When a stock experiences unusual option volume, it can indicate large traders making a big bet on the direction of that stock. Unusual option volume is generally referring to activity in a specific option contract or group of contracts that is much higher than the usual daily volume.

When looking for unusual options activity, most trader look for volume that is:

- At least 5 times higher than average

- Short term (less than 30 days to expiration)

- Far out-of-the-money

Another way to spot unusual activity is to look for volume that is much higher than the open interest in that contract. This can indicate a new trade being placed, rather than a closing out of an existing position.

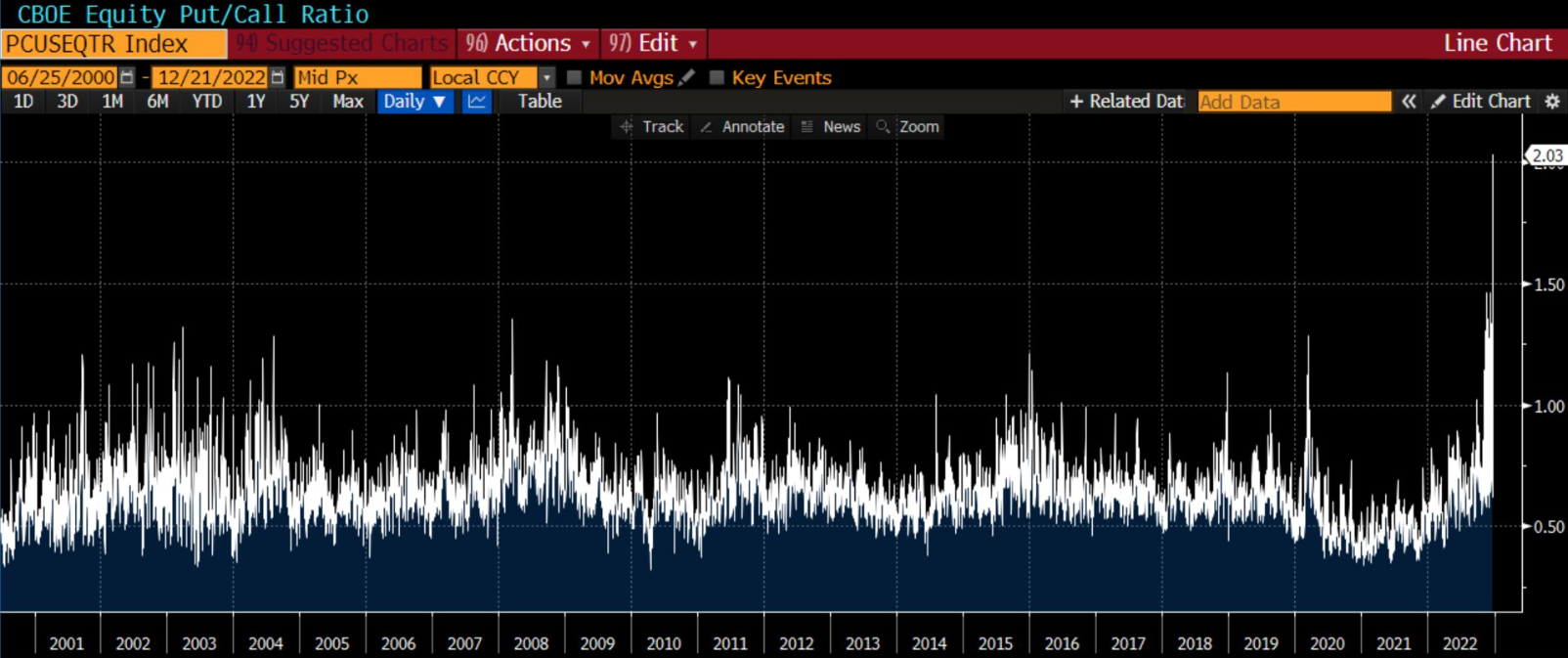

Yesterday, there was an interesting all time record set in the equity put-call ratio. This ratio spiked above 2 for the first time ever.

Clearly people were trading a lot of puts yesterday!

Unusual Stock Options Activity Screener

At Barchart, we have an excellent screener for unusual options activity. The screener identifies options contracts that are trading at a higher volume relative to the contract's open interest.

Unusual options can provide insight on what "smart money" is doing with large volume orders, signalling new positions and potentially a big move in the underlying asset.

When the last price is at or above the ask price the strike price is highlighted in green; when the last price is at or below the bid price the strike price is highlighted in red.

If you would like more details on how to use this screener, you can watch this video.

Let’s take a look at the screener for December 23nd. I have added a filter to only look at stocks with a market cap higher than 40 billion.

The first thing to notice here is that they are all tech names and were concentrated in just four names – Tesla (TSLA), Apple (AAPL), Amazon (AMZN) and Nvidia (NVDA).

Let’s take a look at the first line item, the 120 strike December 23rd put option on Tesla. This put option traded 188,424 contracts which is far great than the open interest of 20,098.

Tesla made up 8 of the 10 most actively traded option contracts with five being put options and three being call options.

Tesla is the market leader in battery-powered electric car sales in the United States, with roughly 70% market share.

