seem moderately high, it is marginally lower than the industry average of 21.73x.

Honeywell’s stock also climbed by 4.9% intraday after it reported its Q4 and fiscal 2025 results on Jan. 29. The company’s revenue increased 6% YOY to $9.76 billion, or 11% organically, primarily due to strong demand in the aerospace and building automation segments. The company’s orders grew 23% organically, driven by double-digit growth in aerospace technologies and energy and sustainability solutions (ESS). Additionally, this increased the backlog 4% sequentially to more than $37 billion. However, the top line figure still missed Street analysts’ expectations.

Honeywell’s profitability situation is a bit dicey at the moment, with its segment margin dropping from 20.4% to 19.7%. However, after adjustments, it grew to 22.8%. The pressure on Honeywell’s operating margin also came from one-time charges. The company’s adjusted EPS was $2.59 for the quarter, up 17% YOY and topping expectations. The company is also not strapped for cash, with its 2025 FCF growing by 20% from the prior year to $5.10 billion.

Honeywell has a lot to look up to this year. It projects 3%-6% organic top line growth for 2026 and 6%-9% adjusted earnings growth. The company is undergoing a business transformation, aiming to become leaner. Following the spinoff of its Solstice Advanced Materials business, it is considering a separation of its automation and aerospace businesses in Q3 2026. In addition, after a review, its Productivity Solutions and Services (PSS) and Warehouse and Workflow Solutions (WWS) businesses are held as assets for sale.

For the current quarter, Street analysts expect Honeywell’s profit to drop 7.2% YOY to $2.33 per diluted share, while for the current year, it is expected to increase 7% to $10.46 per diluted share.

Honeywell is considered an industrial stalwart on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 23 analysts rating the stock, 11 analysts have rated it a “Strong Buy,” one analyst suggests a “Moderate Buy,” 10 analysts gave a “Hold” rating, and one analyst gave a “Moderate Sell” rating.

The consensus price target of $238.14 represents a modest 3.13% upside from current levels. The Street-high price target of $266 indicates a 15.2% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20photo%20of%20a%20Sandisk%20Solid%20State%20Drive%20by%20Top%20Popular%20Vector%20by%20Shutterstock.jpg)

/Tesla%20dealership%20with%20cars%20in%20lot%20by%20Jetcityimage%20via%20iStock.jpg)