When cryptocurrency exchange and wallet service provider Coinbase (COIN) launched its initial public offering last year, advocates of decentralized digital assets generally rejoiced. Irrespective of their opinions about COIN stock, the integration of a major player in the virtual currency space into the broader equities market boded well for the entire space.

Setting aside a temporary surge in market value in late 2021, the narrative for Coinbase’s public debut has been largely negative. According to data from Google Finance, the return of COIN stock since its first closing session is a loss of 80.5%. On a year-to-date basis, COIN has tumbled more than 73%.

Unfortunately, this circumstance strongly indicates that the infrastructural angle for COIN stock doesn’t hold water. Arguably, one of the main catalysts for Coinbase was that it facilitated an indirect approach to cryptos. Rather than deal with the wild vagaries of individual coins and tokens, one could simply wager on Coinbase, which provides a service for speculation rather than being the target of said speculation.

However, the events of 2022 thus far have imposed a reality check on COIN stock. Rather than operating independently of fiat-based dynamics, Coinbase has proven rather dependent on them. For instance, COIN dropped 6.5% on Friday, Aug. 26, when Federal Reserve chair Jerome Powell declared that the central bank would take aggressive measures to tackle inflation.

That translates to higher interest rates, sucking the wind out of growth-focused public firms. And irrespective of Coinbase being tied to decentralized assets, the announcement placed significant pressure on the company. Making matters worse, COIN stock is now the subject of bearishly oriented unusual options activity.

Traders Take a Dim View on COIN Stock

Following the closure of the Friday session, bearish traders shined a dubious spotlight on COIN stock. Piling into the $58 put options – which rise in value as the underlying security declines – traders anticipate that further pain is likely. After all, these options feature an expiration date of Sept. 2, which is this coming Friday.

On Aug. 26, COIN stock closed in the open market at $66.74. Therefore, shares will need to drop more than 13% for the transaction to be in the money. Further, as represented by the midpoint price (84 cents), the bid-ask spread came out to 8.33%. While it’s not the widest spread in the derivatives market, it’s wide enough to suggest that the facilitating market maker wants some margin of protection.

Broadly speaking, the bearishness toward COIN stock aligns with established trends. According to data from Barchart.com, the put/call open-interest ratio is 0.97. Typically, the delineation marker between bullishness and bearishness is 0.70. Therefore, traders are buying more puts than calls, suggesting wider pessimism.

Interestingly, covering analysts maintain a generally optimistic view of COIN stock. Currently, based on the opinions of 18 analysts, 11 have issued a “strong buy” assessment, while one features a “moderate buy” rating.

Coinbase Revenue Tells All

So, should prospective investors follow the direction of traders (most of whom are pessimistic right now) or the guidance of analysts, a majority of whom have issued not only “buy” ratings but “strong buy”? To be clear, Barchart readers must conduct their own due diligence and from that, make their own decision.

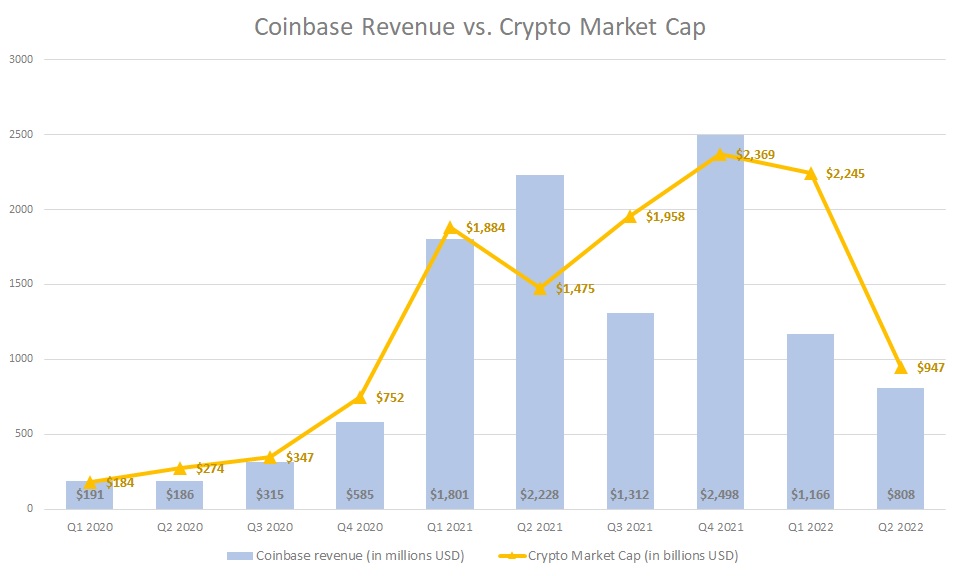

However, to provide additional clarity for the matter, investors should do well to compare the market cap of the crypto sector with Coinbase’s quarterly revenue performance. Juxtaposing the two metrics, investors can immediately recognize the direct correlation between platform sales and sentiment for cryptos:

To elucidate the above data, I’m taking the approximate price of the crypto sector at or near the end of each quarterly period. It’s not an exact science but the wider deduction remains the same. If sentiment for cryptos run red hot, Coinbase enjoys substantial demand. Absent this sentiment, Coinbase sales slip.

By the way, the correlation coefficient between the crypto market cap and Coinbase revenues is 84%.

Unfortunately for COIN stock, the Fed’s warning that it will impose some pain to get inflation under control suggests that for the near term, cryptos will likely suffer headwinds. If so, the historical correlation implies that Coinbase has more to dip before it becomes an attractive bullish proposition.

Head for the Sidelines

Given the fundamental and technical evidence, it appears that there is a higher probability that COIN stock will suffer greater declines in general before circumstances improve. Therefore, it’s possible that bearish traders could benefit from acquiring put options.

However, buy-and-hold investors may be best served heading to the sidelines. While Coinbase does appear attractively priced from its peak, the continued erosion of crypto sentiment could spell further corrective action before the company goes back on the upswing.

More Stock Market News from Barchart

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)