Gladstone Investment Corp (GAIN) is a business development corporation (BDC) that lends privately to middle-market companies at high rates. As a result, its monthly-paid 7.45% dividend yield looks reasonably secure. This makes GAIN stock very attractive to value investors.

Here is how the company works. It pays out a 7.5 cents dividend each month (22.5 cents quarterly). That also works out to 90 cents annually, and at $12.08 as of Friday, Oct. 7, GAIN stock, therefore, has an annual yield of 7.45%.

As a result, GAIN stock, which is down over 24% in the last 6 months, now looks like an attractive bargain stock.

How The Dividend Works

In addition, sometimes the company pays additional distributions of 12 cents per quarter. However, shareholders should not necessarily count on this and indeed Gladstone Investment did not make this other distribution during Q3.

Since there are a little over 33.2 million shares, the quarterly dividend costs the company $7.45 million. This is easily covered by the company's cash flow from operation (CFFO) which was $41.3 million during Q2. That also covered the additional 12-cent distribution, which brought the total Q2 payments to $11.456 million.

So, the bottom line is we can count on this 90-cent dividend distribution going forward, as it costs just 18% of its cash flow.

Upcoming Distribution Announcement

Investors expect GAIN to announce its Q4 dividends sometime this week, and there does not seem to be a high possibility that an additional 12 cents could be included. Here's why.

For one, analysts forecast Gladstone will make $1.06 per share this year. As a BDC it has to pay out 90% or more of its earnings to shareholders to keep its tax-free status.

So far this year (through Q3 it has paid out 91.5 cents (9 months of 7.5 cents and 2 x 12.5 cents). If it declares another set of 22.5 cents on Oct. 12 to be paid during Q4 that brings the total to $1.14. That will be greater than the forecast $1.06 earnings forecast for 2022.

Distributions Look Secure

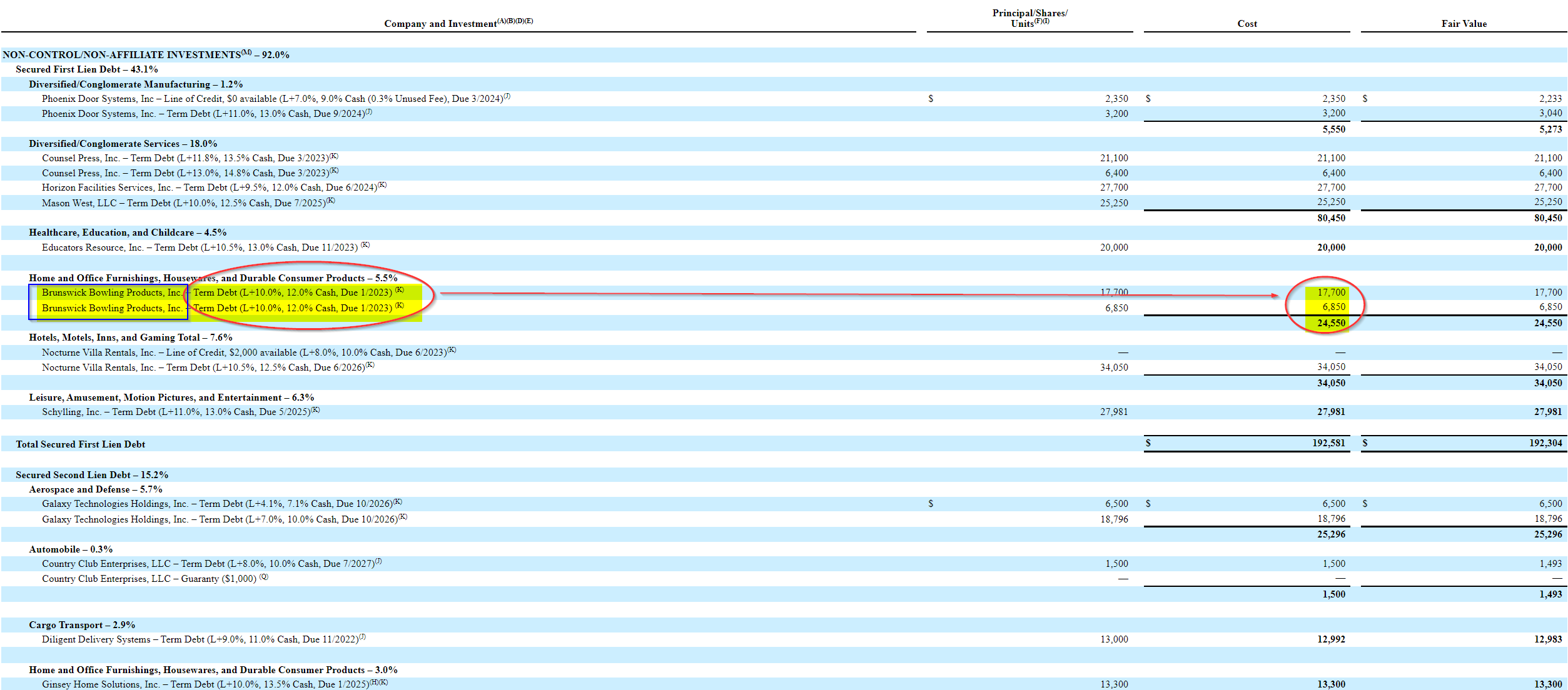

A scan of the company's portfolio from the Q2 10-Q shows that its loans to about 26 companies look very healthy. One advantage of this presentation is that it shows the exact nature of the loans to each company.

For example, look at the page above that shows that 5.5% of the portfolio was in term loans made to Brunswick Bowling Products at Libor plus 10%, along with some equity shares in the company. In fact, many of the loans have floating rate interest rates based on LIBOR plus a spread ranging from 4% to 10%, plus equity kickers.

That means that if rates keep rising with the Fed's aggressive stance, the company's cash flows will adjust according, assuming these loans roll over at higher rates. This shows that the company's cash flows look reasonably secure.

In effect, investors can depend on the ample 7.45% dividend yield since the distributions should be secure going forward.

More Stock Market News from Barchart

- Stock Market This Week: Five Themes to Watch

- Stocks Routed as Strong U.S Jobs Report Keeps Aggressive Fed in Play

- Main Street Capital's 7.9% Yield and Option Income Plays Attract Buyers

- Recent Chip-Stock Rally Ends on Signs of Weakening Global Demand

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)