Used-car retailer America’s Car-Mart (NASDAQ:CRMT) beat analysts' expectations in Q1 FY2024, with revenue up 9.27% year on year to $368 million. The company didn’t provide any forward revenue guidance. Turning to EPS, America's Car-Mart made a GAAP profit of $0.63 per share, down from its profit of $2.07 per share in the same quarter last year.

Is now the time to buy America's Car-Mart? Find out by accessing our full research report, it's free.

America's Car-Mart (CRMT) Q1 FY2024 Highlights:

- Revenue: $368 million vs analyst estimates of $363.8 million (1.15% beat)

- EPS: $0.63 vs analyst expectations of $0.91 (31% miss)

- Free Cash Flow was -$46.2 million compared to -$67.3 million in the same quarter last year

- Gross Margin (GAAP): 44.6%, up from 42.7% in the same quarter last year

- Same-Store Sales were up 8.2% year on year (beat vs. expectations of up 7.5% year on year)

- Store Locations: 155 at quarter end, increasing by 1 over the last 12 months

“In the first quarter, improvements in many areas of the business - unit sales, gross margin, repair costs, diminishing wholesale losses, online credit application activity, working capital management and closing underperforming stores were overshadowed by the increase in the provision for loan losses during the period. The major drivers behind higher loan losses related to post-stimulus normalization of charge-offs, additional provisioning resulting from increased contract term, and a higher average interest rate for the portfolio. Said in a different way, we are experiencing the same credit results on the portfolio as we have historically, but the contract length has changed,” commented CEO Jeff Williams.

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

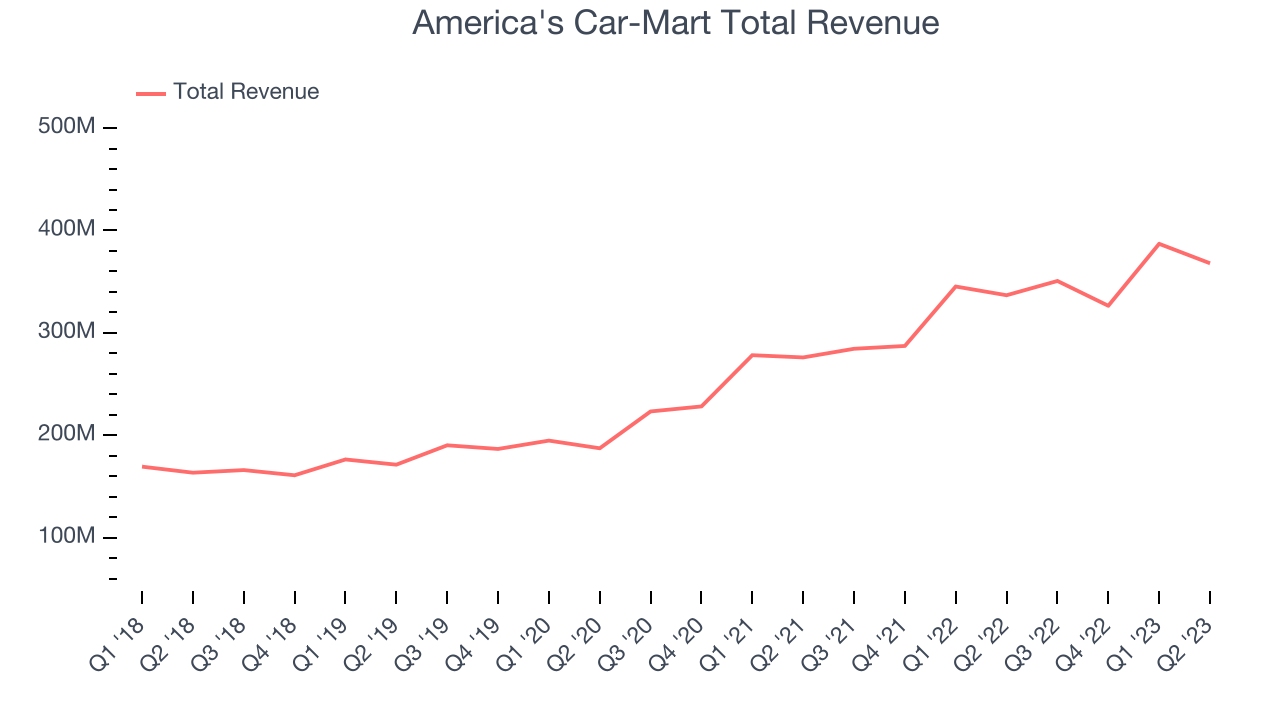

Sales Growth

America's Car-Mart is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

As you can see below, the company's annualized revenue growth rate of 20.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was exceptional despite not opening many new stores, implying that growth was driven by increased sales at existing, established stores.

