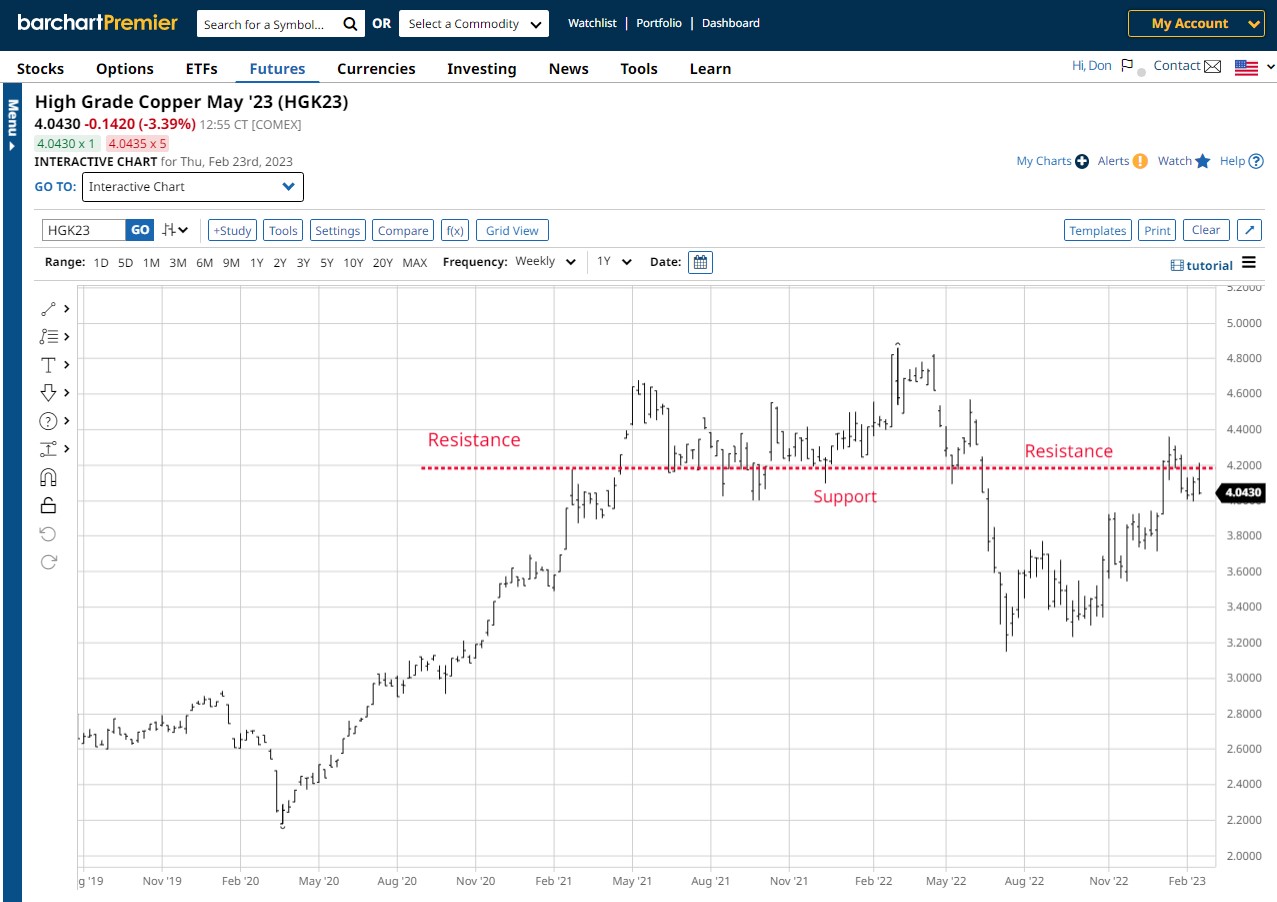

While copper was building its seasonal low in November 2022, I wrote an article for Barchart, "The Second Leg of the Economic Barometer-Copper." Describing how the commercial traders (refiners and end users) had absorbed the copper market supply and prices showed evidence of a seasonal rally. Soon after the rally created an uptrend, managed money (trend followers) began buying copper futures contracts. Since then, prices have rallied into overhead supply and a time of the year that historically has witnessed producers of copper selling pressure.

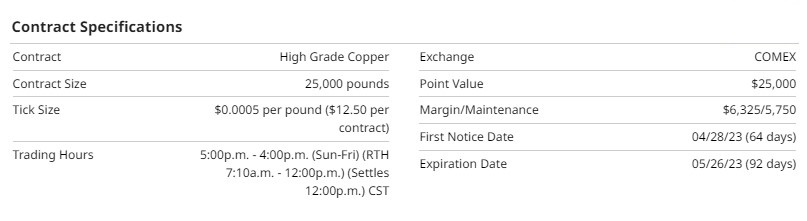

Specifications, Description, & Performance

The word copper comes from the name of the Mediterranean island Cyprus, which was a primary metal source. Dating back more than 10,000 years, copper is the oldest metal used by humans. From the Pyramid of Cheops in Egypt, archeologists recovered a portion of a water plumbing system with copper tubing in serviceable condition after more than 5,000 years.

Copper is one of the most widely used industrial metals because it is an excellent conductor of electricity, has corrosion-resistance solid properties, and is very pliable. Electrical uses of copper account for about 75% of total copper usage, and building construction is the single largest market (the average U.S. home contains 400 pounds of copper). Copper is biostatic, meaning that bacteria will not grow on its surface. It is therefore used in air-conditioning systems, food processing surfaces, and doorknobs to prevent the spread of disease.

