Visa Inc. V, the global payments technology leader, opened fiscal 2026 with another resilient quarter, reinforcing its status as one of the market’s most dependable compounders. Powered by higher payments and cross-border volumes, Visa once again delivered a blend of consistency and quiet growth. For momentum-driven traders, however, Visa’s steady trajectory can sometimes feel short on excitement.

Following the Jan. 29 earnings release, shares briefly slipped about 3% before stabilizing, and now trade 11.7% below the 52-week high of $375.51. Beneath the surface, the quarter revealed multiple growth drivers — and emerging debates around stablecoins — that continue to extend Visa’s long-term runway.

A Closer Look at Visa’s Q1 Performance

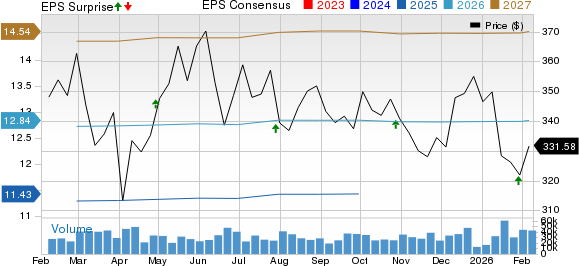

Visa posted adjusted earnings of $3.17 per share, beating the Zacks Consensus Estimate by 3 cents and rising 15% year over year. Revenue of $10.9 billion topped expectations by 1.9% and grew 15%. On a constant-currency basis, cross-border volumes climbed 12%, while payment volumes advanced 8%, supported by operations in the United States, Europe, CEMEA and Latin America. Processed transactions reached 69.4 billion, up 9% year over year, though slightly below the consensus mark of 69.8 billion. Even so, the broader trend remains intact, underscoring Visa’s unmatched scale and network reach.

For more insights, read our blog: Visa Beats Q1 Earnings on Volume Muscle, Shrugs Off Processing Miss.

Visa’s transaction-based model continues to insulate results from fluctuations in specific spending categories. Whether consumers spend on travel, retail, dining or digital services, Visa’s network captures value across the spectrum. This structural advantage provides earnings stability even amid shifting economic conditions.

Value-Added Services: The Next Growth Engine

A key highlight was the continued expansion of Visa’s Value-Added Services (VAS) segment. VAS revenues surged 28% in constant dollars to $3.2 billion, driven by rising demand for advisory, fraud prevention, risk management and marketing solutions. With the FIFA World Cup and the Olympic Games approaching, marketing and analytics services are positioned for further acceleration, helping diversify revenues and lift margin quality.

Stablecoins and Digital Infrastructure: A Strategic Pivot

Visa’s growing role in blockchain-based infrastructure adds another layer to its strategy. The Visa Tokenized Asset Platform enables banks to issue and burn stablecoins, while Visa Direct now supports stablecoin settlement for cross-border flows. Annualized settlement volumes reached $4.6 billion.

That said, Visa has tempered expectations around stablecoins as a mainstream consumer payment tool, especially in developed digital payment markets. Management noted that in regions with highly advanced digital payment ecosystems, such as the United States, the U.K., Europe or other markets, stablecoins currently lack compelling product-market fit for everyday transactions. Consumers already benefit from fast, frictionless digital payments, reducing the urgency to adopt crypto-based alternatives.

Even so, stablecoins retain strong appeal in cross-border transactions. Their ability to compress settlement times, reduce costs and unlock trapped liquidity makes them attractive for financial institutions and global enterprises. Additionally, yield opportunities linked to stablecoin holdings further strengthen their adoption case. Regulatory clarity adds another tailwind, with the passage of the GENIUS Act offering long-awaited guidelines for digital assets, lowering compliance risk for companies operating in this space.

Overall, Visa remains well-positioned regardless of how the stablecoin narrative unfolds. For smaller and mid-sized financial institutions, partnering with Visa may increasingly become a necessity rather than an option, especially as regulatory complexity rises. Visa’s digital infrastructure, compliance capabilities and global network make it a natural ally for banks seeking modernization without heavy capital investment, reinforcing the company’s powerful network effects.

