/Facebook%20greg-bulla-KItSIXhXFDY-unsplash.jpg)

Meta Platforms (META) announced better-than-expected earnings and free cash flow (FCF) for Q4 on Feb. 1. As a result, investor interest is now skewed to its calls options, making them attractive to short sellers for income.

This is based on a comparison of out-of-the-money premiums for calls vs. puts at similar strike price widths away from the META stock price.

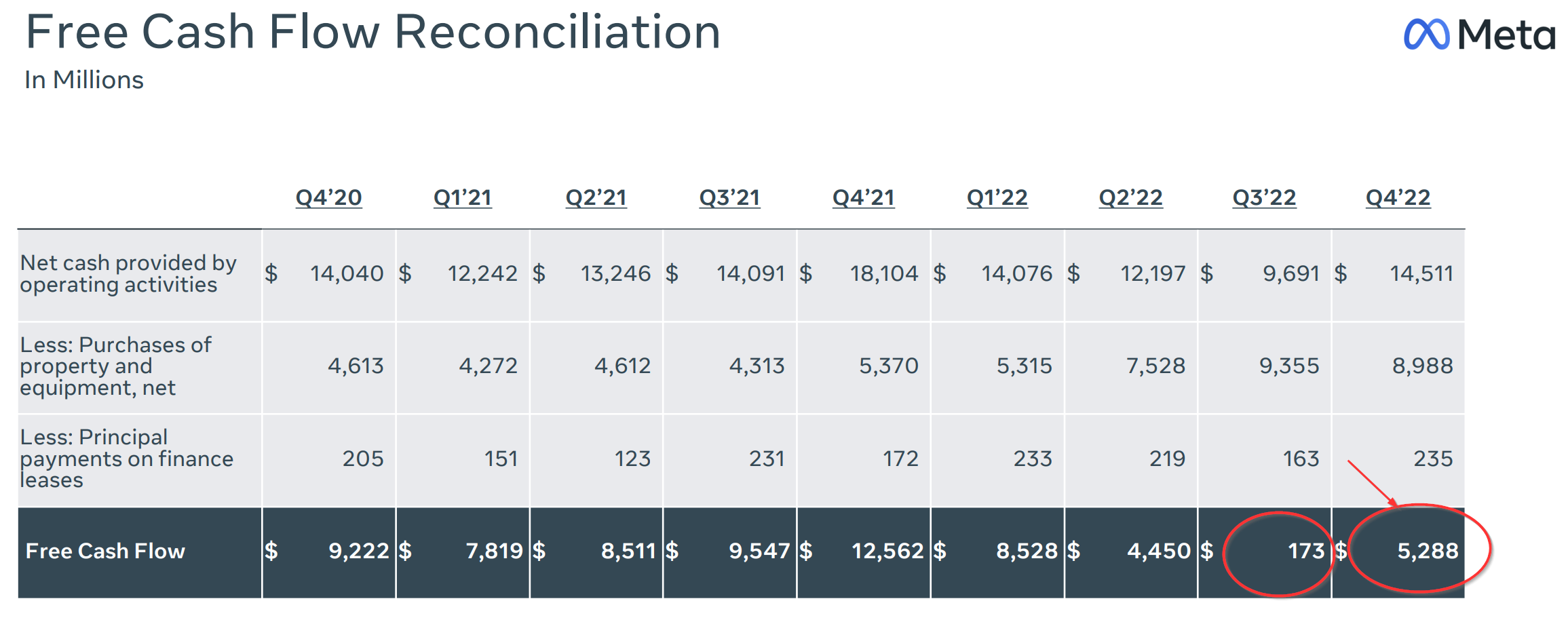

The company reported that although revenue for the quarter was down 4% to $32.165 billion from a year ago, its FCF was still very high at $5.288 billion. This gives the company a very good FCF margin of 16.4%.

Granted, this was lower than the $12.562 billion in FCF last year but compared to the Q3 figure of just $173 million, this allayed all fears that its cash flow was spiraling out of control.

In fact, the company said during the conference call it plans on slowing down capex spending. It now has a target capex spend of $30 to $33 billion in 2023, vs. prior guidance of $34 to $37 billion. That could raise FCF by at least $4 billion, putting it close to $10 billion for the year.

That raises its FCF margin and makes the stock more valuable. No wonder then, Meta Platforms said it was going to increase its share repurchase program by $40 billion. Last year they spent $27.93 billion on buybacks. If Meta spends $40 billion over the next year, that represents a 43% increase. It also works out to 8% of its $494.5 billion market cap.

This is another reason why the stock has been surging, up over 51% YTD. As a result, investors are now attracted to its call options, especially compared to puts.

Shorting Out-of-the-Money Calls

For example, for the March 3 expiration period, the $205 strike price, 8.3% over the price today of $189.52 trade for $3.01 before the options market opens on Feb 6. That represents a juicy 1.59% covered call yield for an investor who buys 100 shares at $189.25.

By comparison, the $170.00 puts for March 3, a strike price that is 8.97% below today's spot price, trade for just $2.65 before the options market opens (it should fall). That is just 1.56% of the put strike price.

In other words, the call prices are now very attractive to short sellers and option prices are skewed to the call price side for similar strike price widths away from the spot price.

One way to play this is to do a Jade Lizard options strategy, which I have described in earlier articles. For example, to do this strategy, which does not require a covered call purchase of 100 shares, the investor would short calls at $205, and buy long calls at $207.50. That spread would bring in a net credit of $0.45 (i.e., $3.01 - $2.56). In addition, the investor would sell short an out-of-the-money put that covers the $2.50 call strike spread (i.e. $205-$207.50).

For example, the $177.50 puts trade at $4.68. As a result, the total net credit is $5.13 (i..e, $4.68 +$0.45). This more than covers the $2.50 call spread risk by $2.63 per contract. In other words, the investor will have no upside risk and will make $2.63 per contract if the stock trades between $180 and $205 by the close on March 3 of the options contracts. That represents a better return than just the covered call return alone and/or a cash-secured short put strategy.

More Stock Market News from Barchart

- Markets Today: Stocks Fall on a Hawkish Fed Outlook

- Option Volatility And Earnings Report For Feb 6 - 10

- Stocks Set To Open Lower As Strong U.S. Jobs Report Sparks Rate Hike Worries

- More Earnings On Tap, Powell Speaks And Other Key Themes To Watch This Week

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)