On January 22, 2023, crude nearby March NYMEX WTI crude oil futures were at the $81.64 level, with the active month Brent futures at $87.63. In an article on Barchart that day, I wrote, “While crude oil and gasoline are not likely to return to the 2022 highs, prices above $100 per barrel and $3 per gallon wholesale are possible over the coming months.” Over the past month, crude oil’s price edged lower.

In that piece, I highlighted that crude oil could have a floor at the $70 per barrel level because the U.S. administration has stated it plans to replace the U.S. Strategic Petroleum Reserve at around that price. Crude oil has yet to challenge the level that has become technical and fundamental support. Still, it has not staged a significant rally as it consolidates around the $76 level on the nearby NYMEX contract.

The SPR is at the lowest level since 1983, supporting oil prices

At the end of 2021, the U.S. Strategic Petroleum Reserve stood at 594.7 million barrels. The U.S. government stores its sweet and sour crude oil reserves in caverns across the country.

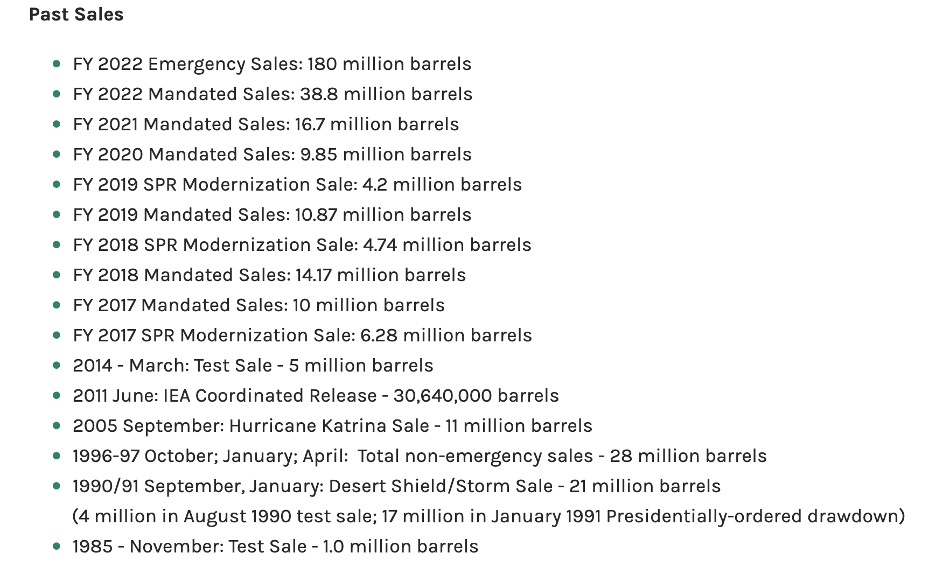

Past SPR sales since 1985 include:

Source: Energy.gov

The 2022 “mandated and emergency sales” were an unprecedented release from the SPR, as the previous highest sale was in June 2011, when it released 30.64 million barrels. In 2022, a total of 218.8 million barrels reduced the SPR by 36.8% from the December 31, 2021, closing level. As of February 10, 2023, the U.S. SPR stood at 371.6 million barrels, the lowest level since December 1983.

On February 13, 2023, the U.S. Department of Energy announced the release of up to another “26 million barrels of sweet crude oil from two SPR storage sites, with deliveries beginning as early as April 1, 2023.” If completed, the sales will push the total U.S. SPR to 345.6 million barrels, 141.9% below the end of 2021 level. There is a slight difference of 4.3 million barrels between the reported SPR releases and the current SPR level reported by oilprice.com on February 14, 2023.

The U.S. has released crude oil to control prices because OPEC production decisions include Russian participation. The Russians have used crude oil and other commodities as economic weapons against “unfriendly” countries supporting Ukraine.

Inventories have risen in 2023

Crude oil and oil product inventories increased in 2023.

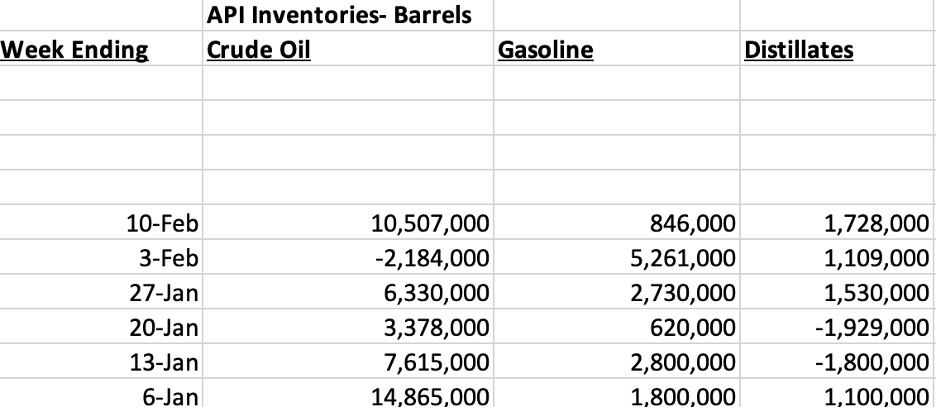

Source: Oilprice.com/API

The chart shows that the American Petroleum Institute reported a 40.511-million-barrel increase in crude oil inventories from the week ending on January 6, 2023, through February 10, 2023. Over the same period, gasoline stockpiles increased by 14.057 million barrels, and distillate stocks rose by 1.738 million barrels.

