/Tesla%20Charging%20Station%20Plugged%20In.jpg)

Considerable unusual activity in Tesla (TSLA) call options shows that some institutional investors are very bullish on the electric vehicle manufacturer. If TSLA stock rises, the calls will pay off quite well. The stock is down almost 15% in the last month and over 25.4% in the last 6 months. Large purchases of TSLA call options recently show that some believe the stock will turn around.

There are good reasons for this unusual stock options activity. As it stands, TSLA stock is now trading at one of its cheapest multiples ever. For example, 33 analysts now project that earnings next year will rise 37.9% on average from $4.14 per share by the end of 2022 to $5.71 in 2023.

At today's price of $160.95 as of Dec. 13, TSLA stock is now on a forward multiple of just 28.2x. This is well below its average over the past 5 years, which is over 5 times higher.

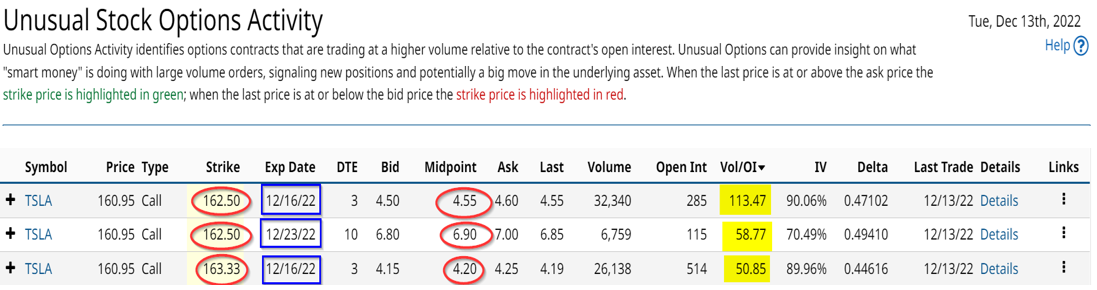

As a result, investors are piling into TSLA call options. The Barchart Unusual Stock Options Report shows that 3 tranches of call options have had large volume recently. This can be seen in the Barchart Unusual Stock Options report below:

This shows that the calls expiring Friday, Dec. 16, 2022, traded 32,340 call option contracts at the $162.50 strike price at a midprice of $4.55. That implies that the investors in these calls expect TSLA stock will close this week above $167.05 (i.e., $162.50 +$4.55), or 3.79% over today's price of $160.95. They were willing to pay $4.55 for this bet, or 2.80% over the strike price.

The investors paid $14.715 million for these call options, a huge bet. If the stock rises to $168, for example, by Friday, the investor stands to make almost one dollar per contract, or $3.072 million (i.e., ($168-167.05) x 32,340 x 100). Note that Barchart shows that this volume is 113.47x the open interest in the $162.50 strike price calls (i.e., Vol/OI column). Also note that the implied volatility (i.e., is extremely high at 90%). Typically the variance for these calls will be half of that amount.

The same is true of the $162.50 strike price calls for the period ending Dec. 23. The investors were willing to pay $6.90 for these calls. That means TSLA stock has to rise to $169.40, or 5.25% on or before Dec. 23, before the investor starts to make a profit above that price. Since there were 6,759 contracts bought at that strike price, the investors seem very confident that TSLA stock will shoot up over the next two weeks.

The last TSLA call option with huge volume is at the $163.33 strike price for expiration on Friday, Dec. 16. The investors paid $4.20 for 26,138 of these call options. This implies they believe the stock will rise to at least $167.33 by the close of business on Friday. that represents a gain of just about 4.1% from today. The investors were willing to bet $10.978 million on this bet. So, for example, if TSLA stock ends up at $168.00 on Friday, they will make a profit of $1.751 million (i.e., ($168-$167.33) x 100 x 26,138).

As a result, you can see these call options involve huge bets. TSLA stock will have to rise by at least 3.79%, 4.1%, and 5.25% by the end of this week, and, in tranche, in 10 days, for the investors to break even. They must believe that the stock's rout is now at a bottom to make these huge bets. They stand to make a good deal of money should TSLA rise to $170 or higher in the next few days.

More Stock Market News from Barchart

- Long Call Butterfly Screener Results For December 14th

- Ah, "Shucks," Corn Prices are Looking Higher

- Stocks Close Higher as U.S. Consumer Prices Moderate

- Shorting Tech Stocks May Remain Profitable Next Year

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)