A large number of puts were purchased in Texas Instruments (TXN) reflecting a very pessimistic outlook on the stock. But the institutional investor who did this is taking a huge risk, given that the chip maker is producing large amounts of free cash flow (FCF). The company is likely to keep this up in Q3, which will prevent the stock from cratering.

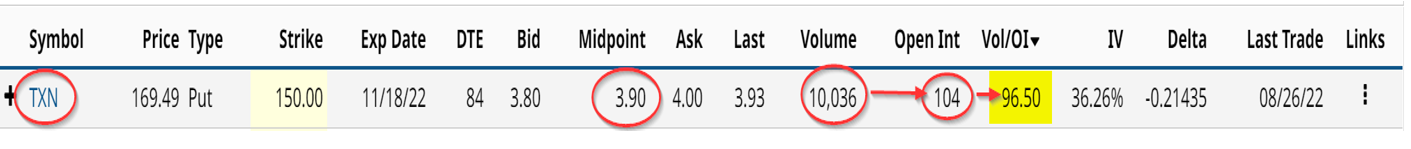

This position can be seen in Barchart's Unusual Stock Options Activity report on Aug. 26. As the table below shows, some institutional investor(s) bought 10,036 long-dated puts options at an out-of-the-money price of $150. TXN stock closed at $169.49 on Aug. 26.

This shows that the investor may have paid $3.90 for 10,036 put options which would have cost $3.914 million (i.e., $3.90 x 10,036 x 100). They are betting that the stock will fall at least $19.49 per share by Nov. 18, which represents an 11.5% drop over 84 days (days to expiration or DTE). In fact, given the $3.90 cost of the puts, the stock will have to fall below $146.10 (i.e., $150 - $3.90), or over 13.8% from today before the put options are “in-the-money” by expiration.

On the other hand, whoever sold these puts has probably made a very good investment. They immediately received $3.914 million in income and have an obligation to buy shares at just $150 for $150.54 million. That represents a 2.60% yield (i.e., $3.90/$150) over the next 84 days or an annualized yield of 11.3%.

How likely is this bet to pay off for the out-of-the-money OTM put option investor? Not very high. Let's see why.

Prospects for TXN Stock

The main reason that investors should be careful about being bearish on TXN stock is that the company is producing large amounts of free cash flow (FCF). For example, in Q2, FCF was $1.17 billion for the quarter and $5.889 billion in the last 12 months (LTM). That represents a 22.5% FCF margin on $5.2 billion for the quarter and a 30% LTM margin.

Moreover, the company projects that for Q3 its revenue will be between $4.9 billion and $5.3 billion, which is close to the $5.2 billion in sales for the second quarter.

Moreover, Texas Instruments is committed to spending its FCF on shareholder returns. For example, its dividend is likely to be hiked before the end of Sept. TXN has paid $1.15 per share for the last 4 quarters and it has raised the dividend every year in the past 16 years.

Last year the company hiked the dividend by 12.7% from $4.08 to $4.60 annually. Let's assume that TXN raises the dividend by 10% to $5.06 per share in Sept. That puts the stock, at $169.49 on a 2.99% dividend yield. This is well over the 2.50% historical yield for TXN in the last four years, according to Seeking Alpha.

As a result, if we divide $5.06 by 2.50% we get a target price of $202.40 per share. This represents a potential 19.4% rise in TXN stock. That is far away from the put investor's hope that the stock falls to below $150 by Nov. 18.

And this does not include Texas Instrument's huge share buyback activity. For example, in Q2 the company spent $1.182 billion on stock repurchases. In the last 12 months, it paid $2.05 billion on share buybacks. Its Q2 run rate works out to $4.728 billion annually if it keeps this up. That is over 3.0% of its $154.86 billion market value.

So, these two uses of FCF will act to push up the stock price. Investors should be careful in following the put investor which hopes to see TXN fall below $150 by Nov. 18.

More Stock Market News from Barchart

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)