NRG Energy (NRG) is attracting value-oriented buyers with its 4.68% yield, 6.1x forward P/E multiple, and a huge new stock buyback program. In addition, NRG stock offers investors high-yield covered call and short put income opportunities. With its new acquisition of Vivant Smart Home on Dec. 6, the stock is poised to make new highs.

Recently the Houston-based electric power generation and distribution company raised its annual dividend by 8% to $1.51, as I projected in my article on Nov. 6. That means that NRG stock, at $32.28 as of Dec. 9, has an annual dividend yield of 4.68%.

Moreover, analysts project that earnings per share (EPS) will rise over 42% in 2023 to $5.26. This puts it on a 6.1x forward multiple, which is very cheap. This is well below the stock's 5-year average of 13.6x, according to Morningstar.com.

NRG stock is off over 27% in the last month, down 21% in the last week alone. The fear of the market is that it is not spending its capital wisely with the Vivant Smart Home technology acquisition.

But this gives value investors an opportunity to buy its high yield and low P/E. In addition, the company announced its buyback program would be $600 million in 2023. That is on top of the $397 million that is left to be done in 2022. Given that NRG Energy has a market cap of $7.44 billion, the buyback yield is now at least 8.0% (i.e., $600m / $7,440 million = 8.0%).

That elevates its total yield to over 12.48%, given its 4.68% dividend yield and 8.0% buyback yield. It also implies that with a 10% total yield, NRG stock could rise by 24.8% to $40.29 per share. This is seen by dividing 12.48% by 10% (i.e., 1.248 and multiplying it by today's price of $32.28).

Value investors can use this to set a strike price target for shorting out-of-the-money (OTM) covered call options to create more income opportunities.

Shorting Out-of-the-Money Covered Calls for Income Plays

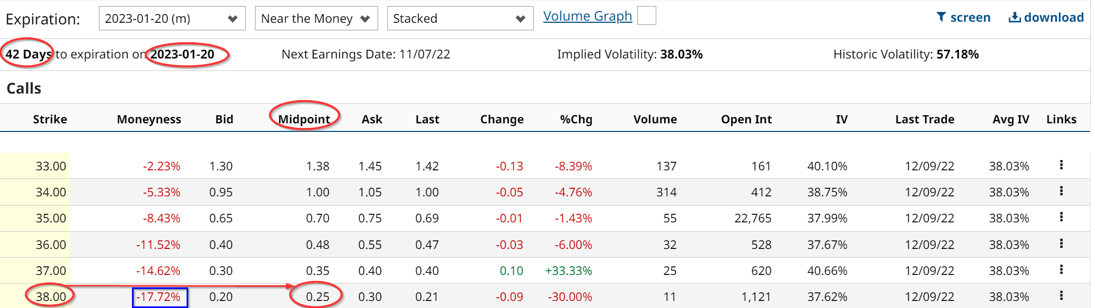

NRG stock offers covered call premiums at the $38 strike price for Jan. 13 at a midprice of $0.25 per call contract, according to Barchart.com. That strike price is over 17.7% over today's price of $32.28 per share.

This means that an investor can make an immediate income of $25 per call contract for every 100 shares he or she owns. This occurs If he or she sells a call option to sell those shares for $3,800 if NRG stock reaches $38 or higher on or before Jan. 20. That represents a potential 17.7% capital gain and ab immediate income of 0.774% (i.e., $0.25/$32.28 price today). That represents an annualized yield of about 9.29%.

It actually might make more sense to wait for the stock to rise a bit and then short covered calls at an even higher strike price. In the meantime, investors can short out-of-the-money (OTM) put options to create income.

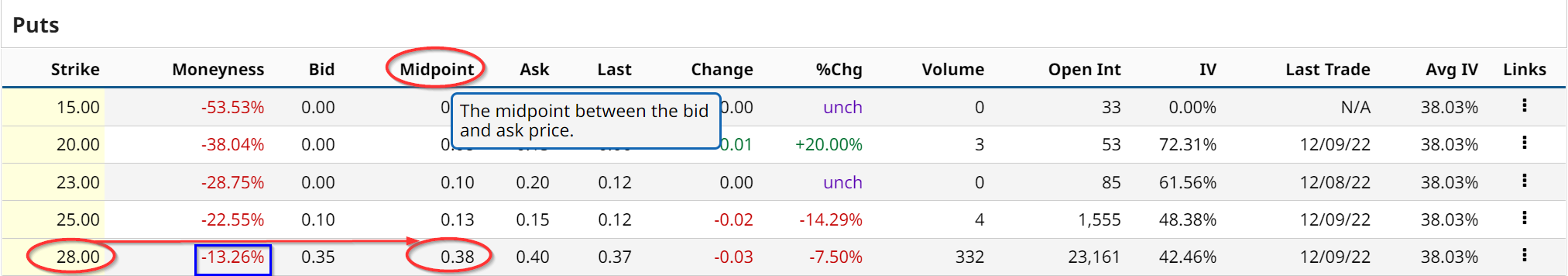

For example, the Jan. 20, 2023, puts at the $28.00 strike price offer 38 cents to the short put investor. This means that the investor puts up $2,800 in cash and/or margin with his or her brokerage firm and then “sells to open” the $28.00 strike price puts. The account will immediately receive $38 for the $2,800 investment or 1.357%.

That is an annualized yield of 16.29%. Moreover, the investor will not have to buy NRG stock unless it falls by over 13%. However, there is potential for an unrealized capital gain.

The bottom line is that on top of the stock's true value metrics, its near-term OTM covered call and short put option plays offer investors additional income opportunities.

More Stock Market News from Barchart

- Stocks Retreat as Strength in U.S. PPI Boosts Bond Yields

- Chinese Tech Investors Pivot to Hong Kong from U.S. Exchanges

- Stocks Edge Lower as Bond Yields Rise on Strength in U.S. PPI

- Markets Today: Stock Indexes Tumble as Bond Yields Rise on Strong U.S. PPI

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)