This quarter, America's Car-Mart reported solid year-on-year revenue growth of 9.27% and its revenue of $368 million outperformed analysts' estimates by 1.15%. Looking ahead, the analysts covering the company expect sales to grow 5.35% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

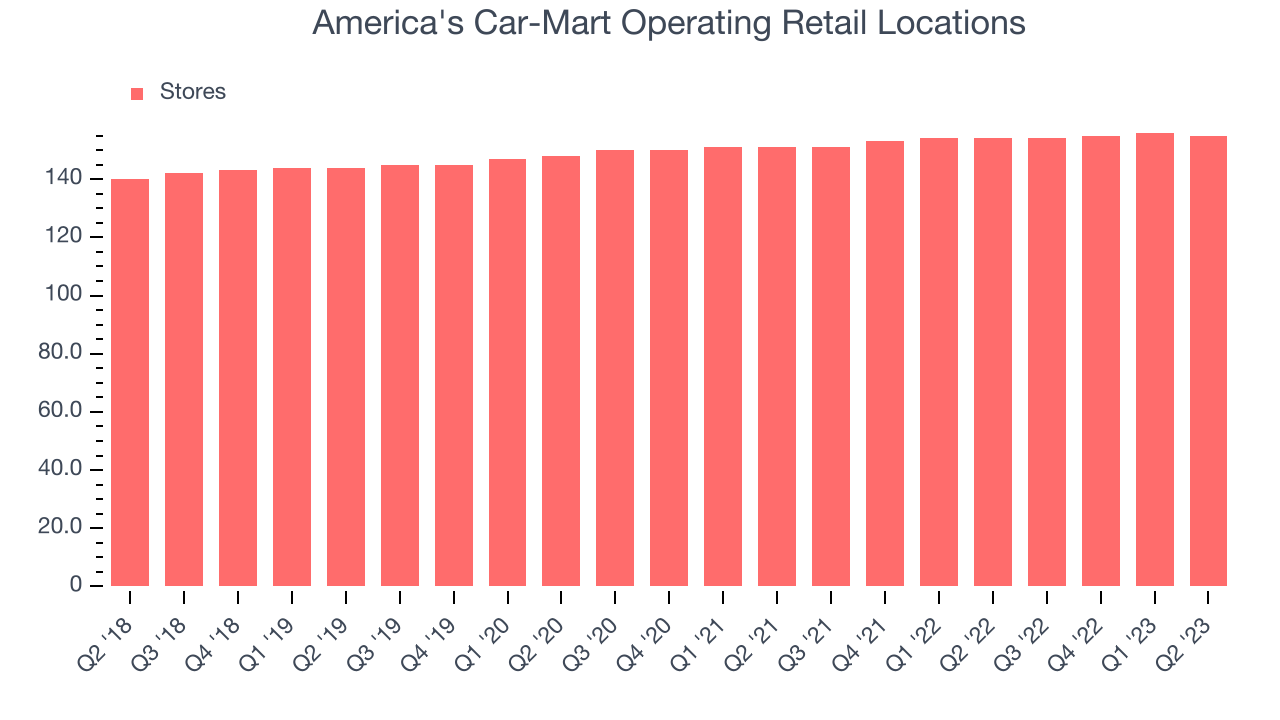

Number of Stores

The number of stores a retailer operates is a major determinant of how much it can sell, and its growth is a critical driver of how quickly company-level sales can grow.

When a retailer like America's Car-Mart keeps its store footprint steady, it usually means that demand is stable and it's focused on improving its operational efficiency to increase profitability. At the end of this quarter, America's Car-Mart operated 155 total retail locations, in line with its store count 12 months ago.