The largest producers of copper in 2022 were Chile, Peru, the Democratic Republic of the Congo, China, the United States, Russia, Indonesia, Australia, Zambia, and Mexico.

Source: Statista.com

Copper's performance over the past three months was +12%, while the prior 52 weeks had negative returns of -8%. Most of the preceding year's losses were attributed to the upcoming recession, the weak stock market, and the copper market's perception of a slowing economy. During the past three months home building and new home products industry were able to lock in low prices for the upcoming spring building season.

While copper is used in industrial equipment, electric vehicles, and electronic products, the primary demand comes from the building industry. New homes can have approximately 400 pounds of copper installed. Where in 2022, 46% of copper was used in this sector.

Seasonal Pattern

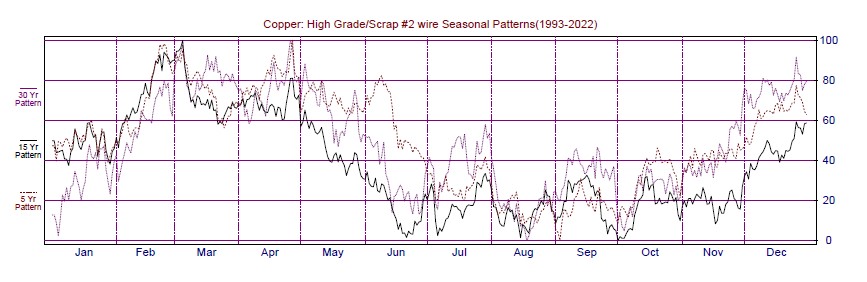

Source: Moore Research Center, Inc. (MRCI)

MRCIs research has revealed that copper usually has a price rally from a seasonal low in October-November as the building supplies and homebuilders prepare for the upcoming spring homebuilding season. Reviewing the MRCIs seasonal pattern for copper prices, we notice that the high prices for the past 15 years have arrived in February-March. Possibly due to the new demand for copper in electric vehicles (EVs), the 5 and 30-year pattern indicates a new high in April-May has been occurring, leading to a possible change in the seasonal pattern in the future. Another factor impacting the seasonal pattern was the robust housing market for the past two years. Due to the extensive demand, suppliers and home builders needed more copper than expected as new home orders came in.

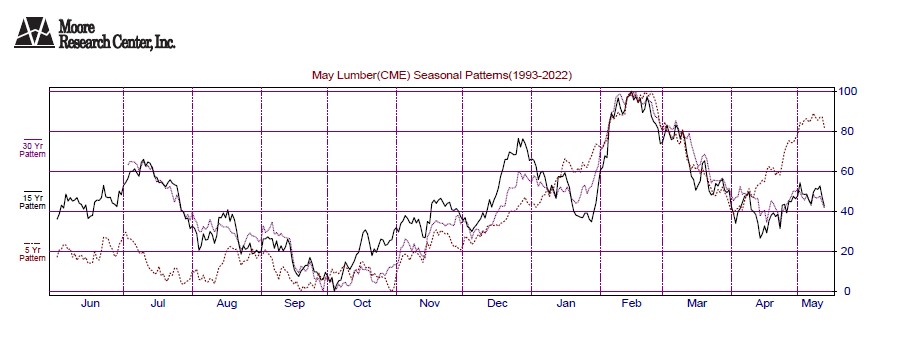

As an added confirmation to copper's repetitive seasonal high in February-March, lumber prices exhibit a similar seasonal high pattern.

The seasonal low for lumber was slowly developing, but January had a mediocre rally, leading to a seasonal high in February. As the news of higher interest rates and the looming recession, the lumber market has retraced its January rally.

Both copper and lumber are signaling an economic slowdown ahead. Also, the oil market (CL) usually has a significant rally this time of year due to the upcoming driving season, and oil prices are trading at the low end of their trading range.

Reviewing the weekly contract-specific chart of May copper, prices found supply at an area that has made copper prices go lower.

MRCIs seasonal pattern for copper illustrates a downtrend into the June timeframe, at which the market tends to go sideways while waiting for the following seasonal low to form.

If mortgage rates continue to climb or a housing crisis develops due to the Federal Reserve's non-stop rate increases, home-buying demand will dissipate, lowering copper and lumber prices.

Products to Trade Copper

The standard-size copper contract (HG) is one choice. However, the large contract size (25,000 pounds of copper) requires much more capital than most traders may have. A micro-copper contract (Barchart symbol: QL Exchange symbol: MHG) is available with only 2,500 pounds of copper, exposing traders to less risk and capital requirements. For equity traders, there is an exchange-traded note (ETN) symbol JJC.

Summary

If Dr. Copper's and associate's lumber market analysis of the upcoming weak economy is correct, then recommending caution for other asset classes should be considered. Observing the oil market prices may also indicate the strength or weakness of the economy. When economies are doing well, more demand appears for energy, and prices rally. The opposite holds for weaker economies.

More Stock Market News from Barchart

- Warner Bros Discovery Rebounds on the Company’s Cost-Cutting Plans

- This Company Is Flashing A 100% Buy And Is Highly Recommended By Analysts

- Stocks Fluctuate in the Afternoon

- Markets Today: Nvidia’s Bullish Revenue Outlook Lifts Stock Index Futures

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)