In the current market environment, investors might be more interested in generating income rather than capital gains.

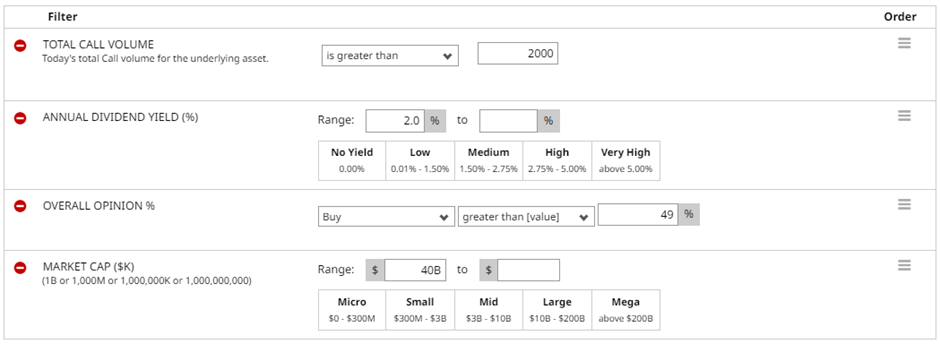

Today, we’re looking at two covered call examples on Gilead stock. The first step to finding our covered call candidates is to use the Stock Scanner with the following parameters:

Which produces the following results:

Gilead Sciences (GILD) is up 28% in the last three months and is currently showing a dividend yield of 3.38%. The stock also has a high IV Percentile which means options are expensive compared to the recent past.

Using options, we can generate an additional income from high yielding stocks via a covered call strategy.

GILD Covered Call Example

Let’s look at two different covered call examples on GILD stock. The first will use a monthly expiration and the second will use a seven-month expiration.

Let’s evaluate the first GILD covered call example.

Buying 100 shares of GILD would cost around $8,535. The February 17, 87.50 strike call option was trading yesterday around $1.80, generating $180 in premium per contract for covered call sellers.

Selling the call option generates an income of 2.15% in 30 days, equalling around 25.37% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 87.50?

If GILD closes above 87.50 on the expiration date, the shares will be called away at 87.50, leaving the trader with a total profit of $395 (gain on the shares plus the $180 option premium received). That equates to a 4.73% return, which is 55.66% on an annualized basis.

Instead of the February 17 call, let’s look at selling the August 87.50 call instead.

Selling the August 87.50 call option for $6.10 generates an income of 7.70% in 212 days, equalling around 13.19% annualized.

If GILD closes above 87.50 on the expiration date, the shares will be called away at 87.50, leaving the trader with a total profit of $825 (gain on the shares plus the $610 option premium received).

That equates to a 10.41% return, which is 17.84% on an annualized basis.

These figures don’t include any potential dividends received during the course of the trades.

Of course, the risk with the trade is that the GILD might drop, which could wipe out any gains made from selling the call.

Barchart Technical Opinion

The Barchart Technical Opinion rating is a 72% Buy with a Weakest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Implied volatility is at 27.18% compared to a 12-month low of 17.20% and a 12-month high of 39.14%.

The next earnings release is set for February 7th.

Company Description

Gilead Sciences is a pioneer in developing drugs for the treatment of human immunodeficiency virus, liver diseases, hematology/oncology diseases and inflammation/respiratory diseases. The company has a strong HIV franchise with key HIV/AIDS therapies like tenofovir alafenamide based products - Genvoya, Odefsey, Descovy, Biktarvy and Truvada. The portfolio also includes hepatitis C virus drugs like Harvoni and Epclusa and HBV drug. The first cell therapy approved for the treatment of adult patients with relapsed or refractory large B-cell lymphoma, has diversified Gilead's portfolio. Tecartus, another CAR T-cell therapy, was granted an accelerated approval in the United States for the treatment of relapsed or refractory mantle cell lymphoma. The company is also working on diversifying and growing its business beyond antivirals into other therapeutic areas. Gilead is also making inroads in the oncology space with strategic collaborations and acquisitions.

Of the 19 analysts following the stock, 9 rate it as a Strong Buy and 10 have a Hold rating.

Covered calls can be a great way to generate some extra income from your core portfolio holdings.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks See Downard Pressure from Mixed Corporate Earnings Results

- The Pros and Cons of Ryan Cohen’s Latest Activist Play

- Strength in Meta Platforms May Not Last

- Stocks in the Red After Mixed Earnings Releases

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.