Bitcoin is an asset and the child of technological advances in finance. In his 2008 whitepaper, Satoshi Nakamoto introduced blockchain and Bitcoin. In 2010, the tokens were worth five cents. Over the following eleven years, the ascent was unprecedented. A $1 investment in 2010 bought twenty Bitcoin. At the November 2021 high, that $1 had yielded an incredible return and was worth $1.38 million at the high. A $10 investment was worth $13.8 million, and $100 turned into a $138 million fortune. At the $19,760 level on September 15, $1 spent on Bitcoin in 2010 was still worth $395,200, and a $10 or $100 investment was worth millions.

While Bitcoin has turned pennies into fortunes, it has also given birth to thousands of other cryptocurrencies over the past decade. If the past performance is a guide to the future, Bitcoin’s explosive and implosive nature could make the current consolidation period a launchpad for another dizzying rally over the coming months and years.

Bitcoin continues to lead the cryptocurrency assets class

At the $19,700 level, Bitcoin’s (BTC)market cap stood at just below $376.5 billion, double that of the second-leading cryptocurrency, Ethereum (ETH). The asset class’s total market cap was at around the $959.666 level, with Bitcoin and Ethereum’s combined value occupying 58%, or most of the asset class.

The “Popular Coins” page on Barchart highlights the price action in the most actively traded cryptocurrencies. However, there are many more tokens that comprise the asset class. According to CoinMarketCap.com, on September 15, there were 20,949 cryptocurrencies trading in the market. Each day, new cryptos come to market.

The number of tokens continues to rise

I have followed the rise of the cryptocurrency asset class by tracking the number of tokens since the end of Q1 2019, when 2,136 tokens comprised the asset class. The growth rate has been staggering:

- At the end of 2019, it rose to 4,986, a 133.4% increase in nine months.

- On December 31, 2020, 8,153 tokens amounted to a 63.5% rise for the year.

- On December 31, 2021, a total of 16,238 tokens was 99.2% higher than at the end of 2020.

- As of September 15, 2022, 20,986 tokens were already 29.2% higher in 2022.

While Bitcoin, Ethereum, and the nearly 21,000 other tokens routinely experience explosive and implosive price moves, the number of tokens has been a one-way street higher over the past years. The one sure thing has been that there are more cryptos trading today than yesterday, and there will be even more tomorrow.

The technical levels to watch over the coming weeks

After an ugly move that took Bitcoin from $68,906.48 in November 2021 to $17,614.34 in June 2022, the price has been consolidating in a range, mostly between $20,000 and $25,000 over the past months.

Technicians will be watching the chart, which shows support at the June $17,614.34 low and the first resistance level at the August 15 $25,198.76 high. A move above or below those levels could trigger follow-through buying or selling. While some Bitcoin bulls are again calling for the price to rise to $100,000 or even higher, it must first move above the $25,200 level, to establish some technical strength.

While other market participants believe Bitcoin is worthless, a move below the June low is necessary to keep the bearish trend intact. The bottom line is the current trading range offers few clues about the future path of least resistance.

BITQ is an ETF that holds crypto-related companies

The most direct routes for an investment or trading position in Bitcoin are via the physical market and holding the crypto in a computer wallet or on an exchange, or through the CME futures market.

Meanwhile, the Bitwise Crypto Industry Innovators ETF (BITQ) holds shares in companies that tend to move higher or lower with Bitcoin’s price. The most recent top holdings include:

BITQ’s fund summary states:

Liquidity in the BITQ product is a function of liquidity in Bitcoin. A bullish trend in the leading cryptocurrency will likely increase activity in BITQ, while a falling market or continuation of the consolidation period will weigh on activity.

At $7.47 per share, BITQ had $68.04 million in assets under management. BITQ trades an average of 94,229 shares daily and charges a 0.85% management fee.

BITQ could be an inexpensive route to Bitcoin exposure

BITQ’s future is in Bitcoin’s hands as the leading crypto continues to consolidate the losses since late 2021.

