The dollar index futures contract rose to 114.745 in late September 2022, the highest level since 2002. The index broke above its critical long-term technical resistance level at the March 2020 103.96 high and followed through on the upside. The March 2020 previous high became technical support for the index that tracks the Us currency against the euro, British pound, Japanese yen, Canadian dollar, Swedish krona, and Swiss franc. The US dollar is the world’s reserve currency, a function of political stability. However, interest rate differentials determine the value of one currency versus another. In the world of reserve currencies, the yield can determine the currency of choice for countries.

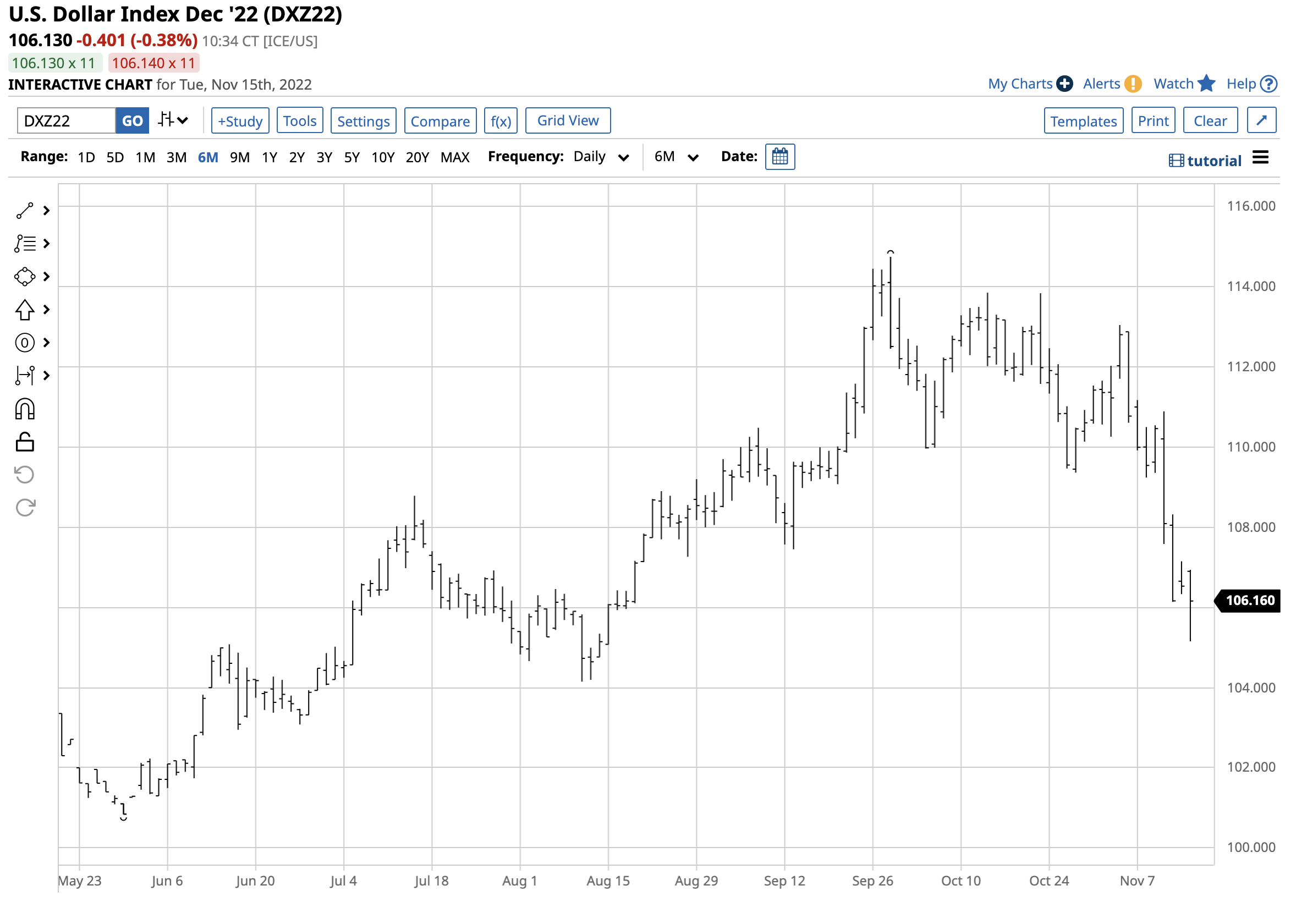

Last week, the dollar index plunged to the 105.155 level, 8.4% below the late September high.

The dollar rallied on the back of a hawkish Fed

The dollar index began rallying in early 2021 when the market believed the US Federal Reserve would need to battle rising inflation with higher interest rates. Since interest rate differentials are a primary factor for the path of least resistance of one reserve currency against another, rising rates can put upward pressure on a foreign exchange instrument.

The chart highlights the dollar index’s rise from 89.165 in early January 2021 to 114.745 in late September 2022. The 28.7% rise from the lowest level since April 2018 to the highest in two decades was a significant move for the dollar index.

