/shutterstock_1357496909.jpg)

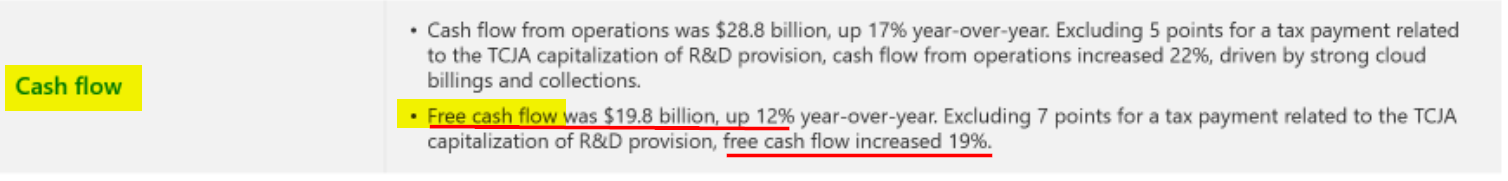

Microsoft (MSFT) reported massive free cash flow (FCF) growth on July 25 for its fiscal Q4 ending June 30. At $19.8 billion FCF was up 12% YoY, but after deducting a one-time tax payment, it was up 19% to $21 billion.

As a result, MSFT stock is now considered cheap by analysts who can project an even higher FCF next year. In fact, traders now find options plays such as long-call buys and short sales of out-of-the-money puts are attractive.

Free Cash Flow Projections and Target Price

For example, based on the adjusted $21 billion FCF Q4 figure, it is apparent that Microsoft made an extremely high 37.4% FCF margin, as its Q4 revenue was $56.1 billion. We can use that to project FCF for next year.

For example, 43 analysts surveyed by Seeking Alpha forecast $266.7 billion in revenue next fiscal year to June 30, 2024. That means that if we apply the $37.4% FCF margin, all things else being equal, Microsoft could generate $100 billion in FCF.

That figure allows us to estimate a price target. Here is how. First, note that $100 billion is approximately 4.0% of its $2.51 trillion market cap. Historically, however, large-cap stocks like this with huge free cash flow can have peak valuations with 3.0% to 3.33% FCF yields.

For example, if we divide $100 billion by 3.0%, the resulting market cap target is $3.33 trillion, up 32.8% over today's $2.51 trillion market value. At 3.33% the market cap target is $3.0 trillion, up 19.6% from today's market cap.

In other words, MSFT stock, trading at $336.95 in early trading on Monday, July 31, is worth between 20% to 33% more, or between $404 to $449 per share. Let's call it $427 per share, or 27% over today's price. We can use that to set a target price for options plays.

Long-Term Call Plays

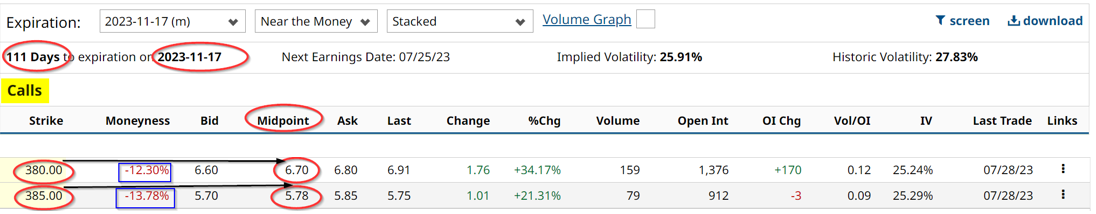

Given this high target price, it makes sense to look at buying long-term call options, perhaps 4 months in the future. For example, take the Nov. 17, 2023, options expiration period, which is 111 days from now.

The $380 strike price calls, which are 12.3% over today's spot price, trade for $6.70. The $385 strike price, 13.8% higher, is at $5.78 per call contract.

After paying for the calls, an investor has to hope that MSFT stock rises to either $386.70 (up 14.8% from today), or $390.78 (up 16.0% higher).

The call buyer may not mind paying for these calls since their target price is well over $400 per share for MSFT stock. For example, assuming it rises to $400 per share, the $380 call premium will be worth at least $20 (i.e., $400-$380), plus an extra amount of extrinsic value since there is time left in the call option period. The $385 call option would be worth at least $15.00.

That means the call buy would make at least 200% (i.e., $20/$6.70-1), and the $385 strike price call buyer would make 160% (i.e., $15/$5.78-1).

Moreover, it's possible that the trader could have some of the call option price paid for by shorting near-term out-of-the-money (OTM) puts.

Shorting OTM Puts for Income

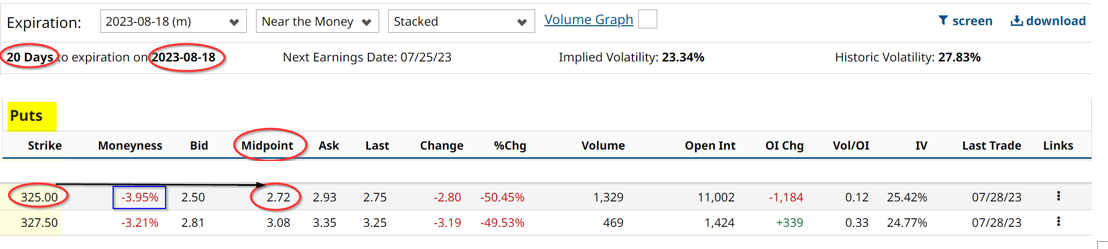

Another to make money on MSFT stock is to short OTM puts in near-term expiration periods - in fact, repeating the bets. This income can be used to pay for long-term call purchases.

For example, the Aug. 18 put expiration period shows that the $325 strike price, 4% below today's spot price, trades at $2.72 per put contract. That provides an immediate yield of 0.83% (i.e., $2.72/$325).

Moreover, if this trade can be repeated just 3 times - i.e., over the next 9 weeks, or about half of the expiration period of the long-call purchase period, it can be used to pay for the calls. This can be seen by multiplying the $2.72 per call contract premium received by 3x, or $8.16. This is greater than the $6.70 call purchase at $380, with $1.46 left over.

The risk with this play is if MSFT falls below $325 on or before Aug. 18. In that case, the investor will have the $32,500 that was secured with the brokerage firm in cash and/or margin to purchase 100 shares of MSFT stock at $325.00.

But the investor still keeps the income generated from the short-put play. And, as we have noted, it could have already been used to buy the long-term call options. Moreover, the investor can then also sell short covered calls to help pay for any unrealized loss that they may have.

Therefore, given our analysis, there is a good likelihood that MSFT will be worth well over $400 per share over the next year. Our analysis shows that there are good ways to make money in MSFT stock. This can be done by buying long-term calls and shorting near-term OTM puts.

More Stock Market News from Barchart

- Markets Today: Stocks Push Higher on Strength in China and Europe

- Option Volatility and Earnings Report for July 31 – August 4

- Stocks Set to Open Higher as Investors Await U.S. Payrolls Data and More Big Tech Earnings

- Earnings, PMI and Other Can't Miss Items this Week

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)