Bitcoin and Ethereum reached all-time highs on November 10, 2021, when they ran out of upside steam. After falling for over eight months, the two cryptos hit bottoms on June 20, 2022. Since then, sideways price action has dominated the leading cryptos a lot closer to the June 2022 low than the November 2021 high.

In late 2021, at the high, the cryptocurrency asset class’s market cap rose to over $3 trillion. On October 18, 2022, it was sitting below the $1 trillion level.

After a significant decline that followed substantial price volatility with explosive and implosive moves, cryptos have gone to sleep. The price volatility has decreased to a level where the incentive for market participants to speculate has evaporated.

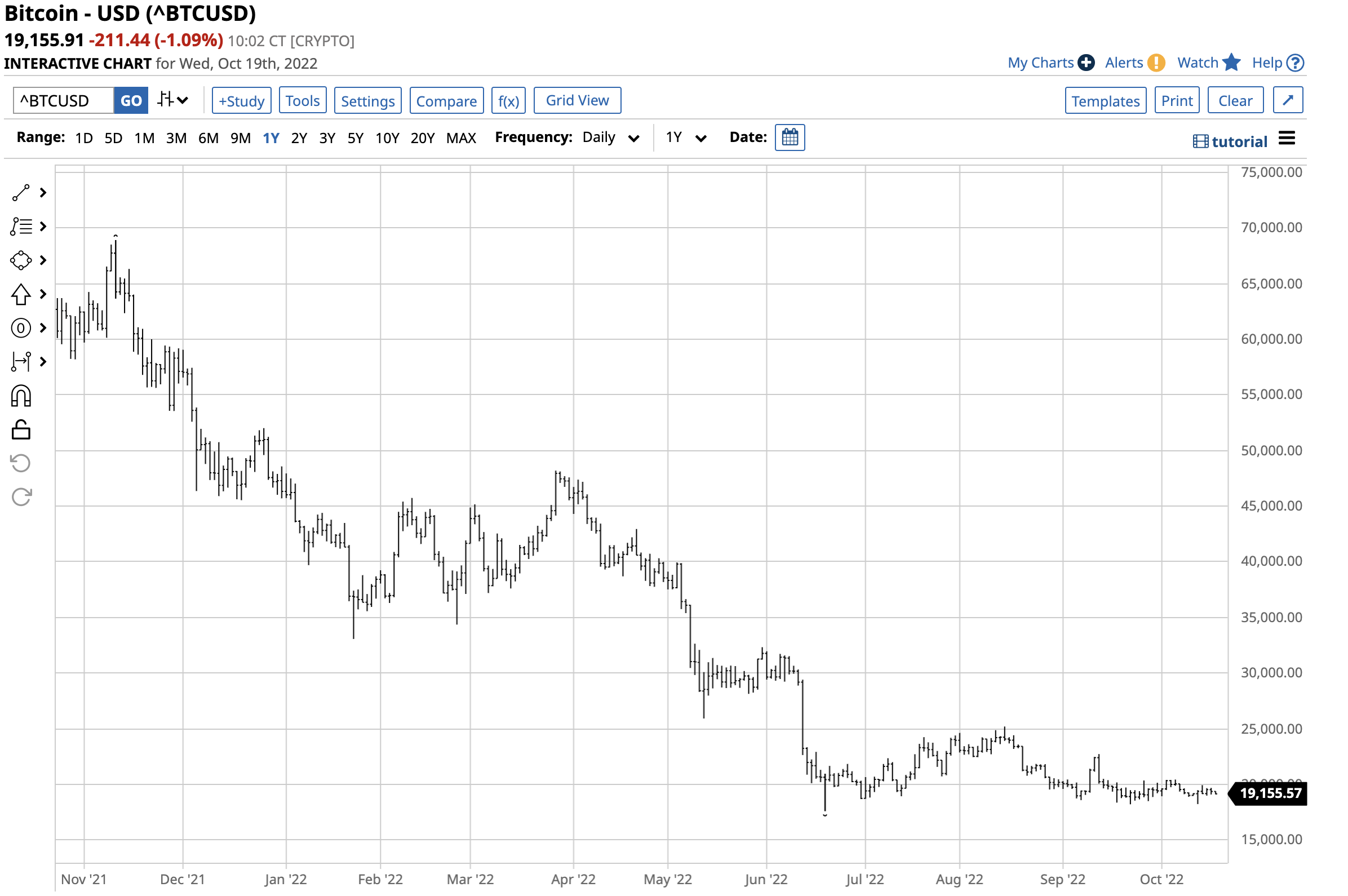

Bitcoin plunged and moved into a sideways pattern

Bitcoin spent eight months making lower highs and lower lows before going into a volatility coma.