The company's flagship Model 3 is the best-selling EV model in the United States. Tesla, which has managed to garner the reputation of a gold standard over the years, is now a far bigger entity that what it started off since its IPO in 2010, with its market cap crossing $1 trillion for the first time in October 2021.'

The EV king's market capitalization is more than the combined value of legacy automakers including Toyota, Volkswagen, Daimler, General Motors and Ford.

Over the years, Tesla has shifted from developing niche products for affluent buyers to making more affordable EVs for the masses. The firm's three-pronged business model approach of direct sales, servicing, and charging its EVs sets it apart from other carmakers.

Tesla, which is touted as the clean energy revolutionary automaker, is much more than just a car manufacturer.

The Barchart Technical Opinion rating is a 100% Sell and ranks in the Top 1% of all short term signal directions. Long term indicators fully support a continuation of the trend. The market is in highly oversold territory. Beware of a trend reversal.

Apple Unusual Option Activity

Apple also experience large option volume, particularly in the 130 and 132 put options for December 23rd expiration.

Apple's business primarily runs around its flagship iPhone.

However, the Services portfolio that includes cloud services, App store, Apple Music, AppleCare, Apple Pay & licensing and other services which become the cash cow.

Moreover, non-iPhone devices like Apple Watch and AirPod have gained significant traction.

In fact, Apple dominates the Wearables and Hearables markets due to the growing adoption of Watch and AirPods.

Solid uptake of Apple Watch also helps Apple to strengthen its presence in the personal health monitoring space.

Apple also designs, manufactures and sells iPad, MacBookand HomePod.

These devices are powered by software applications including iOS, macOS, watchOS and tvOS operating systems.

Apple's other services include subscription-based Apple News, Apple Card, Apple Arcade, new Apple TV app, Apple TV channels and Apple TV, a new subscription service.

The Barchart Technical Opinion rating is a 100% Sell with a Strengthening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend. The market is approaching oversold territory. Be watchful of a trend reversal.

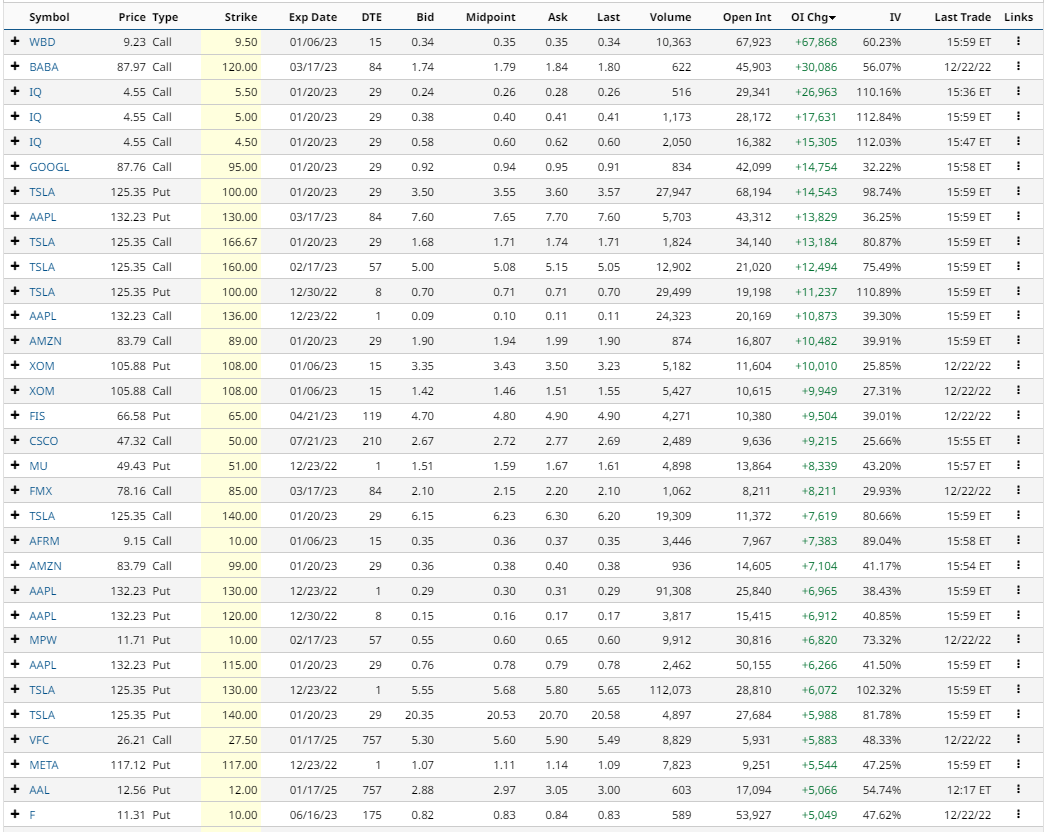

Options Change In Open Interest

The Options Change In Open Interest is another interesting report that can be used to spot unusual options activity.

Here we can see there were large changes in the January 100 puts on Tesla and the March 130 puts on Apple.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Fall Sharply on Tech Weakness and Hawkish Economic News

- Tech Stocks May Find Continued Rough Sledding in Early 2023

- Stocks Slide on Chip Stocks and Hawkish Economic News

- Markets Today: Stocks Fall on Weak Revenue Outlook from Micron

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)