After sitting at zero percent in March 2022, a hawkish US Fed hiked the Fed Funds Rate to between 3.75% and 4.00% at its latest December FOMC meeting. The central bank may have waited far too long to address inflation with monetary policy. Still, the trajectory of rate increases over the past eight months has demonstrated its commitment to pushing the economic condition to its 2% target rate.

The October CPI and PPI data dealt the dollar a blow

Market participants have criticized the Fed for calling rising inflation a “transitory” event throughout much of 2021. After reaching the highest level since the early 1980s, the central bank became an inflation fighter.

Meanwhile, the war in Ukraine, causing rising food and energy prices, threw a curveball at the Fed. The increasing costs are a supply instead of a demand-side economic condition, and monetary policy tends to address the economy’s demand side. Therefore, at least part of the inflationary pressures is caused by factors immune to the tighter monetary policy via rising short-term interest rates and quantitative tightening to reduce the central bank’s swollen balance sheet.

Moreover, GDP declines in Q1 and Q2 2022 were signs the US economy could be slipping into a recession. Rising interest rates inhibit economic growth, increasing the odds of a recession. Stagflation is one of the central bank’s most challenging economic conditions because the monetary policy tools to address inflation and recession are mutually exclusive.

Last week’s consumer price index data and this week’s PPI data showed that inflation could be turning lower. The October CPI rise by 0.4% for the month and 7.7% on a year-on-year basis, both lower than estimates. October PPI came in at 8%, below the market’s expectations. The inflation data caused a substantial correction in the dollar index as the market believes the Fed will soon curb its enthusiasm for rate hikes.

The chart shows the 8.4% decline in the December dollar index futures contract from 114.745 to last week’s low of 105.155. After four consecutive 75 basis point Fed Funds increases, the latest CPI could cause the data-sensitive central bank to only increase rates by 50 basis points at its December FOMC meeting. The decline in CPI and the dollar index caused stocks, bonds, and commodity prices to recover last week.

Inflation remains well above the Fed’s target level

With CPI at 7.7% in October and core CPI, excluding food and energy, at the 6.3% level, and core PPI at 6.7%, inflation remains far above the Fed’s 2% target rate. However, at the most recent FOMC meeting, the statement acknowledged that rate hikes take a while to impact economic conditions and inflationary pressures. Higher rates have pushed mortgage rates from below 3% in late 2021 to over 7% in November 2022. Moreover, rates on car, business loans and credit cards have increased appreciably, which should impact spending.

The Fed will watch the incoming data, but the current inflation rate remains at a level that the central bank says requires “sufficiently restrictive” monetary policy to return inflation to its target. The Fed is walking an economic tightrope as it balances inflationary versus recessionary risks. Overdoing rate hikes could cause the economy to slow significantly over the coming months and years as the lag works both ways.

Currency trends can last for years- The path of least resistance of the US dollar will impact other asset classes

Currency trends can last for years, and spikes higher or lower are rare. The 28.7% rise in the dollar index from January 2021 to September 2022 was a significant move, but it was slow and steady with lots of backing and filling. Governments manage currency moves to stabilize cross-border payments and often intervene in markets to eliminate price spikes and excessive volatility.

The dollar index chart dating back to 1985 illustrates that trends can last for years. The current bullish trend of higher lows and higher highs began fourteen years ago in 2008, when the dollar index fell to 71.05. While the index corrected 8.4% from the late September high, the long-term bullish trend remains intact in November 2022.

Watch the technical support level at around 104

In May 2022, the dollar index broke above its critical technical resistance level at the March 2020 103.96 high. The index followed through on the upside, reaching 114.745. Meanwhile, the previous technical resistance level has become a critical support area on the dollar index’s chart. Therefore, 104 is now a level to watch in the dollar index.

Markets reflect the economic and geopolitical landscapes. Inflation has caused US rates to rise, putting upward pressure on the dollar index as the dollar appreciates against other world reserve currencies. Moreover, the war in Ukraine is on Europe’s doorstep, putting pressure on the European economy. Since the dollar index has a 57.6% exposure to the euro currency, the war that impacts and threatens Europe is a bearish factor for the European foreign exchange instrument, pushing the dollar index higher.

As of mid-November 2022, the trend in the dollar index remains higher, and the 104 technical support level should hold. However, if peace were to break out in Ukraine, we could see a significant recovery in the euro that would push the dollar index below its support and threaten the bullish trend that has been in place for nearly a decade and a half.

The path of US interest rates and the war in Ukraine is the most significant factors for the dollar index in late 2022.

A rising dollar will continue to weigh on stocks and commodities, while a significant correction could ignite a bullish fuse in these asset classes.

More Forex News from Barchart

- Stocks Rally as Slower Inflation Eases Fed Rate-Hike Concerns

- Dollar Posts Moderate Gains on Higher T-note Yields

- Tech Stocks Sag on Higher T-note Yields

- Dollar Plunges for Second Day as Rate-Hike Concerns Ease

/AI%20(artificial%20intelligence)/AI%20engineer%20working%20on%20laptop%20by%20ART%20STOCK%20CREATIVE%20via%20Shutterstock.jpg)

/Nike%2C%20Inc_%20swish%20by-%20Tartezy%20via%20Shutterstock.jpg)