Description

The word copper comes from the name of the Mediterranean island Cyprus, which was a primary metal source. Dating back more than 10,000 years, copper is the oldest metal used by humans. From the Pyramid of Cheops in Egypt, archeologists recovered a portion of a water plumbing system with copper tubing in serviceable condition after more than 5,000 years.

Copper is one of the most widely used industrial metals because it is an excellent conductor of electricity, has strong corrosion-resistance properties, and is very ductile. Electrical uses of copper account for about 75% of total copper usage, and building construction is the single largest market (the average U.S. home contains 400 pounds of copper). Copper is biostatic, meaning that bacteria will not grow on its surface. It is therefore used in air-conditioning systems, food processing surfaces, and doorknobs to prevent the spread of disease.

The largest producer of copper is Chile, with 26.7% of the world's production, followed by Peru with 10.5%, China with 8.6%, the U.S. with 5.7%, and Australia with 4.3%.

Source: Barchart CRB Yearbook

Will copper help light the way for a more robust 2023 economy?

In a recent article for Barchart, I wrote about the lumber market and how it appeared to be trying to put in a bottom but would need the copper market to help confirm if there would be strong demand in the building industry in 2023.

Usually, the lumber market puts in a seasonal low in October. Since writing the article, lumber rallied into November and returned to the October lows. The October lows showed strong support by the commercial traders (red line) by being the most bullish than at any time in the past 12 months. The current price action shows the commercials are adding to their longs as the price returns to the October lows.

The housing market can significantly affect the economy. Consider that purchasing a home entails borrowing large amounts of money that are good for the financial sector of the markets. Then there will be demand for furnishings, carpets, remodeling, painting, etc. Since lumber and copper are the primary home-building components, it makes sense to track these two commodities to understand future economic events.

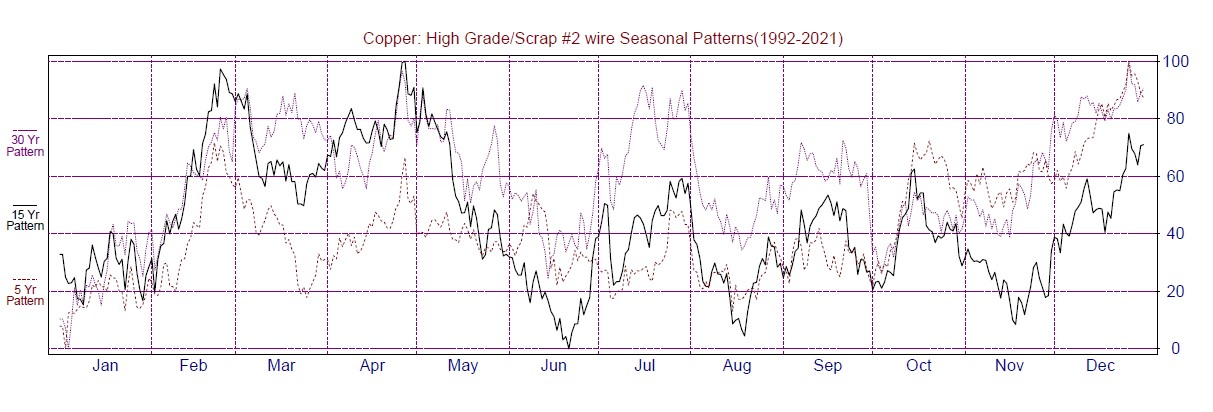

Seasonality of copper

Source: Moore Research Center, Inc. (MRCI)

MRCI has found that the cash copper market puts in a seasonal low towards the end of June. While there is some accumulation of copper during the early fall season, the copper market tends to retest the seasonal lows in August and late November. From the end of November until March of the following year, copper tends to rally and pull back into late March and then rally into its seasonal high in May. Once May arrives, refiners of copper products (pipes, electrical wire, switches, etc.) will have accumulated the copper they need for the upcoming building season.

