A long straddle is an advanced options strategy used when a trader is seeking to profit from a big move in either direction and / or an increase in implied volatility.

To execute the strategy, a trader would buy a call and a put with the following conditions:

- Both options must use the same underlying stock

- Both options must have the same expiration

- Both options must have the same strike price

Since it involves having to buy both a call and a put, the trader must pay two premiums up-front, which also happens to be the maximum possible loss.

The potential profit is theoretically unlimited, although the trade will lose money each day through time decay if a big move does not occur.

The position means you will start with a net debit and only profit when the underlying stock rises above the upper break-even point or falls below the lower break-even point.

Profits can be made with a smaller price move if the move happens early in the trade.

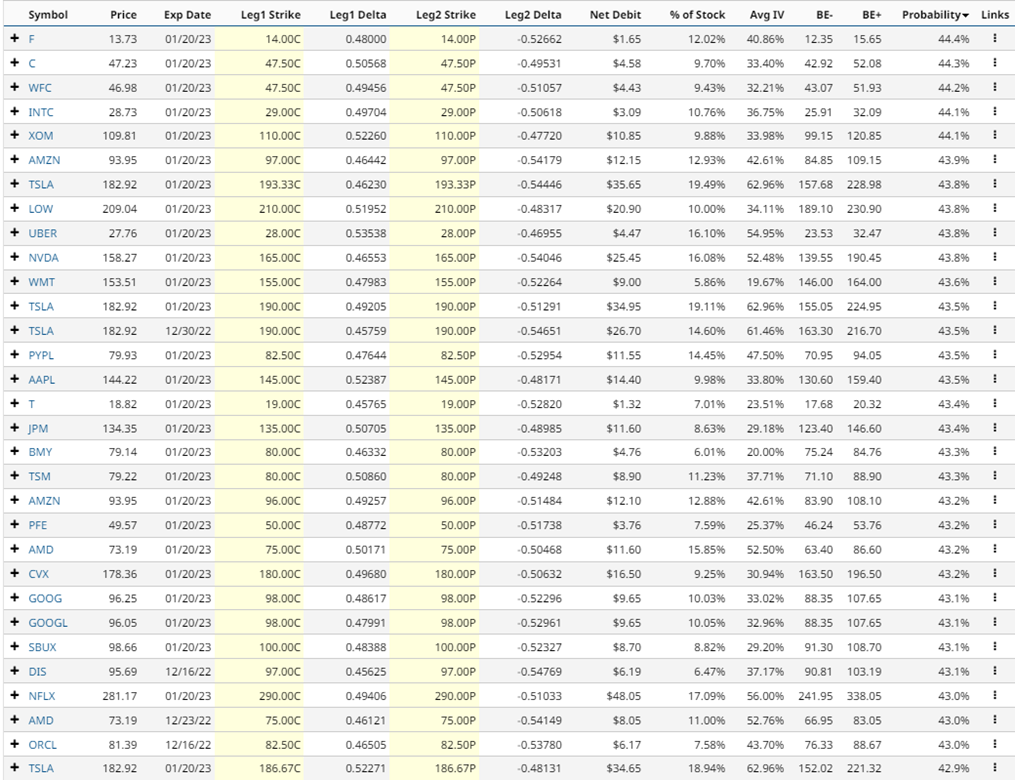

Let’s take a look at Barchart’s Long Straddle Screener for November 29th. I have added a filer for Market Cap above 40b to remove small capitalization stocks.

The screener shows some interesting long straddle trades on popular stocks such as F, C, WFC, INTC, XOM, AMZN, TSLA, LOW, UBER, NVDA and WMT. Let’s walk through a couple of examples.

Ford Long Straddle Example

Let’s take a look at the first line item – a long straddle on Ford.

Using the January 20th expiry, the trade would involve buying the 14 strike call and the 14 strike put. The premium paid for the trade would be $165 which is also the maximum loss. The maximum profit is theoretically unlimited. The lower breakeven price is 12.35 and the upper breakeven price is 15.65. The premium paid is equal to 12.02% and the probability of success is estimated at 44.4%.

The Barchart Technical Opinion rating is an 8% Sell with a weakest short term outlook on maintaining the current direction.

Implied volatility is currently 39.40% compared to a twelve-month low of 36.50% and a high of 63.25%.

Citigroup Long Straddle Example

Let’s take a look at the second line item which is on a stock with slightly lower volatility – Citigroup.

Using the January 20th expiry, the trade would involve buying the 47.50 strike call and the 47.50 strike put. The premium paid for the trade would be $458 which is also the maximum loss. The maximum profit is theoretically unlimited. The lower breakeven price is 42.92 and the upper breakeven price is 52.08. The premium paid is equal to 9.70% which is slightly less than the Ford example, because Citigroup implied volatility is 33.40% compared to 40.86% for Ford. The probability of success is estimated at 44.3%.

The Barchart Technical Opinion rating is a 56% Sell with a weakening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

Wells Fargo Long Straddle Example

Let’s take a look at one final straddle, the third line item – a long straddle on WFC.

Once again, using the January 20th expiry, the trade would involve buying the 47.50 strike call and the 47.50 strike put. The premium paid for the trade would be $443 which is also the maximum loss. The maximum profit is theoretically unlimited. The lower breakeven price is 43.07 and the upper breakeven price is 51.93. The premium received is equal to 9.43% which is similar to the Citigroup example. The probability of success is estimated at 44.2%.

The Barchart Technical Opinion rating is a 72% Buy with a weakening short term outlook on maintaining the current direction.

Implied volatility is currently 28.36% compared to a twelve-month low of 25.95% and a high of 50.74%.

Mitigating Risk

Long straddles can lose money fairly quickly if the stock stay flat, and / or if implied volatility drops.

Position sizing is important so that a large loss does not cause more than a 1-2% loss in total portfolio value. Another good rule of thumb is a 20-30% stop loss.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Tumble on China Pandemic Woes and Hawkish Fed Comments

- Unusual Options Volume May Bode Well for Wynn Resorts (WYNN)

- Etsy Is a High-Flier Among E-Commerce Stocks

- Stocks Fall on Global Growth Risks as the Pandemic Worsens in China

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)