The New York-based Omnicom Group Inc. (OMC) is one of the world’s most established advertising and marketing communications holding companies. It provides media planning and buying, branding, public relations, crisis and investor communications, healthcare marketing, and advanced data analytics.

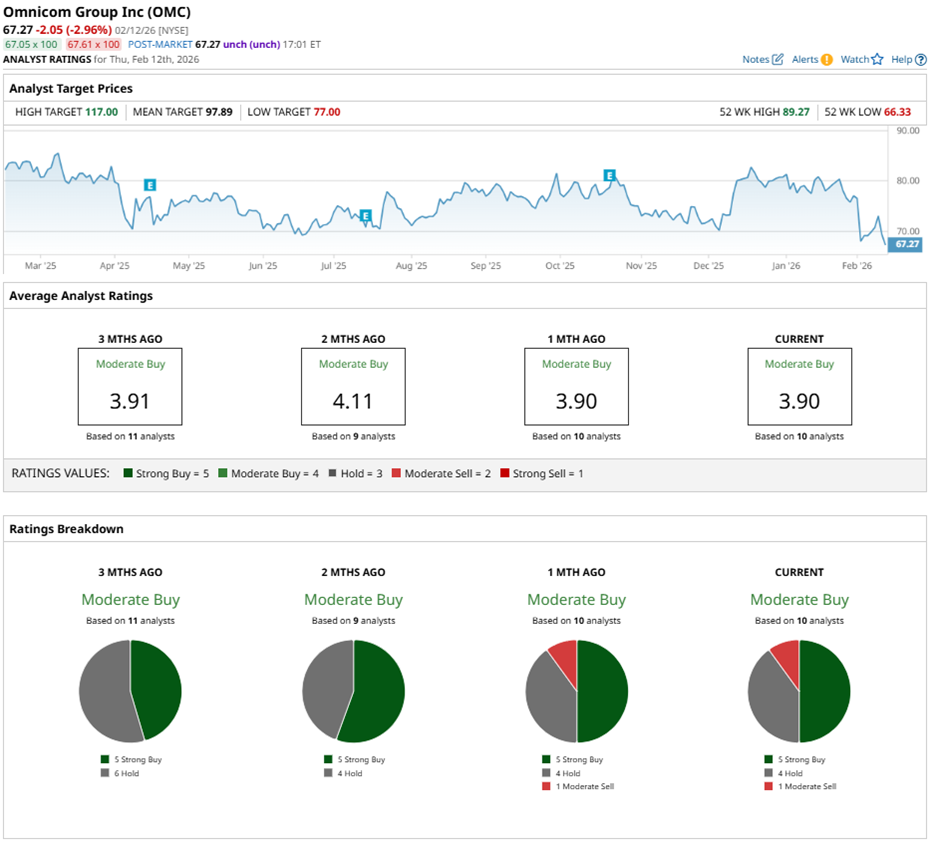

The company holds a market cap of approximately $13.4 billion, yet the market has not rewarded that breadth over the past year. Omnicom’s shares have declined 17.2% over the last 52 weeks, while the S&P 500 Index ($SPX) gained 12.9% during the same period. Year-to-date (YTD), the stock has fallen 16.7%, even as the broader index experienced only a marginal pullback.

Even against its sector benchmark, the Invesco S&P 500 Equal Weight Communication Services ETF (RSPC), which has gained 4.4% over the past year and slipped 5.5% YTD, Omnicom's shares have lagged noticeably.

Management, however, has moved decisively to sharpen its competitive edge. On Jan. 29, the company announced the appointment of Jantzen Bridges as Global President of Credera, Omnicom's enterprise transformation consultancy, and the market responded with a 1.7% rise in the stock on Jan. 30.

Bridges brings more than 20 years of experience leading complex, high-growth businesses at global consulting firms. Under her leadership, Omnicom is significantly expanding its ability to modernize client organizations, optimize the execution of marketing and sales programs, and drive revenue and customer expansion.

Earnings expectations further strengthen the investment narrative. Analysts expect fiscal year 2025, which ended in December, to deliver diluted EPS of $8.59, reflecting projected growth of 6.6% year over year. Importantly, Omnicom has exceeded EPS estimates in each of the last four quarters, demonstrating consistent operational delivery.

Wall Street’s stance reflects measured optimism. Analysts have assigned OMC stock an overall “Moderate Buy” rating. Of the 10 analysts covering the stock, five recommend “Strong Buy,” four advise “Hold,” and one has issued a “Moderate Sell.”

Importantly, the distribution has remained mostly unchanged over the past three months, when five analysts also carried “Strong Buy” ratings, indicating stable conviction.

Price objectives reveal a market that anticipates stronger performance ahead. The average price target of $97.89 represents potential upside of 45.5%. Meanwhile, the Street-high target of $117 points to a gain of 73.9% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)