Shareholder Returns Remain a Priority

Visa continues to pair growth with capital returns. During the quarter, the company returned $5.1 billion to shareholders, including $3.8 billion in buybacks and $1.3 billion in dividends. As of Dec. 31, $21.1 billion remained under its repurchase authorization. Its dividend yield of 0.81% exceeds Mastercard Incorporated’s MA 0.63% and the industry average of 0.76%. Meanwhile, American Express Company AXP boasts a dividend yield of 0.91%.

Analyst Estimates Signal Steady Growth

The Zacks Consensus Estimate for Visa’s fiscal 2026 and fiscal 2027 EPS implies an 11.9% and 13.3% uptick, respectively, on a year-over-year basis. Similarly, the consensus mark for fiscal 2026 and fiscal 2027 revenues suggests an 11.3% and 10.2% increase, respectively.

The company beat earnings estimates in each of the past four quarters, with an average surprise of 2.1%.

Visa’s Price Performance & Valuation

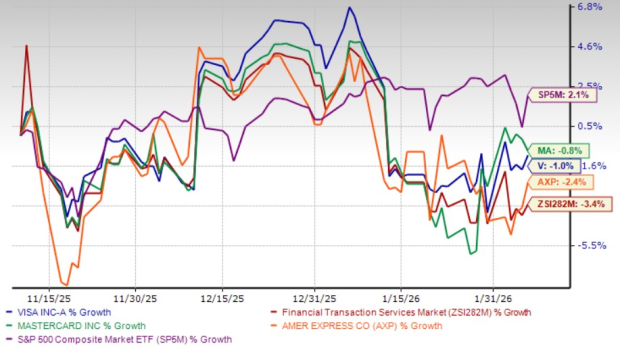

Over the past three months, Visa shares declined 1%, outperforming the industry’s 3.4% drop but trailing the S&P 500’s 2.1% gain. Mastercard slipped 0.8%, while American Express fell 2.4%.

3-Month Price Performance– V, MA, AXP, Industry & S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

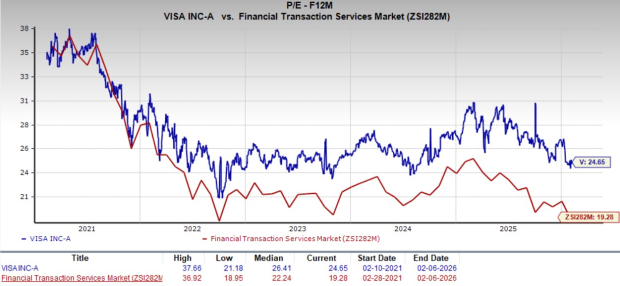

Visa’s valuation remains above the industry average, but that has been the case for the most part of recent history. The stock is trading at 24.65X forward price/earnings versus its five-year median of 26.41X and the industry average of 19.28X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Meanwhile, Mastercard and American Express are currently trading at 27.93X and 20.18X, respectively.

Key Risks to Monitor

Despite its strengths, Visa is not without challenges.The potential launch of stablecoins by major retailers and technology giants could eventually divert a portion of transaction volume away from traditional card networks, pressuring interchange fee growth. While this risk remains speculative, the pace of innovation in digital payments warrants close monitoring.

Regulatory scrutiny also continues to intensify. In the United States, the Department of Justice had accused Visa and Mastercard of leveraging market dominance to maintain elevated merchant fees. Ongoing litigation and proposed settlement challenges introduce uncertainty around long-term pricing power. Internationally, regulatory actions in the U.K., including tribunal rulings and potential fee caps, add another layer of complexity.

Conclusion

Visa’s solid fiscal first quarter performance reaffirmed the durability of its transaction-led business model, supported by steady payment growth, robust cross-border volumes and accelerating Value-Added Services momentum. Strategic investments in digital infrastructure and stablecoin settlement further strengthen its long-term positioning, even as near-term adoption uncertainties persist. Meanwhile, consistent capital returns and favorable earnings estimate trends provide added support.

That said, valuation remains elevated, while regulatory risks and potential competitive disruption warrant caution. With these factors balanced, Visa currently carries a Zacks Rank #3 (Hold), suggesting investors may benefit from maintaining positions while awaiting a more attractive entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).