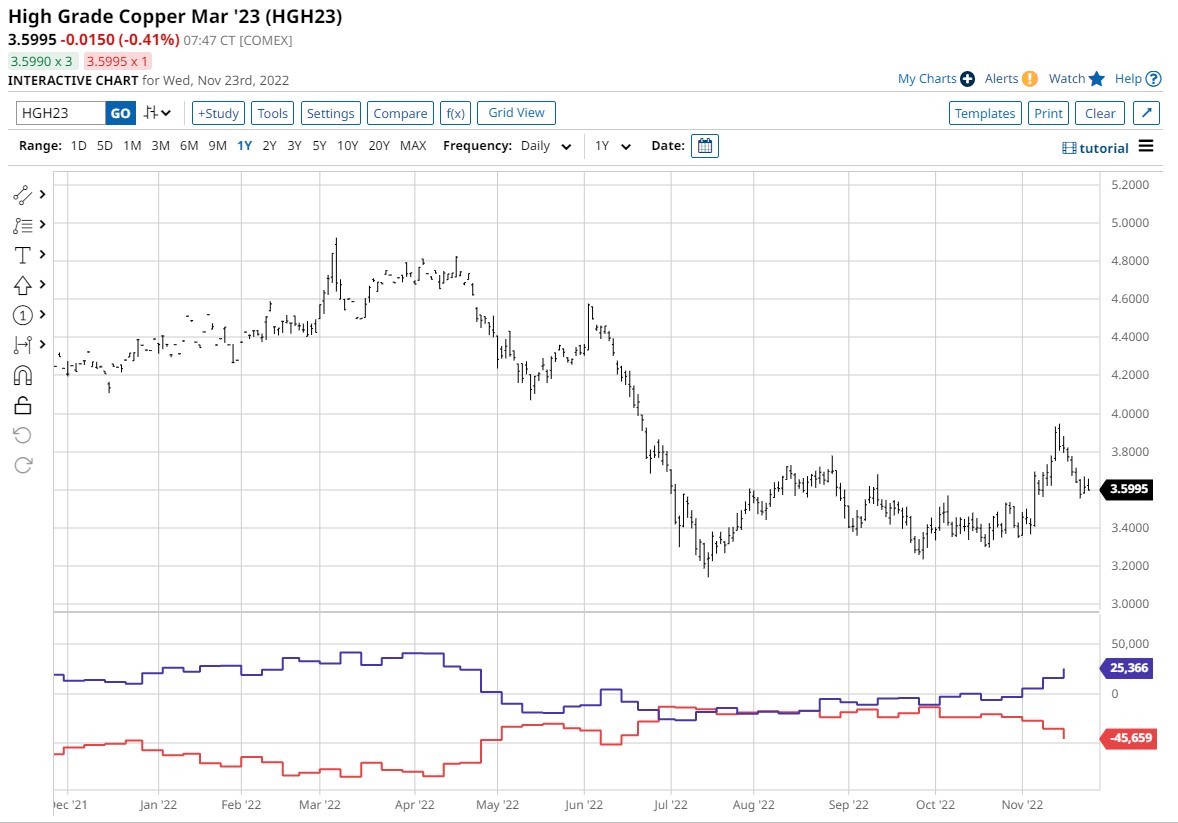

The Commitment of Traders Report (COT Report) for Copper

To confirm a seasonal pattern, it helps to verify that the commercial traders will need the commodity again this season. Using the COT report is a way to do that. Looking at the seasonal low month of June, we see the commercial traders (red line) held the most bullish positions in the past 12 months. Another verification is that as the market drifted sideways during the fall season in August and November, the commercials maintained their bullish posture, as evidenced by the red line going sideways at 12-month highs.

The usual pattern has now developed where commercial traders absorb supply in the market. Once the managed money (blue line) trend following systems detect a new trend, they begin buying, forcing higher prices.

COT trading tip

The COT report can be an excellent tool to help stay out of choppy markets and when to participate in trending markets. Notice that the price action tends to trend when the red and blue lines are spread apart. When the red and blue lines overlap for a period, there tends to be sideways trading activity. The copper COT shows the lines expanding, indicating a possible trend beginning.

Technicals of the copper market

Since the commercials scaled into their long positions, the market has traded higher. The daily trend has turned up regardless of using price action or the 10-20 EMAs. The horizontal red line connects three primary resistance points. Since the price has traded through the prior resistance, the price will most likely return to that old resistance and become new support. The support is an area, not a specific price.

Currently, copper has a seasonal pattern supporting the market, and the COT report shows the commercials built a strong base, and technical analysis shows a current uptrend. We're set to go with this market if it were any other trade. But there is something that's not right at the moment.

A fly in the ointment

In another article for Barchart, I described how crude oil is going through a low liquidity period—causing excessive volatility and risk.

The copper market open interest is trending down (illustrating fewer overnight positions) and is lower than at any time in the past 12 months.

I highlighted last year at this time on the open interest and the price chart. Notice how the market drifted down into the latter part of December, and then the open interest began increasing, and the price rallied.

What is happening is that we are coming into year-end trading. Traditionally December is a low liquidity period due to the last two weeks of the month for Christmas and New Year. And many managed fund managers and large banks begin closing their books down for the year.

Many traders could learn a lesson from this "seasonal pattern." Large traders' philosophies are that if they have not made money during the previous 11 months, they will surely not make it in the last month of the year. And, if they have been profitable, they want to refrain from giving back profits during a known illiquid time of the year.

Products to trade copper

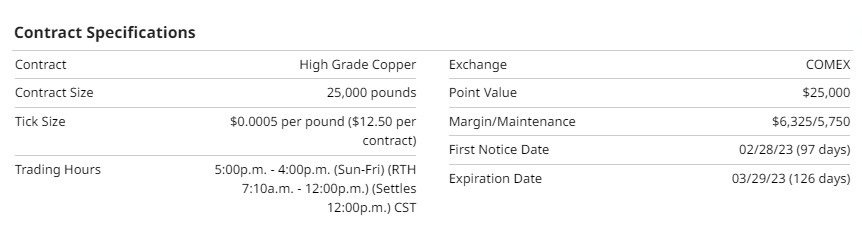

The standard-size copper contract (HG) is one choice. However, the large contract size (25,000 pounds of copper) requires much more capital than most traders may have. A micro-copper contract (Barchart symbol: QL Exchange symbol: MHG) is available with only 2,500 pounds of copper, exposing traders to less risk and capital requirements. For equity traders, there is an exchange-traded note (ETN) symbol JJC.

Summary

The setup for copper futures confirms the lumber futures setup, and this trade still has potential. Observing the copper market open interest, looking for it to show signs of increasing along with up-trending price action could be a better-timed trade.

If copper and lumber keep showing signs that the seasonal pattern will work this season, we could have seen the worst of the stock market correction. The stock market is currently about 16% off its recent low, with market internals showing some strength. The interest rate market has also rallied in price and declined in yield, signaling a perception that the Federal Reserve may not have to be as aggressive in raising rates.

More Metals News from Barchart

- Stocks Push Higher on Lower Bond Yields and Mixed Economic News

- Dollar Drops on Lower T-note Yields

- Stocks Higher on Corporate Earnings and Lower Bond Yields

- Dollar Gains on Higher T-note Yields and Safe-Haven

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)