With markets looking increasingly volatile, investors might be interested in looking at safe-haven investments. Safe haven investments are used by investors when they are concerned about economic or political risks in the market.

The most common safe-haven investments are gold and bonds. These assets have the potential to outperform stocks during equity bear markets.

Gold investing can be done on via the Spdr Gold Shares ETF (GLD), which aims to match the performance of the price of gold bullion.

This gold ETF has seen a return of +11.97% in the last 6 months, which is a lot better than most equities. Unfortunately for income investors, the GLD ETF does not pay a dividend.

Thankfully, as sophisticated investors, we can generate an income from holding GLD by using options. The strategy is a known as a covered call which involves selling call options against a stock position.

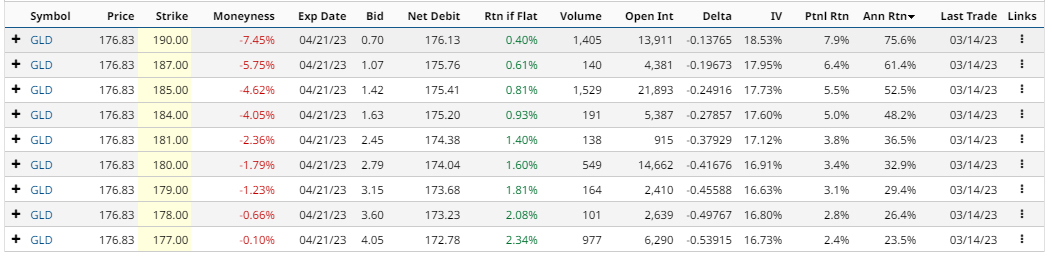

Let’s take a look at the Barchart Covered Call Screener for GLD:

GLD Covered Call Example

Let’s evaluate the first GLD covered call example. Buying 100 shares of GLD would cost $17,683. The April 21, 190 strike call option was trading yesterday for around $0.70, generating $70 in premium per contract for covered call sellers.

Selling the call option generates an income of 0.40% in 37 days, equalling around 3.82% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 190?

If GLD closes above 190 on the expiration date, the shares will be called away at 190, leaving the trader with a total profit of $1,387 (gain on the shares plus the $70 option premium received).

That equates to a 7.9% return, which is 75.6% on an annualized basis.

That particular covered call allows for a lot of capital appreciation. What if an investor was more income focused? They would need to sell a call much closer to the stock price (look for a low value in the Moneyness column).

Instead of the April 190 call, let’s look at the April 177 call (last row).

Selling the 177 call option for $4.05 generates an income of 2.34% in 37 days, equalling around 22.51% annualized.

If GLD closes above 177 on the expiration date, the shares will be called away at 177, leaving the trader with a total profit of $422 (gain on the shares plus the $405 option premium received).

That equates to a 2.4% return, which is 23.5% on an annualized basis.

Of course, the risk with the trade is that the GLD might drop, which could wipe out any gains made from selling the call.

Barchart Technical Opinion

The Barchart Technical Opinion rating on GLD is an 88% Sell with a Strengthening short term outlook on maintaining the current direction.

Implied volatility is at 16.53% compared to a 12-month low of 12.85% and a 12-month high of 21.00%. Some traders may prefer implied volatility to be higher before starting a covered call trade.

Gold investing can provide a hedge against inflation and geopolitical risks, but the returns can be unattractive for income investors without a dividend payment. Thankfully, you now know how to generate an income from your GLD position now.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Options News from Barchart

- Unusual Stock Options Volume Signals Concerns for Ally Financial (ALLY)

- Western Alliance Bancorp is Up Big on Citadel Purchase of 5.4%

- The 3 Financial Stocks I’m Buying Now

- Adobe Earnings: Iron Condor Could See 37% Return On Risk

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.