/Apple%20Logo%20on%20Store%20Front.jpg)

Apple Inc. (AAPL) reported missed earnings on Feb. 2. The stock moved up in anticipation of good numbers but now it's retracing that rise. Nevertheless, covered call income plays are still popular with investors.

Revenue was down 5% YoY and earnings per share (EPS) came in 10.5% lower YoY at $1.88 for the quarter. So far in 2023, AAPL stock is up over 20%. But it is coming off its highs after the earnings release.

One problem is that AAPL stock is not deemed as cheap anymore. For example, analysts project EPS of $6.01 for the year ending Sept. 30. This puts AAPL stock on a high earnings multiple. At $150.87 per share on Feb. 9, its forward P/E multiple is 25.1x.

That is well over the 22.5x average forward earnings multiple for the past 5 years, according to Morningstar. Moreover, pays out a 92-cent annual dividend (although that is likely to rise next quarter), giving AAPL stock a 0.61% dividend yield. But in the past 5 years, the average dividend yield has been almost 1.0% (0.97%, according to Morningstar).

Shorting Covered Calls with AAPL Stock

As a result, investors are finding it useful to short near-term out-of-the-money (OTM) calls. I have written about this option play in prior articles as it is relatively popular. This is because this trade increases the investor's annualized yield. It also works well if the stock is perceived as overvalued and may not rise dramatically over the next month.

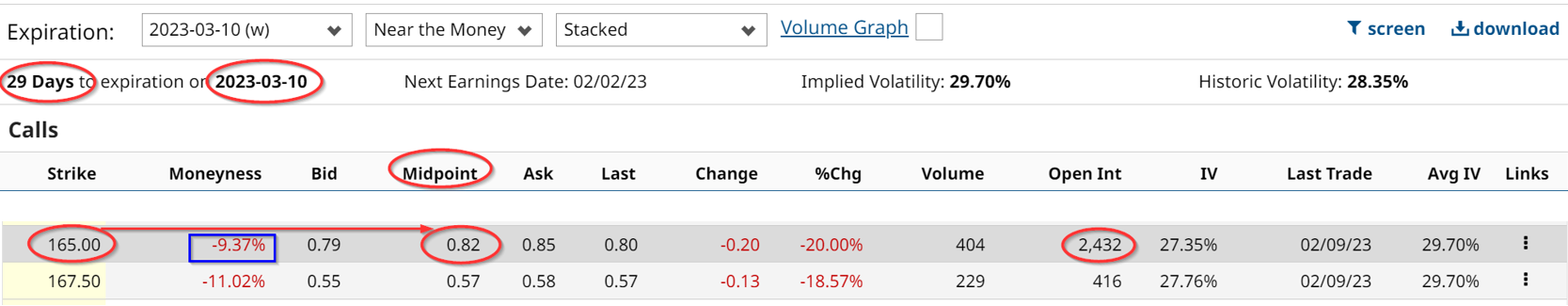

For example, the Barchart March 10, 2023, expiration option chain below shows that the $165.00 strike price calls trade for 82 cents. This strike price has the largest number of contracts outstanding for OTM calls in the March 10 expiration chain. It is also 10% above today's price.

In other words, investors who own at least 100 shares of AAPL stock can enter an order to “sell to open” the $165.00 strike price calls expiring March 10. That provides an immediate yield of 0.54% on the spot price of $150.87 as of Feb. 9.

That also means that if the trade can be repeated each month over the year, it will provide a total yield of 6.52% (i.e., 0.54% x 12 = 6.52%). In addition, the stock will have to rise almost 10% before the investor would have to sell the shares at $165.00 if the call option is exercised.

However, if investors want to be even more conservative, they could short the $167.50 strike price calls. That strike price is over 11% over today's price, providing good potential unrealized gains and upside.

However, the 57 cents premium provides a lower covered call yield of just 0.388% (i.e., $0.57/$150.87). That works out to an annualized return of 4.53%, vs. the 6.52% annualized yield from the $165.00 strike price covered call play.

Either way, this shows that investors can make significantly more income than the dividend yield by shorting out-of-the-money covered calls with AAPL stock.

More Stock Market News from Barchart

- Stocks Relinquish Early Gains and Close Lower as Bond Yields Climb

- The Battle for AI Dominance Begins

- Stocks Give Up Earlier Gains And Drift Lower

- How Should Investors Approach the Dramatic Lift in Carvana (CVNA)?

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)