Cisco Systems CSCO is set to release its second-quarter fiscal 2026 results on Feb. 11.

The company anticipates second-quarter fiscal 2026 revenues between $15 billion and $15.2 billion. Non-GAAP earnings are expected between $1.01 per share and $1.03 per share.

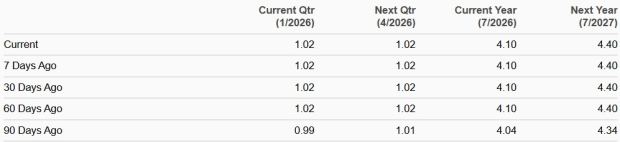

The Zacks Consensus Estimate for revenues is pegged at $15.12 billion, indicating growth of 8.1% from the year-ago quarter’s reported figure. The consensus mark for earnings has been steady at $1.02 per share over the past 30 days, suggesting year-over-year growth of 8.5%.

Consensus Estimate Trend

Image Source: Zacks Investment Research

CSCO’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 3.22%.

Let’s see how things are shaping up prior to this announcement.

Key Factors to Note for CSCO’s Q2 Earnings

Cisco’s second-quarter fiscal 2026 results are expected to have benefited from strong demand for AI infrastructure and campus networking solutions. The company is riding on strong AI-related demand driven by an innovative networking portfolio powered by Silicon One, AI-native security solutions and operating systems. Cisco expects to ship its one millionth Silicon One chip in the to-be-reported quarter, reflecting robust demand.

The Zacks Consensus Estimate for fiscal second-quarter Networking revenues is currently pegged at $7.74 billion, indicating 13% growth from the figure reported in the year-ago quarter.

Cisco’s strategy of infusing AI across Security platforms and developing agentic capabilities across the portfolio has been a key catalyst. The Splunk acquisition has been contributing to top-line growth along with strong demand for Secure Access, XDR, Hypershield and AI Defense solutions. The Zacks Consensus Estimate for fiscal second-quarter Security revenues is currently pegged at $2.15 billion, indicating 2% growth from the figure reported in the year-ago quarter.

The consensus mark for Observability revenues is currently pegged at $298 million, suggesting 7.6% growth over the figure reported in the year-ago quarter. The Zacks Consensus Estimate for Collaboration is pegged at $984 million, suggesting a 1.2% decline from the figure reported in the year-ago quarter.

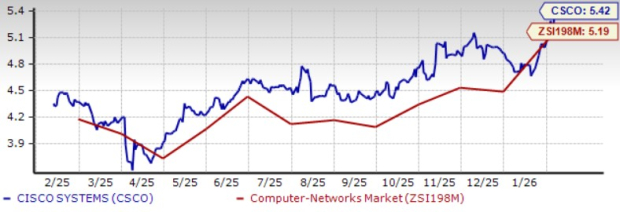

CSCO Shares Outperform Sector

Cisco shares have appreciated 35% in the trailing 12-month period, outperforming the Zacks Computer & Technology sector, as well as competitors including Dell Technologies DELL, Arista Networks ANET and Hewlett-Packard Enterprise HPE. Shares of Dell Technologies, Arista Networks and Hewlett-Packard have appreciated 7.7%, 14.3% and 10.1%, respectively. The broader sector has risen 21.8% over the same time frame.

CSCO Stock’s Performance

Image Source: Zacks Investment Research

Cisco is suffering from stiff competition from Arista Networks, Dell Technologies, Broadcom and Hewlett Packard Enterprise across AI networking and enterprise security.

However, the Value Score of D suggests a stretched valuation for Cisco at this moment.

In terms of the forward 12-month price/sales, CSCO is trading at 5.42X, higher than the Zacks Computer Networking industry’s 5.19X, Dell Technologies’ 0.64X and Hewlett Packard Enterprise’s 0.77X.

CSCO’s Valuation

Image Source: Zacks Investment Research

Cisco Rides on Strong Portfolio

Cisco’s aggressive AI push and growing security dominance have been major growth drivers. Rapid acceleration in the capacity requirements of the network due to unprecedented levels of network traffic and an ever-evolving threat landscape bodes well for Cisco’s prospects. In the campus networking portfolio, the company is seeing very strong demand for switching, routing and wireless products, indicating that enterprise customers are investing in the connectivity needed for AI deployments.

Growing demand for the 9000K series bodes well for Cisco’s prospects. Its next-generation solutions, including smart switches, secure routers and Wi-Fi 7 wireless products, are ramping faster than prior product launches. The company sees these new products offering a multiyear, multibillion-dollar refresh opportunity.

Cisco expects to recognize roughly $3 billion in AI infrastructure revenues from hyperscalers in fiscal 2026. The company expects continued robust demand for Acacia’s market-leading coherent pluggable optics, offering significant cost and power savings. All hyperscalers are now customers of these products. CSCO sees a growing pipeline in excess of $2 billion for its high-performance networking products across sovereign, Neocloud and enterprise customers. Product orders for AI use cases beyond hyperscaler training are gaining traction with strong orders for data center systems, including switching and compute.

Across the industrial IoT portfolio, Cisco is benefiting from strong demand for new ruggedized equipment. The company expects this demand to increase, driven by onshoring of manufacturing to the United States, the increase of AI workloads at the network edge and the emergence of physical AI.

Here is Why CSCO Stock is a Hold Now

Cisco’s near-term results are expected to benefit from an improving networking business and growing security business, along with a rich partner base. However, a challenging macroeconomic environment, stiff competition and a stretched valuation are major concerns.

Cisco currently carries a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Dell Technologies Inc. (DELL): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).