/shutterstock_1357496909.jpg)

Microsoft (MSFT) could potentially generate $100 billion in free cash flow for the fiscal year ending June 2025 if its high FCF margins hold up. This is one reason why MSFT stock is worth a good deal. It also makes MSFT stock attractive to value investors as well as short sellers of its put options.

As of Friday, Sept. 15, 2023, the stock was at $330.22 per share, which is roughly the same price as when I last wrote (Sept. 1) about the stock. I discussed Microsoft's massive free cash flow (FCF) in that piece: “Microsoft Stock's Dip Looks Like a Good Opportunity to Value Investors.”

Free Cash Flow and Valuation

To recap, here is why I believe Microsoft is on track to generate up to $100 billion in free cash flow.

Last quarter the company produced $19.8 billion in FCF, up 12% YoY. After adjusting for a one-time tax payment, it actually made $21 billion, as I discussed in my July 31 Barchart article, “Cheap Stock Alert: Microsoft and Its Huge Free Cash Flow.”

Given that its revenue for the quarter ending June 30 was $56.2 billion, that means that its FCF margin was an astounding 37.4% (i.e., $21b / $56.2b). If that keeps up we can forecast its annual FCF.

For example, analysts surveyed by Seeking Alpha have an average revenue estimate of $235.85 billion by June 2024 and $267.26 billion for the year ending June 2025. So, if we multiply this 37.4% FCF margin to $267.26 billion, we get $100 billion in FCF for that year.

Accordingly, MSFT stock could be worth a good deal with that much FCF. For example, using a 30x FCF multiple, Microsoft could have a $3 trillion market cap by then. That is the result of multiplying $100 billion by 30x. This is also the same as giving MSFT stock a 3.33% FCF yield.

That is well over its market cap today of $2.453 trillion. It implies the stock could rise 22.3% (i.e., $3 trillion / $2.453 tr). That gives investors a target stock price of just over $400 at $403.85.

This also makes it attractive to short sellers of its out-of-the-money (OTM) put options. That is one way to gain extra income for shareholders.

Shorting OTM Puts for Income

MSFT stock has a relatively low dividend yield of just 0.82%. One way to increase that income is to sell short OTM puts.

For example, in my last article, I discussed selling short the $310 strike price put options that expire on Sept. 29. At the time those puts were selling for $1.63 per contract and the strike price was over 5% below today's price.

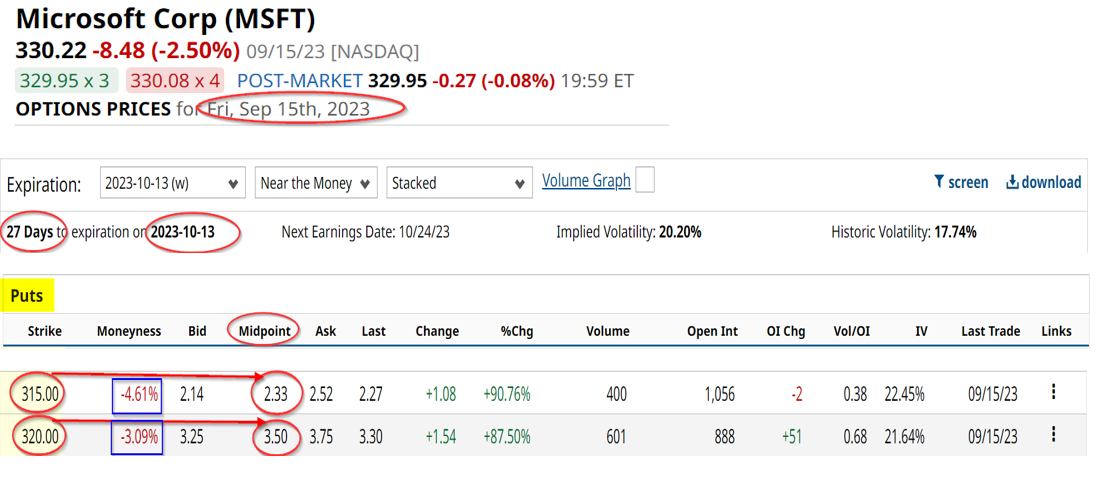

As of Friday, Sept., 15, the premium is now down to just 63 cents. That means that short sellers of those puts have already made good money. They might want to start thinking about shorting the Oct. 13 puts that expire 27 days from now.

For example, the $315 strike price puts trade for $2.33 per contract, and the $320 strike price puts are at $3.50 per contract. That means that a short seller can make an immediate yield of 0.74% and 1.09% respectively.

This means that an investor who secures $31,500 in cash and/or margin can then enter an order to “Sell to Open” a put contract at the $315 strike price. The account will then immediately receive $233.00.

That works out to 0.74% with just 27 days until expiration. If it can be repeated every month for a year, that provides an investor with an 8.88% yield.

If the investor wants to take on more risk, they can put up $32,000 in cash and/or margin. By entering an order to “Sell to Open” 1 contract at $320, the account could receive $350.

However, this contract is only 3.09% out-of-the-money. If MSFT falls to $320, the put contract could be exercised and the $32,000 would be used to buy 100 shares at $320.00. Nevertheless, the breakeven price is $3.50 below this, as the investor gets to keep the income. So unless MSFT falls below $316.50 per share there would still be a profit for the trade. That provides 4.15% of downside protection from today's price of $330.22.

The bottom line is that MSFT is inexpensive here, given its huge FCF generation. That makes holding the stock until it reaches the target price and selling OTM put options for extra income a good long-term strategy.

More Stock Market News from Barchart

- 3 Top Energy Stocks to Buy on Rising Oil Prices

- Soybean Prices Poised to Decline Further Into Their October Seasonal Lows

- 2 Buy-Rated Dividend Stocks to Scoop Up Now

- Stocks Slump as Tech Stock Weakness Weighs on the Overall Market

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)