If you are looking to generate additional income or balance out your portfolio with some great dividend-paying stocks, there are many excellent options to choose from among the stocks in the S&P 500. You could work from the list of stocks that have increased their annual dividends for at least 25 straight years. There are about 65 of them, at last count.

Or you could go right to the S&P 500 and pick the stocks with the five highest dividend yields. But the highest-yielding dividend stocks are not always the best investments. Here's why -- along with a recommendation for a better option.

Why the highest yields are not always the best

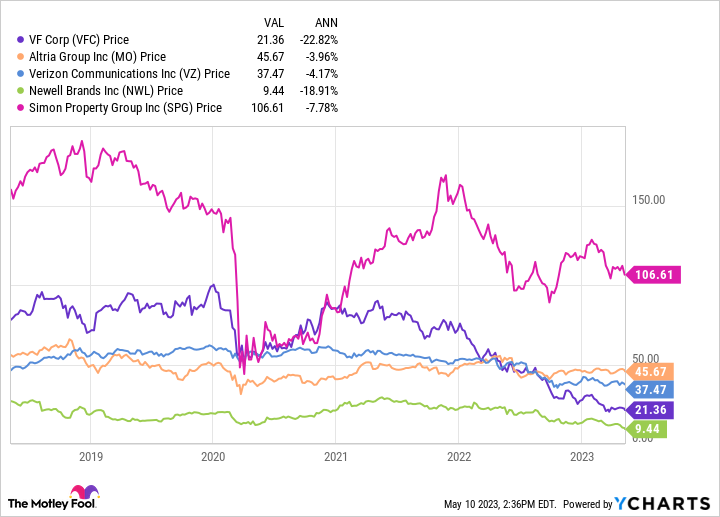

The stocks that currently have the highest dividend yields on the S&P 500 are Altria Group (NYSE:MO) (8.2%); V.F. Corp (NYSE:VFC) (6.9%); Newell Brands (NASDAQ:NWL) and Verizon Communications (NYSE:VZ) (6.3% each); and Simon Property Group (NYSE:SPG) (6.1%).

These are eye-popping yields, but there are red flags with each one of these companies. Tobacco company Altria has a high payout ratio of over 75%, and it has seen its earnings decline in recent years. For V.F. Corp., a footwear and apparel company, it is a similar story, with an 84% payout ratio along with declining earnings that have seen its stock price post a negative 23% annual return over the past five years.

However, both these companies have long histories of increasing their dividends -- Altria for 53 straight years and V.F. Corp. for 49 consecutive years.

Telecom giant Verizon is probably the best dividend stock among the five highest yielders, but it has issues as well. The earnings have been fairly steady, and the payout ratio is a manageable 51%. However, the company has struggled with debt and stiff competition, and its stock price has been on a downward trend in recent years. Newell Brands, a maker of household products, has had an even more difficult time and has not raised its dividend since 2017.

Finally, there is Simon Property Group, which owns and manages retail malls and outlets. This has been an extremely difficult time for retail stores, and Simon Property's spotty earnings and falling share price have reflected that. It is a real estate investment trust (REIT), which is required to pay out at least 90% or more of its taxable income in dividends. However, its payout ratio is about 119%.

The main reason all these yields are so high is because these stocks have all struggled. Since the yield is a percentage of the share price that is paid in dividends each year, the lower the share price, the higher the yield.

A better option

A much simpler way to find the best and most reliable dividend stocks is to invest in a dividend-focused exchange-traded fund (ETF).

One of the best you can find is the Invesco S&P Ultra Dividend Revenue ETF (NYSEMKT:RDIV), which screens for stocks within the S&P 500 with the highest dividends. The ETF screens for the top five in each sector that have the lowest payout ratio. This allows it to weed out the dividends that may not be sustainable. The stocks with the highest percent of revenue gained over the most recent quarter have the most weight in the portfolio. This is done to ensure that the companies are growing.

Currently, the three largest holdings in the portfolio of 60 stocks are Best Buy, Intel, and LyondellBasell Industries.

It should be noted that not one of the five top-yielding stocks in the S&P 500 made it through these screens, so you may be better off with this ETF.

10 stocks we like better than Invesco Exchange-Traded Fund Trust II-Invesco S&P Ultra Dividend Revenue ETF

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Invesco Exchange-Traded Fund Trust II-Invesco S&P Ultra Dividend Revenue ETF wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of May 8, 2023

Dave Kovaleski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Best Buy. The Motley Fool recommends Intel, Simon Property Group, and Verizon Communications and recommends the following options: long January 2023 $57.50 calls on Intel and long January 2025 $45 calls on Intel. The Motley Fool has a disclosure policy.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)