Exxon Mobil (XOM) stock has moved slightly lower since releasing its earnings on Jan. 31. XOM stock still has an attractive 3.27% dividend yield despite the company's powerful free cash flow (FCF). However, short-put income plays are also now attracting value investors.

I described this income play in my last article on Feb. 3, where it was clear that the March 3, 2023, expiration puts at the $103 strike price were very attractive. They were trading for $1.18 per put option at the time, but, as of today, Feb. 21, almost three weeks later, the premium has fallen to $0.22 per put option by mid-day today, Feb. 21.

Even though the stock has fallen from $114.74 on Feb. 3, to $111.50 today, the put premiums have not risen, which would hurt the short put income player. Instead, the investor now has a gigantic profit of $0.96 per put option shorted (i.e., $1.18-$0.22), or 81.4%.

Rolling the Short Put Trade Over

The investor has now made most of the profit, with just 19.6% left on the table. Instead of waiting out the remaining 10 days of expiration, it might make sense to roll this income play over once again. This will allow the investor to catch the majority of another period's put premium decay.

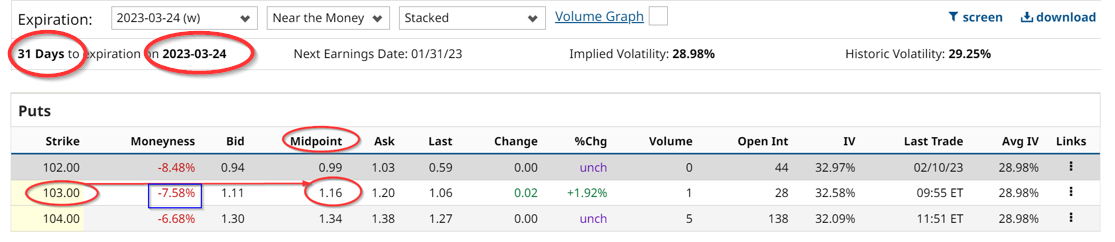

For example, the March 24 expiration shows that the $103 strike price puts are trading for $1.16 per put contract. That is very close to the original $1.18 put price received earlier this month. Given that the last 30 days of a put contract has the largest amount of put price decay, this is ideal.

For example, the investor will have to buy back, or put in an order to “buy to close” the March 3, 2023, $103 strike price put. That will cost $22 per put contract. But then the investor can immediately “sell to open” a new contract for 1 put at the $103 strike price for expiration on March 24.

This means that the investor earns a net $94 per put contract. Given that they had to secure $10,300 (i.e., $103 x 100 shares) per put contract with the brokerage firm in cash and/or margin, the immediate return is 0.91% (i.e., $94/$10,300). That is a very attractive return since if repeated over a year, the annualized return is 10.95%.

Moreover, if the investor is willing to take on more risk, they could short the $104 puts and make $1.34 per contract. After deducting the rollover cost of $0.22, the net return is $1.12. That works out to 1.087% for the month, or 13.0% on an annualized basis. This makes the rollover short-put trade even more attractive.

Granted, it also means more risk. The investor may be forced to buy XOM at $104 per share if it falls to that price or lower on or before March 24.

But don't forget. XOM stock now yields 3.27% and this is a very good yield. At $104, in fact, the dividend yield is slightly higher at 3.50% (i.e., $3.64 dividends / $104 strike price). That will help the investor who shorts this out-of-the-money put earn slightly more.

More Stock Market News from Barchart

- Short Sellers Burned by This Year’s Tech Stock Rally

- Stocks Fall on Concern about Hawkish Fed

- 3 Ways to Play This Down and Out Media Stock

- Markets Today: Stocks Under Pressure from Fed Policy Concerns

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.