Target stock experienced an impressive rally from late December to early February, but is now pulling back towards the 50 and 200-day moving averages.

By using a combination of option strategies, we could potentially buy the stock for a significant discount, or achieve a healthy profit if the stock trades sideways.

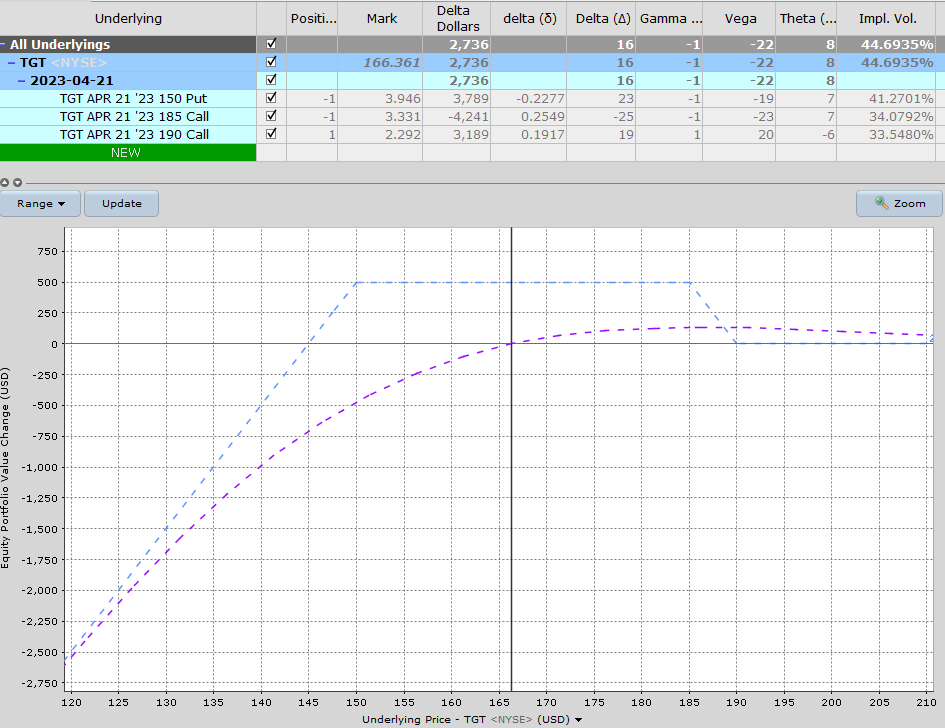

Here’s the trade:

- Sell to open the TGT April 21 put with a strike price of 150, which was trading around $3.95 yesterday.

Then, add a bear call spread:

- Sell to open the TGT April 21 call with a strike price of 185, which was trading around $3.35 yesterday.

- Buy to open the TGT April 21 call with a strike price of 190, which was trading around $2.30 yesterday.

The sold put brings in around $395 in option premium, and the bear call spread add another $105 in premium. In total, the combination of the two trades generates $500 in premium.

Here’s how the trade looks at trade initiation. The blue line represents the profit or loss at expiration and the purple line shows the trade as of today.

The position starts with a delta of 16, meaning it is roughly equivalent to owing 16 shares of TGT stock. This figure will change as the trade progresses.