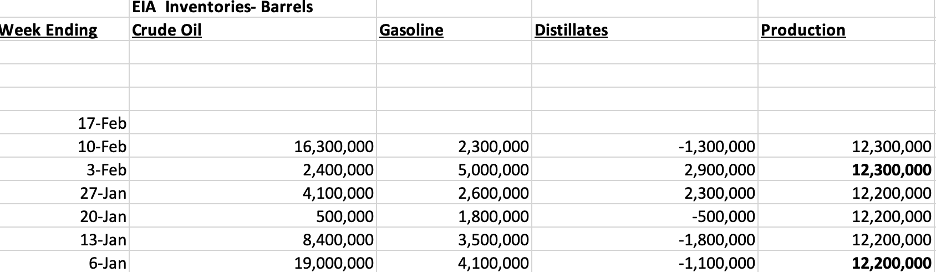

Source: EIA

Over the same period, the U.S. Energy Information Administration reported a 50.7-million-barrel rise in crude oil inventories, a 19.3-million-barrel increase in gasoline stocks, and a 500,000 rise in distillate stockpiles. The EIA has said that U.S. daily crude oil output is running between 12.2 and 12.3 million barrels per day in 2023, slightly below the March 2020 record 13.1 mbpd record peak.

While inventories are rising, U.S. SPR sales have masked the energy commodity’s fundamental supply and demand situation. According to the EIA, the total changes in U.S. oil and product inventories in 2022 were:

- Crude oil stocks increased by 12.039 million barrels

- Gasoline inventories fell by 2.222 million barrels

- Distillate stockpiles dropped by 7.674 million barrels

Subtracting the SPR releases highlights the severity of the tightness of the petroleum and oil product markets.

Chinese demand is critical for oil’s price

There has been some debate over SPR sales that are winding up in China and India. On January 27, the U.S. House of Representatives passed a bill limiting the President’s ability to draw down the SPR for any other reason than a “severe energy supply disruption.” The bill passed 221-205 would prohibit any new drawdowns on the SPR until federal agencies developed a plan to lease federal lands for oil and gas production “by the same percentage of petroleum…that is to be drawn down.” The legislation will not see the light of day, as it lacks support in the Democratic-controlled Senate, and the President would certainly veto the bill. Some Republicans claim the SPR sales are a political tool that covers up the consequences of the administration’s green agenda.

Meanwhile, another bill restricting SPR sales to China passed the House by a 331-97 margin.

It is hard to tell how much SPR sales wound up in China as oil and oil products can flow worldwide without identity, and traders can mask origins. However, Chinese demand will likely be a critical factor for the path of least resistance of the energy commodity in 2023. As China emerges from its COVID-19 lockdowns, the demand will rise. Saudi Arabia and Russia remain China’s and India’s leading oil suppliers. As the demand increases, OPEC and Russia could increase production, but prices will likely rise. However, on February 16, the Saudi energy minister said that the current production quotas would be “locked in” until the end of the year. No change in production policy and rising Chinese demand could cause oil prices to rise above the $100 per barrel level, a bonus for the Saudis and a source of funding for Russia’s ongoing war in Ukraine.

China’s economy will be a crucial factor for oil prices over the coming months. Meanwhile, the U.S. SPR releases cannot continue at the same pace in 2023. Any price correction to the $70 per barrel level will encourage buying to replace the sales, limiting the downside for the energy commodity while the upside remains explosive.

The driving season is coming- Gasoline crack spreads and ethanol prices remain strong

The traditional energy markets are moving towards the 2023 driving season, where the demand for gasoline increases.