Over the last two years, the company has only opened a few new stores, averaging 1.49% annual growth in new locations. This sluggish pace lags the broader sector. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

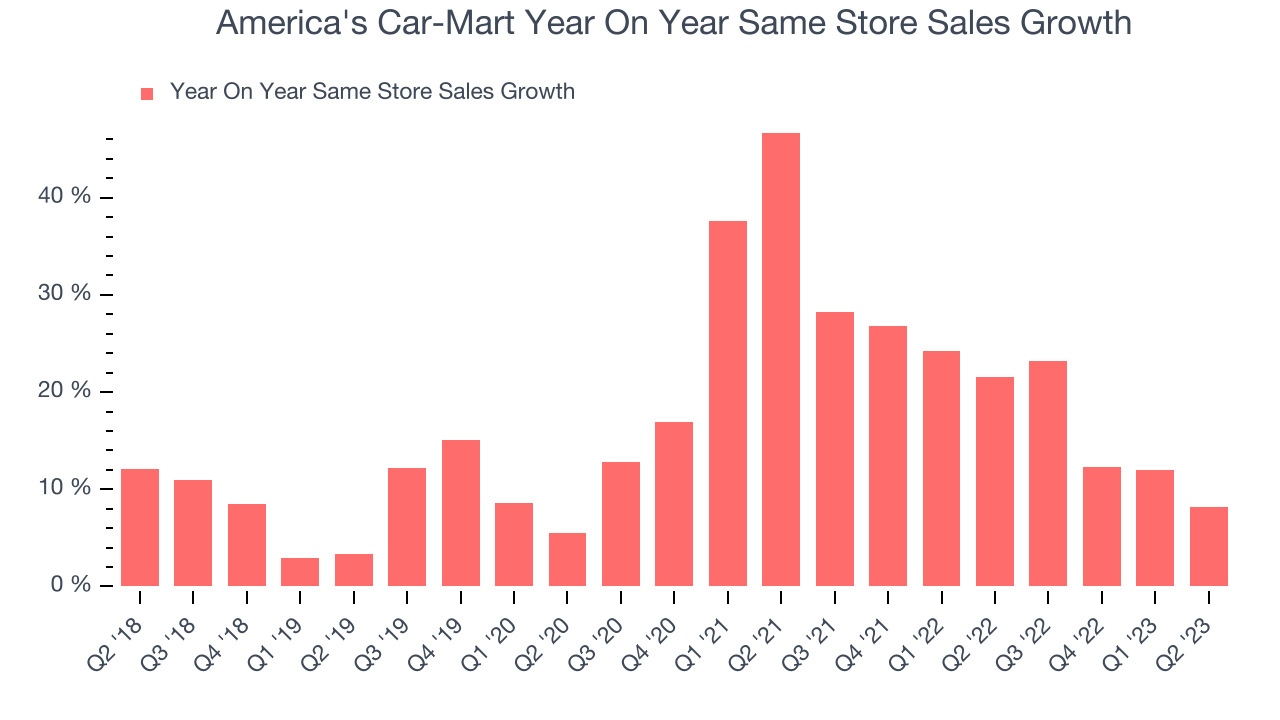

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

America's Car-Mart's demand has been spectacular for a consumer retail business over the last eight quarters. On average, the company has increased its same-store sales by an impressive 19.6% year on year. Given its flat store count over the same period, this performance could stem from increased foot traffic at existing stores or higher e-commerce sales as the company shifts demand from in-store to online.

In the latest quarter, America's Car-Mart's same-store sales rose 8.2% year on year. By the company's standards, this growth was a meaningful deceleration from the 21.5% year-on-year increase it posted 12 months ago. One quarter fluctuations aren't material for the long-term prospects of a business, but we'll watch America's Car-Mart closely to see if it can reaccelerate growth.

Key Takeaways from America's Car-Mart's Q1 Results

With a market capitalization of $643.1 million, America's Car-Mart is among smaller companies, but its more than $6.31 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

Retail units sold missed but revenue beat. EPS missed by a large margin because provision for credit losses and net charge offs were both meaningfully higher this quarter than in the same period last year. Management remarked that "improvements in many areas of the business...were overshadowed by the increase in the provision for loan losses during the period. The major drivers behind higher loan losses related to post-stimulus normalization of charge-offs, additional provisioning resulting from increased contract term, and a higher average interest rate for the portfolio. Said in a different way, we are experiencing the same credit results on the portfolio as we have historically, but the contract length has changed.” Over this was a mixed quarter marred by the increase in provision for loan losses. While management expects this to normalize over time, the stock still closed down 13.7% yesterday.

So should you invest in America's Car-Mart right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)