The chart highlights the decline from $68,906.48 on November 10, 2021, to $17,614.34 on June 20, a 74.4% plunge. Since June 21, 2022, Bitcoin has traded in a narrow range from $18,222.21 to $25,198.76. The high was still 63.4% below the late 2021 high.

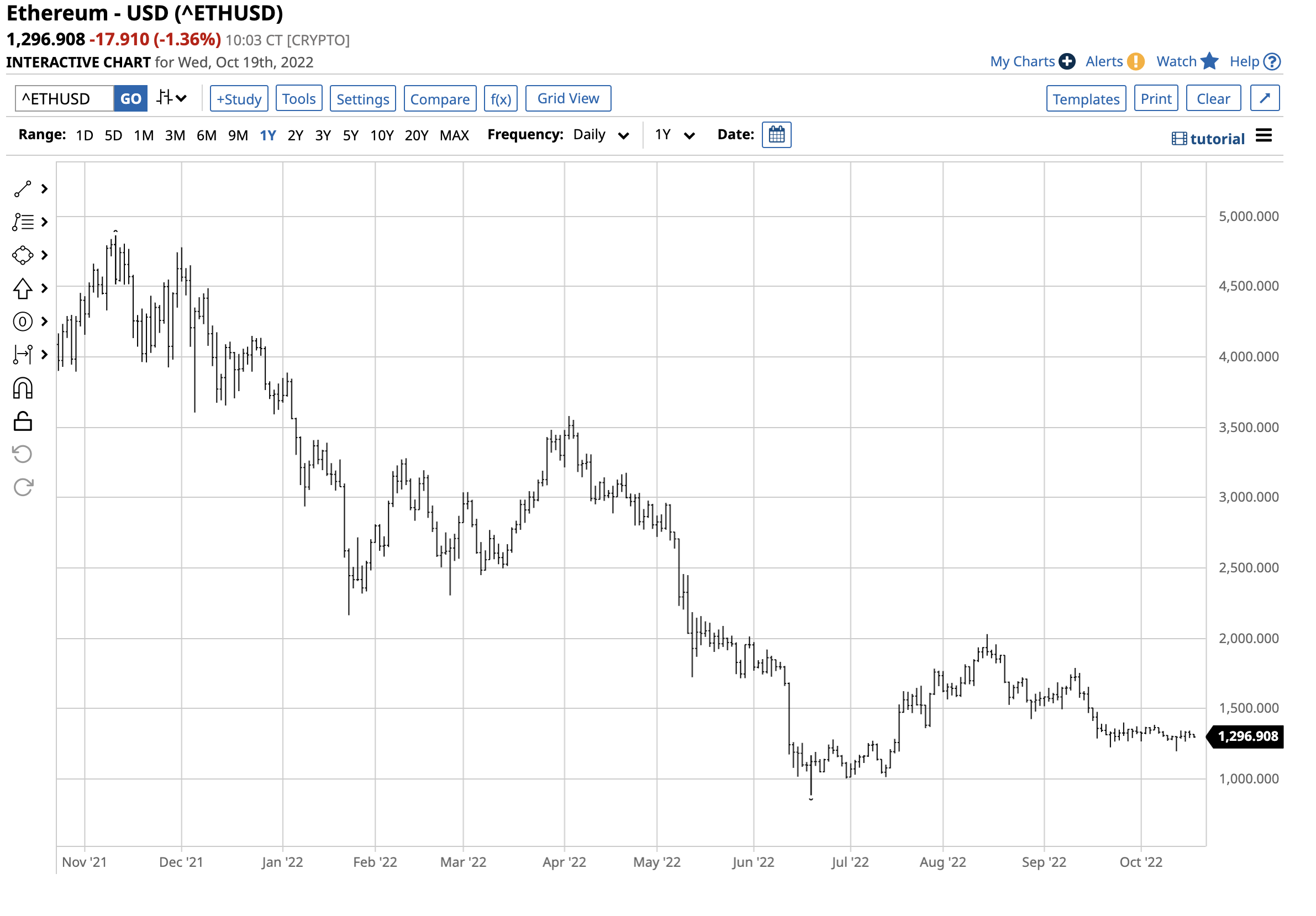

Ethereum follows the same path

Ethereum, the second-leading crypto, did even worse during the correction.

Ethereum fell from $4,865.462 in November 2021 to $883.159 on June 20, an 81.8% decline. Since June 21, Ethereum’s range has been from $1,001.695 to $2,028.65 per token. Ethereum was still 58.3% below the November 20 high at the most recent peak.

The percentage plunge is nothing new

Price implosions are nothing new for the two top cryptos. After reaching a high of $19,862.00 in December 2017, Bitcoin fell to a low of $3,158.10 one year later in December 2018, an 84.1 % drop. Ethereum plunged from $1,419.975 in January 2018 to a low of $82.408 in December 2018, a 94.2% correction.

The fall from the November 2021 highs to the June 2022 lows was smaller on a percentage basis than the declines from the late 2017 and early 2018 highs to the December 2018 bottoms. After reaching lows in late 2018, cryptocurrencies took off on the upside, making a series of new all-time peaks.

The crypto case remains compelling

While controversy continues to surround Bitcoin, Ethereum, and the other over 21,400 cryptocurrencies, Blockchain technology remains a universally accepted advance in finance. Blockchain improves efficiency and speed, and financial institutions have spent considerable sums on upgrading systems to include the technology.

Moreover, fiat currencies which have dominated the payments systems for decades and centuries, derive value from the full faith and credit of the countries that issue legal tender. The theory that underpins cryptos is value depends solely on bids to buy and offers to sell without government interference.

Controlling the money supply is critical for governments seeking power through citizen’s pocketbooks. Cryptos are a libertarian approach to finance, taking power away from governments, central banks, and monetary authorities and returning it to individuals. While China is in the final stages of issuing a digital yuan, and other countries are testing and investigating digital currencies, cryptos remain the only fully operational alternative to traditional currencies. Moreover, cryptos transcend borders, making them global financial instruments. While the case for cryptos is compelling, governments will not likely give up control of the money supply to financial instruments that transcend political ideologies.

I favor BITQ as an inexpensive crypto lotto ticket

Cryptocurrencies are boom-and-bust financial instruments. The price action from November 2021 through June 2022 was another example of the extreme volatility that has gripped the asset class since Bitcoin quietly burst on the scene in 2010 at five cents per token. I expect the sideways price action to give way to another explosive rally over the coming months and years.