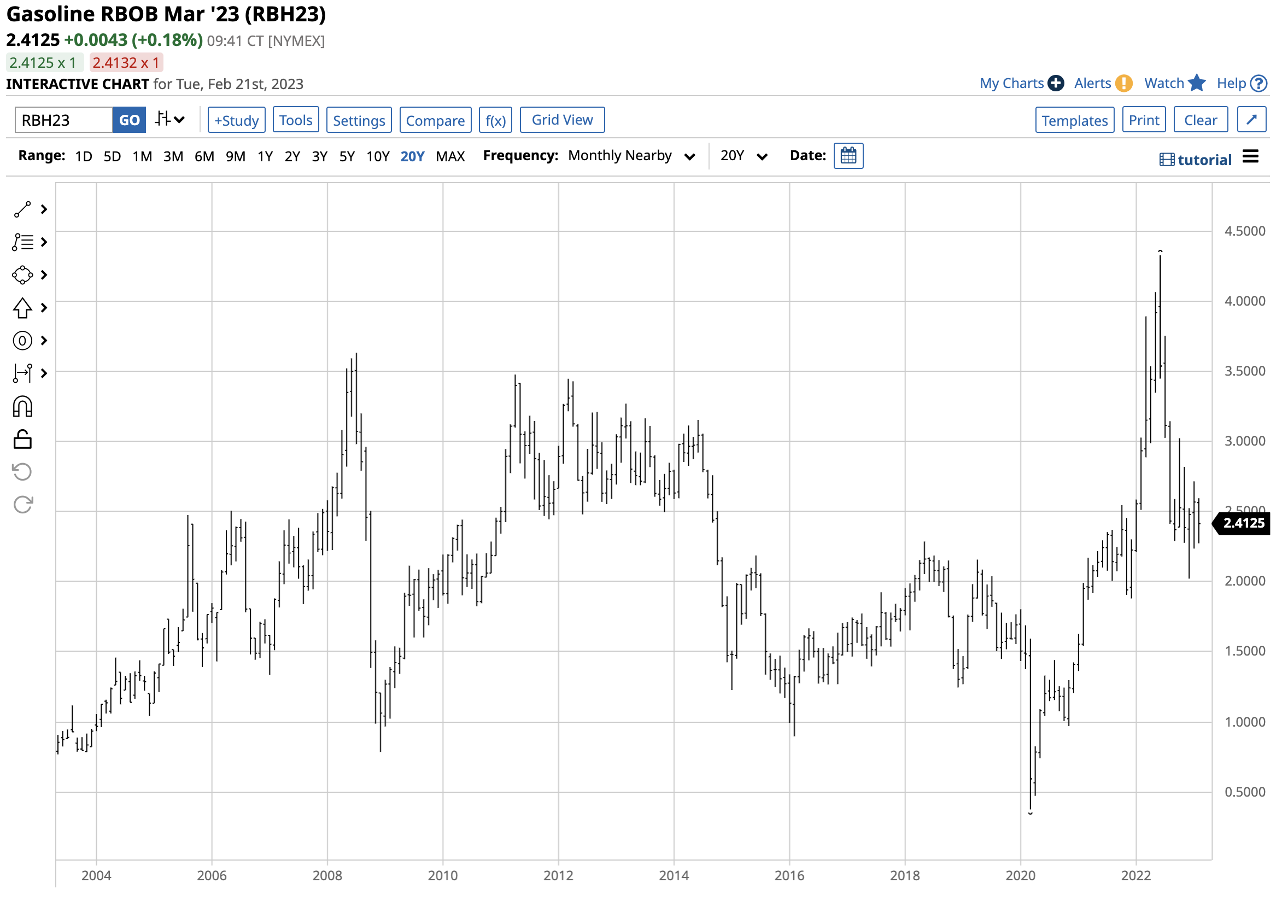

As the chart highlights, at the $2.41 per gallon wholesale level, nearby March NYMEX gasoline futures are substantially lower than the $4.3260 per gallon record high in June 2022. They are slightly below the price in February 2022 when Russia invaded Ukraine. However, gasoline remains at the highest pre-2022 level in February since 2014. At over $26 per barrel, the March gasoline crack or refining spread is also at an elevated level in February. NYMEX gasoline for June delivery was above the $2.57 per gallon level on February 21.

Gasoline demand will rise in the spring and peak in the summer, and prices will likely increase. In 2022, SPR sales kept a lid on prices, but in 2023, the lack of those sales could cause a significant rally in the current environment.

Geopolitics is the critical factor for crude oil prices

Nearby March NYMEX crude oil futures have been trading on either side of $80 per barrel as the price consolidates.

The chart shows that the energy commodity’s primary range is $75 to $80 per barrel.

Markets reflect the economic and geopolitical landscapes. On the economic front, growth in China, a rising U.S. dollar, the highest U.S. inflation in decades, and tight central bank monetary policy pushing interest rates highs are conflicting factors for oil prices. Meanwhile, the decline in U.S. SPR sales could uncover the objective market fundamentals.

On the geopolitical front, the war in Ukraine continues to rage. Relations between the U.S. and Moscow/Beijing and tensions with Saudi Arabia could cause oil prices to soar over the coming months. Nearby crude oil prices may have a $10-$15 downside risk from the $80 level, with multiples on the upside, favoring a bullish approach to the energy commodity. Geopolitical events are most likely to drive prices as the world has become much more dangerous since early 2022.

At $76 per barrel, it could be a case of all quiet before a volatile storm in the petroleum and oil product markets.

More Energy News from Barchart

- Crude Prices Retreat on Dollar Strength and Global Economic Concerns

- Nat-Gas Prices Plummet as a Warm Winter Boosts Global Gas Storage

- Crude Prices Tumble on Dollar Strength and Economic Concerns

- Why Phillips 66 (PSX) Seems Like a No-Brainer

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Meta%20by%20creativeneko%20via%20Shutterstock.jpg)

/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)