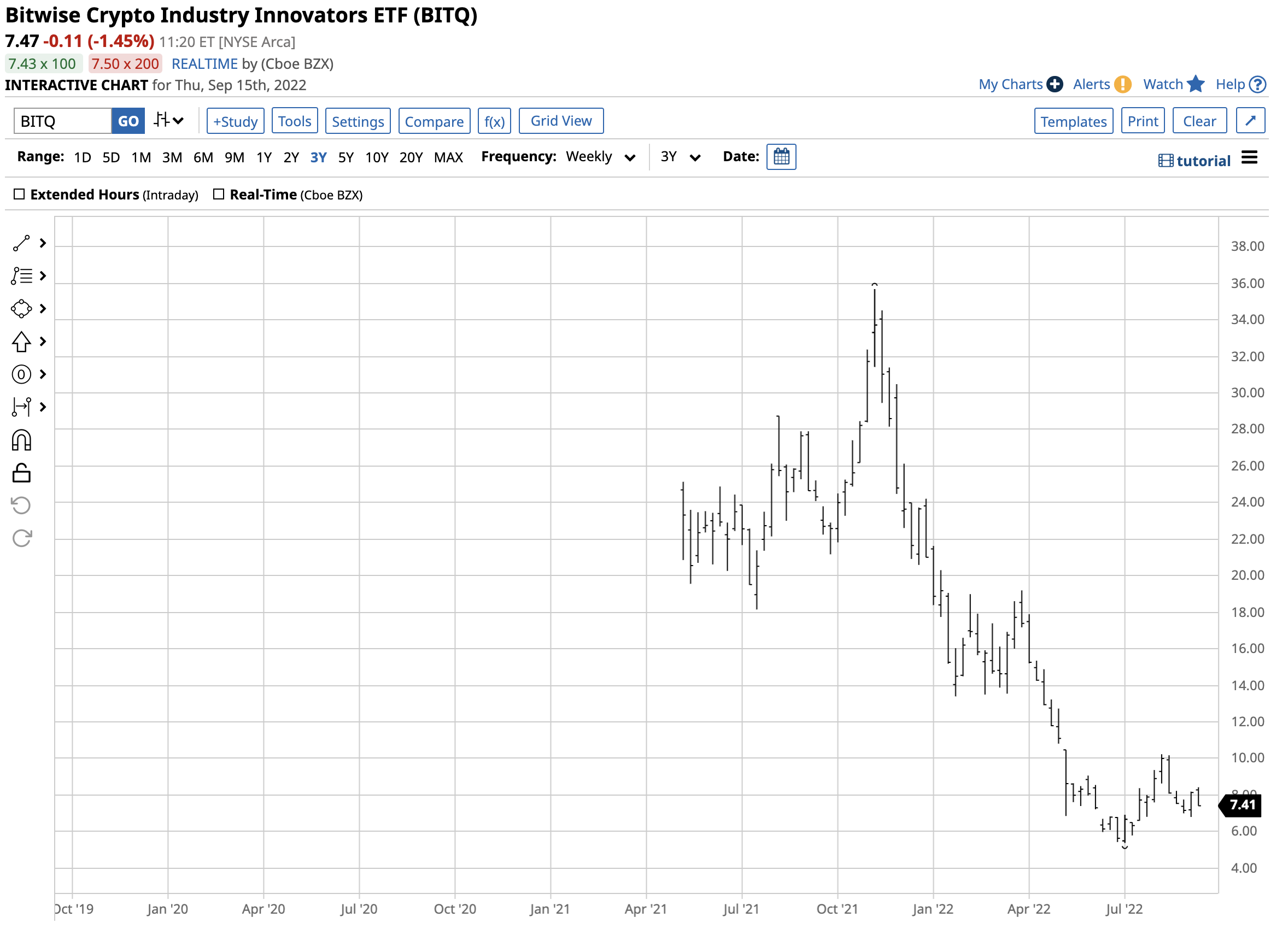

The chart illustrates that BITQ traded to a high of $35.68 per share in November 2021 when Bitcoin reached its all-time peak. The stock found a bottom at $5.39 in early June, just after Bitcoin fell to its low in June. At the $7.67 level on September 15, BITQ was closer to the low, as it follows Bitcoin. An explosive move in the leading crypto could foster a significant rally in the ETF over the coming weeks and months. At below $8 per share, BITQ could be an excellent investment route for those looking for exposure to Bitcoin without holding the crypto or venturing into the futures arena.

History can be a guide to future performance, but it is not a given. If Bitcoin’s historical boom-and-bust pattern holds, BITQ is a candidate to buy the dip during the current consolidation period.

More Crypto News from Barchart

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)