/The%20Shopify%20logo%20on%20a%20smartphone%20screen%20by%20IB%20Photography%20%20via%20Shutterstock.jpg)

Shopify (SHOP) will release its fourth-quarter financials on Wednesday, Feb. 11. Ahead of earnings, SHOP stock has come under pressure, declining by about 31% in the past month. Concerns around the stock’s valuation and broader geopolitical uncertainty have weighed heavily on sentiment, pushing many investors to the sidelines.

Despite the recent selloff, Shopify’s underlying business performance remains solid. The company has shown that it can grow rapidly while maintaining and improving profitability. In the third quarter, Shopify delivered 32% growth in gross merchandise volume (GMV), matched by 32% revenue growth, while generating an impressive free cash flow margin of 18%.

Importantly, this strength has been consistent throughout the year. Revenue increased 27% in the first quarter, accelerated to 31% in the second, and climbed another 32% in the third. Over the same period, free cash flow margins steadily improved from 15% in Q1 to 16% in Q2 and 18% in Q3.

The recent pullback in SHOP stock has also helped ease valuation concerns. After the decline, the stock’s 14-day Relative Strength Index sits at 22.6, well below the 30 level typically associated with oversold conditions. This technical signal suggests that much of the selling pressure may already be priced in, potentially setting the stage for a rebound if earnings meet or exceed expectations.

At the same time, options traders are pricing in a post-earnings move of about 11.1% in either direction for contracts expiring Feb. 13. That is roughly higher than Shopify’s average move of roughly 8.6% after earnings over the past four quarters. Investors should note that SHOP stock fell by over 6.9% following the Q3 earnings report.

Shopify Q4 Outlook: Growth Continues, but Comparisons Get Tougher

Shopify could once again deliver strong quarterly financial results, though headline growth rates are likely to moderate amid challenging year-over-year (YoY) comparisons. Management has guided to Q4 revenue growth in the mid-to-high 20% range, reflecting a sequential deceleration in growth rate, as Q4 of 2024 marked Shopify’s fastest-growing quarter, helped in part by the expanded PayPal (PYPL) partnership, which will no longer provide the same lift as the company laps those benefits.

Even with these headwinds, Shopify’s underlying growth drivers remain strong. Shopify Payments remains a major driver of growth. This strength is driven by higher payment penetration within gross merchandise volume, as more merchants globally adopt the product and existing merchants scale their businesses. Shop Pay could once again deliver strong adoption in Q4.

The company’s offline business is a key growth driver. Offline GMV rose 31% in the third quarter. Moreover, as more brands are turning to Shopify for a unified commerce solution, Shopify’s offline business could see significant growth.

Shopify’s B2B business also continues to deliver impressive results. The business has grown at a solid pace over the past year. Moreover, in Q3, B2B GMV rose 98% YoY. Growth in Q4 could once again remain solid, driven by newly onboarded merchants and established customers.

From a profitability perspective, Shopify has exceeded consensus earnings expectations in the past three quarters of 2025. For Q4, consensus forecasts call for earnings per share of $0.41, a 20.6% YoY increase.

Is SHOP Stock a Buy?

Shopify continues to execute well, delivering solid GMV and revenue growth alongside steadily expanding free cash flow margins. Near term, Q4 revenue growth could decelerate modestly due to tougher year-over-year comparisons and the fading impact of one-time catalysts such as the expanded PayPal partnership. However, the recent selloff has meaningfully reduced valuation risk.

An oversold RSI and more moderate expectations suggest that much of the downside may already be priced in. Further, with continued momentum across Payments, offline, and B2B, the risk-reward profile for SHOP stock appears favorable ahead of earnings.

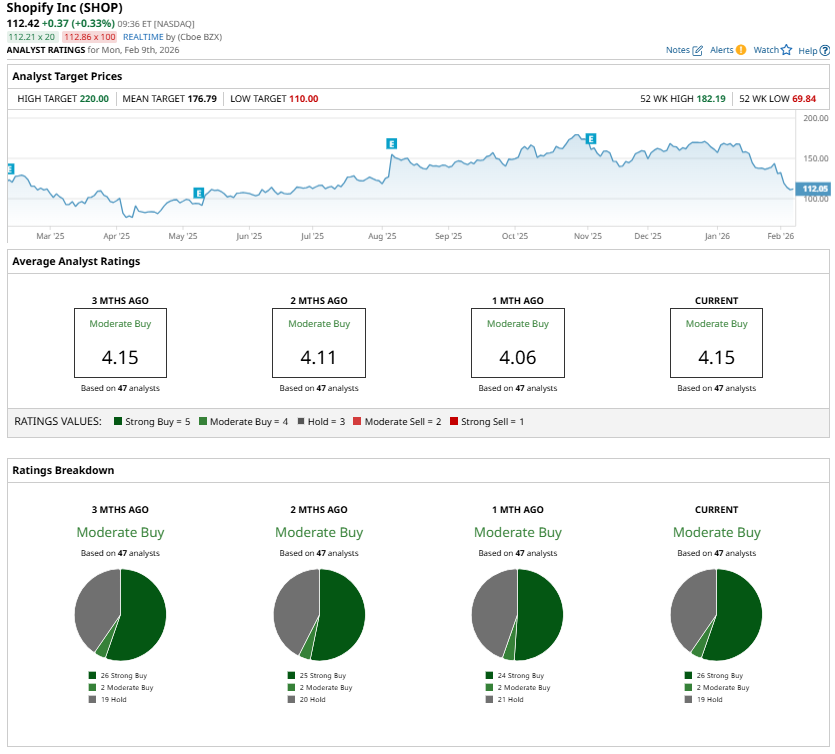

Analysts maintain a “Moderate Buy” consensus rating on SHOP stock.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.