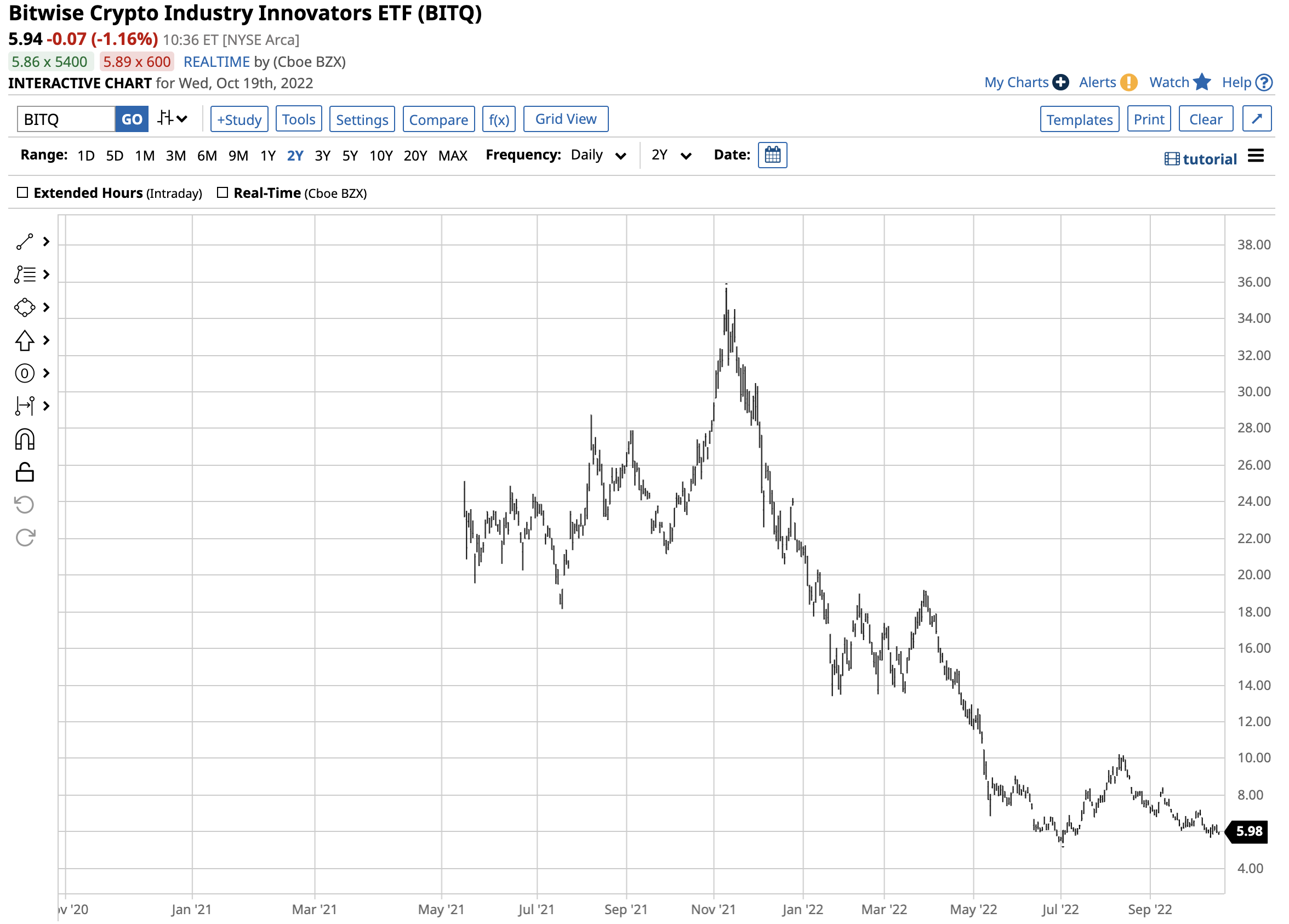

The Bitwise Crypto Industry Innovators ETF product (BITQ) is a newcomer that only began trading in May 2021.

The chart shows BITQ rose to a $35.68 per share high in November 2021 when Bitcoin and Ethereum rallied to record peaks. The ETF fell to a low of $5.39 in early July, just after the leading cryptos reached the most recent bottoms. BITQ fell 84.9% over the period.

At the $5.94 per share level on October 19, BITQ had $58.8 million in assets under management. The ETF trades an average of 106,474 shares daily and charges an 0.85% management fee. BITQ should continue to move higher and lower with the overall cryptocurrency asset class and its leaders, Bitcoin and Ethereum, making BITQ a proxy that investors and traders can hold in traditional stock portfolios.

Given its boom-and-bust history, some exposure to the volatile crypto asset class makes sense. At the current price levels, the cryptos remain in the bust phase, but the current low volatility could be an excellent time to consider exposure. BITQ at $5.94 per share is an expensive way to position for another boom period in cryptocurrencies.

More Crypto News from Barchart

- Options Traders Duke It Out Over This One Blockchain Stock

- Coinbase (COIN) Presents an Obvious Candidate for Unusual Options Activity

- Bitcoin Consolidates as the Bulls Believe a Rally is on the Horizon

- Bitcoin Finds Bargain Buyers as It Crosses $20,000 Again

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)