/A%20corporate%20sign%20for%20AppLovin%20by%20Poetra_RH%20via%20Shutterstock.jpg)

AppLovin (APP) shares plummeted nearly 20% today as valuation and artificial intelligence (AI) disruption fears overshadowed the ad-tech firm’s exceptionally strong Q4 release.

APP saw its revenue grow by 66% on a year-over-year basis to $1.66 billion in the fourth quarter, helping earnings come in at $3.24 a share, both miles ahead of Street estimates.

Still, AppLovin stock crashed on Thursday, bringing its total loss since mid-January to nearly 45%.

This disconnect between operational performance and market reaction creates a potential buying opportunity for contrarian investors willing to distinguish between temporary sentiment shift and underlying business fundamentals.

AppLovin Stock’s Premium Is Justified

APP stock is worth buying on the post-earnings decline because the Nasdaq-listed firm maintains a robust financial stature with $2.49 billion in cash against $3.51 billion in manageable debt.

Moreover, with gross margins exceeding 89% in the fourth quarter, it’s clearly a business executing at an exceptional level with strong operational leverage.

And while AppLovin isn’t inexpensive to own at more than 31x forward earnings, its guidance for an exciting 60% earnings growth this year does help justify that premium a little.

Plus, the management’s guidance for up to $1.775 billion in Q1 revenue suggests concerns of artificial intelligence disruption may be overblown.

Scotiabank Sees Massive Upside in APP Shares

Investing in AppLovin following its Q4 print may prove lucrative also because its relative strength index (14-day) now sits at about 31 only, indicating bearish momentum is approaching exhaustion.

Meanwhile, the firm’s e-commerce self-service platform is scheduled for launch within the next few months, which could help drive its stock price to a high of $775, argued Scotiabank analysts in a post-earnings research note.

And options traders seem to agree with them.

According to Barchart, contracts expiring mid-May have the upper price pegged at $474 currently, signaling AppLovin shares could rally some 30% within the next three months.

How Wall Street Recommends Playing AppLovin

Investors could also take heart in the fact that Scotiabank isn’t the only investment firm which sees the ongoing selloff in APP shares as rather overdone.

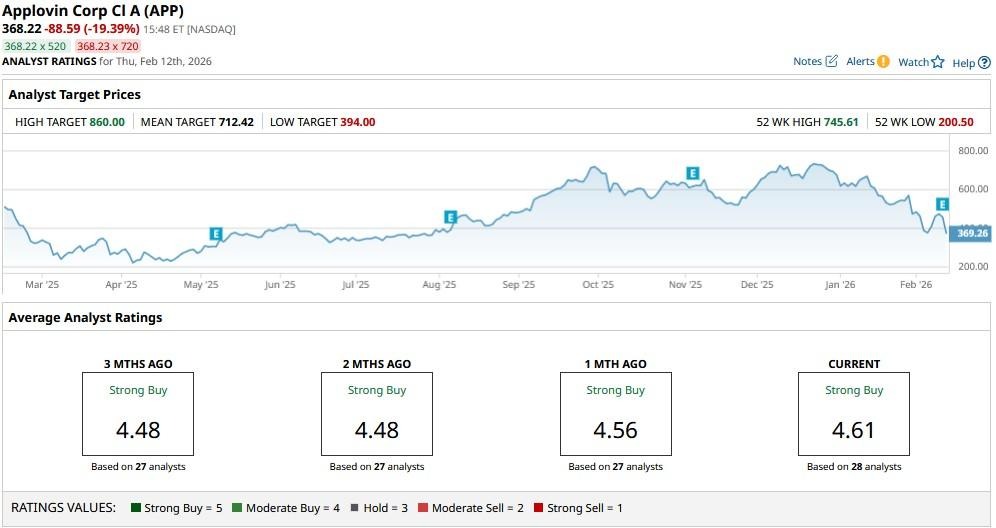

The consensus rating on AppLovin Corp sits at “Strong Buy” with the mean target of about $712 indicating potential upside of nearly 43% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)