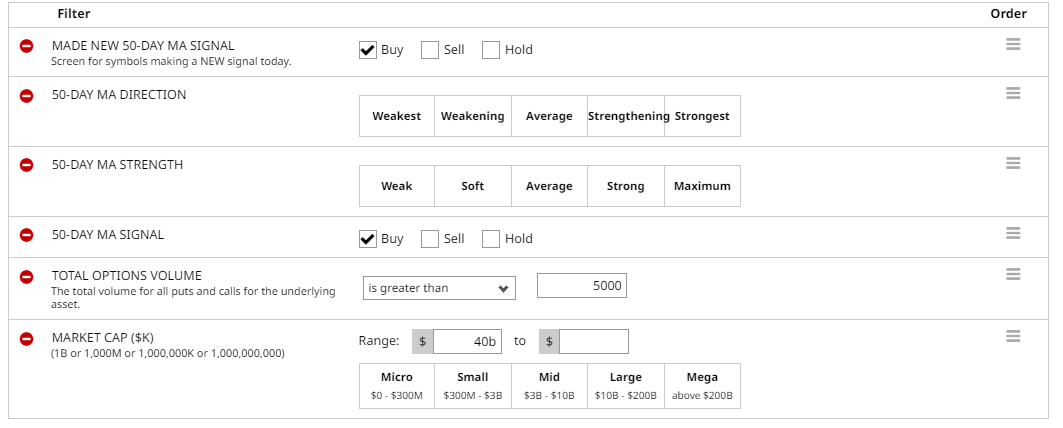

Today, we are using some moving average filters to find bullish stocks and then looking at a couple of different trade ideas.

First the stock scanner:

Which produces these results:

After looking through the charts, we’ll focus our attention on Apple (AAPL), Devon Energy Corp (DVN) and PayPal Holdings (PYPL)

Apple Bull Put Spread

A bull put spread is a defined risk option strategy that profits if the stock closes above the short strike at expiry.

To execute a bull put spread an investor would sell an out-of-the-money put and then but a further out-of-the-money put.

Running the Barchart Bull Put Spread Screener shows these results for AAPL:

Let’s use the first line item as an example. This bull put spread trade involves selling the December expiry 145 strike put and buying the 140 strike put.

Selling this spread results in a credit of around $1.24 or $124 per contract. That is also the maximum possible gain on the trade. The maximum potential loss can be calculated by taking the spread width, less the premium received and multiplying by 100. That give us:

5 – 1.24 x 100 = $376.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 32.98%.

The probability of the trade being successful is 65.5%, although this is just an estimate.

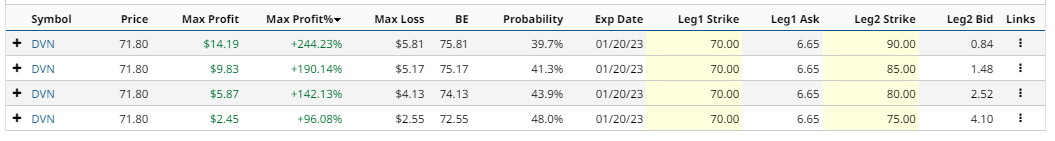

For DVN, let’s look at the bull call spread screener.

DVN Bull Call Spread

Here are the results of the bull call spread screener:

A bull call spread is created through buying a call and then selling a further out-of-the-money call.

Selling the further out-of-the-money call reduces the cost of the trade but also limits the upside.

A bull call spread is a risk defined trade, so you always know the worst-case scenario. Bull call spreads are positive delta (bullish) and positive vega (benefit from a rise in implied volatility).

The first item on the screener results shows a trade that involves buying the January expiration, 70-strike call and selling the 90-strike call.

The trade cost would be $581 (difference in the option prices multiplied by 100), and the maximum potential profit would be $1,419 (difference in strike prices, multiplied by 100 less the premium paid).

This trade has a max profit potential of 244.23% and a probability of 39.7%.

The final idea we will look at is a covered call trade.

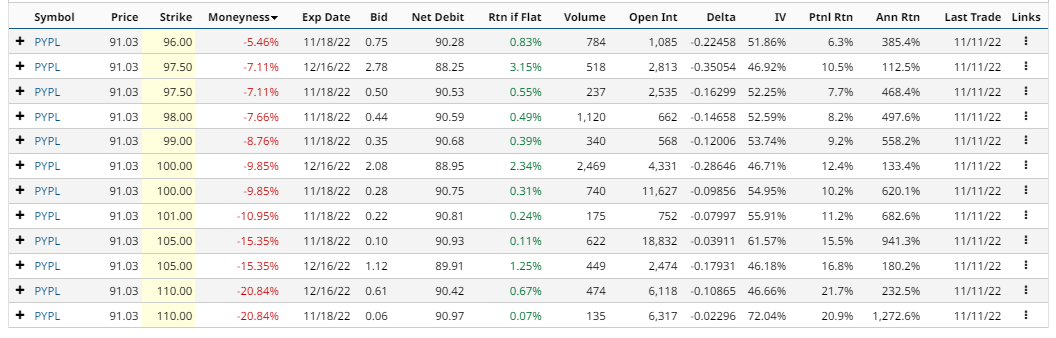

PYPL Covered Call

First, let’s run our covered call screener:

Let’s evaluate the second PYPL covered call example. Buying 100 shares of PYPL would cost around $9,103. The December 16, 97.50 strike call option was trading on Friday for around $2.78, generating $278 in premium per contract for covered call sellers.

Selling the call option generates an income of 3.15% in 32 days, equalling around 34.84% annualized. That assumes the stock stays exactly where it is. What if the stock rises above the strike price of 97350?

If PYPL closes above 97.50 on the expiration date, the shares will be called away at 97.50, leaving the trader with a total profit of $925 (gain on the shares plus the $278 option premium received). That equates to a 10.5% return, which is 112.5% on an annualized basis.

Conclusion

There you have three different bullish trade ideas on three different stocks. Remember to always manage risk and have stop losses in place.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- More Key Economic Data On The Horizon And Other Themes To Watch For Next Week

- AT&T's Call Options Attracting Buyers as Dividend Looks Secure

- Stocks Extend Rally on Expected Fed Dovish Shift

- Stocks See Support from Hopes For Dovish Fed Turn

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)