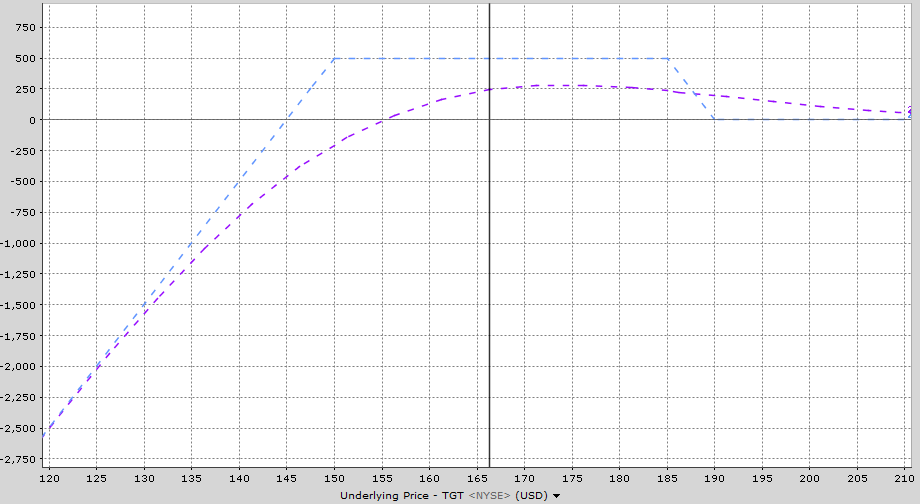

This is how the trade could look in around one month’s time.

Possible Scenarios For This Target Stock Option Trade

Let’s work through a couple of scenarios of how this trade could look at expiration on April 21.

- If TGT stock trades sideways and finishes between 150 and 185, the sold put and bear call spread will both expire worthless. The total profit will be equal to the premium received of $500.

- IF TGT falls below 150 at expiration, we will be assigned on the sold put and will be forced to buy 100 shares at 150. However, our net cost basis will be 145, thanks to the $500 in option premium received. That is around 12.85% below the closing price yesterday.

- If TGT is gets back into rally mode and is above 190, the bear call spread will suffer a full loss of $500, but this will be fully offset by the $500 premium received, leaving us in a no loss scenario (other than commissions).

So the worst case scenario is a very large drop in Target stock, but even then we get to buy a quality company for a significantly lower price than it is trading today.

Company Details

Target is currently rated a Buy. The Barchart Technical Opinion rating is a 40% Buy with a weakest short term outlook on maintaining the current direction.

Of 28 analysts covering TGT, 16 have a strong buy rating, 2 have a moderate buy rating and 10 have a hold rating.

Implied volatility is 45.63% compared to a twelve-month high of 52.03% and a low of 22.45%. That gives TGT stock an IV Percentile of 82% and an IV Rank of 78.36%.

Target is due to report earnings on February 28th, so this trade would have earnings risk if held through that date. The options market is pricing in a potential move of 8.7% in either direction.

Target Corp. has evolved from just being a pure brick-&-mortar retailer to an omni-channel entity. It has been modernizing supply chain to compete with pure e-commerce players. Its acquisition of Shipt to provide same-day delivery of groceries, essentials, home, electronics as well as other products. Target provides an array of owned & premium branded goods ranging from household essentials and electronics to toys and apparel for men, women and kids. It also houses food and pet supplies, home furnishings and d'cor, home improvement, automotive products and seasonal merchandise. It also offers in-store amenities, consisting of Target Caf', Target Photo, Target Optical, Portrait Studio, Starbucks and other food service offerings. A greater number of general merchandise stores provides an edited food assortment, including perishables, dry grocery, dairy & frozen items. Its digital channels include a wide merchandise assortment, including many items found in stores, along with a complementary assortment.

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own.

If you end up being assigned, you can start selling covered calls against the stock position.

You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

Some traders like to add a deep out-of-the-money long put to reduce risk. For example, an April 21 put option with a strike price of 110 could be purchased for around $27. Buying this put, would cap losses below 110 and reduce total capital at risk from $14,500 to $3,500.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Sink as 10-year T-note Yield Rises to 3-1/4 Month High

- Exxon's 3.27% Yield Is Attractive, But Short Put Income Plays Are Gaining Attention

- Short Sellers Burned by This Year’s Tech Stock Rally

- Stocks Fall on Concern about Hawkish Fed

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

/Elon%20Musk%2C%20founder%2C%20CEO%2C%20and%20chief%20engineer%20of%20SpaceX%2C%20CEO%20of%20Tesla%20by%20Frederic%20Legrand%20-%20COMEO%20via%20Shutterstock.jpg)