Main Street Capital (MAIN) has an enticing 7.9% annual dividend yield that is paid on a monthly basis. In addition, the stock has very attractive covered call and cash-secured put income plays. This is attracting value buyers.

Main Street Capital is a business development corporation (BDC), a non-bank lender, that essentially provides debt capital to middle-market companies. Right now the company pays out a 22-cent monthly dividend, which works out to $2.64 per annum. So, at today's price of $33.49 MAIN stock trades has a 7.88% dividend yield.

Good Fundamentals

Moreover, it appears that Main Street Capital should be able to sustain this level of dividends. For example, analysts now project that earnings per share (EPS) for 2023 to be $3.17, well above the $2.64 dividend payment. This is also 5.3% over the forecast for 2022 EPS. Last quarter the company made 75 cents per share, which annualized out to $3.00.

In addition, from a cash flow standpoint, it appears that Main Street Capital can afford the monthly dividends. For example, its cash flow from operations (CFFO) last quarter was positive. However, it was just $10 million, whereas the dividends cost $42.0 million. However, judging the dividend-paying ability from its CFOF is somewhat misleading as companies can adjust their cash expenses.

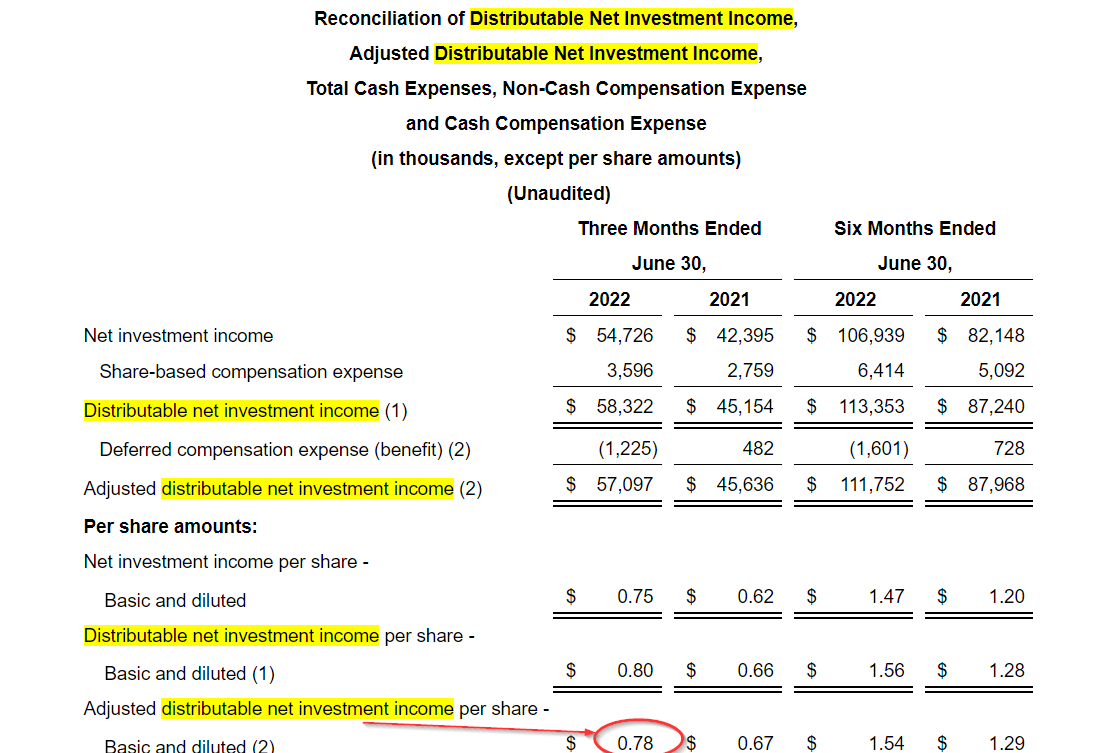

Main Street likes to use a measure called "adjusted distributable net investment income," which is essentially GAAP net income with its stock-based compensation expenses (SBC) added back to GAAP net income. Last quarter (Q2) this raised the figure to 78 cents per share or $3.12 annually, well more than the $2.64 annual dividend.

This makes the 7.87% dividend yield look reasonably secure. It's also higher than the stock's historical 7.40% dividend yield over the last 4 years. That implies MAIN stock could rise another 5.5% to $35.41 per share (i.e., $2.62/0.074=$35.41). We can use that to find profitable option income plays.

Option Income Plays

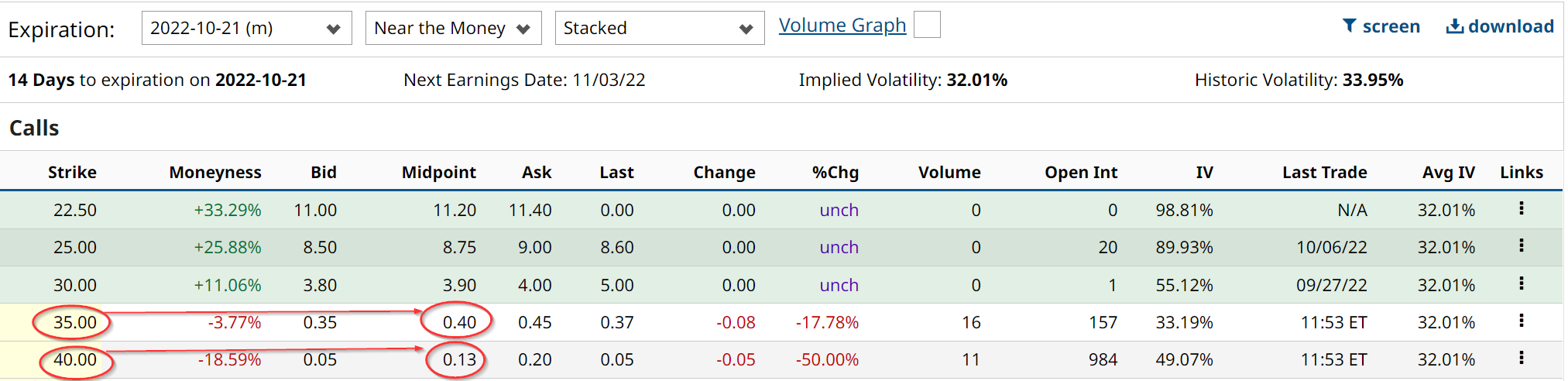

Enterprising investors can gain additional income by shorting out-of-the-money (OTM) covered calls and cash-secured puts. The following table shows that the $35 strike price for call options expiring in 14 days (Oct. 21) trades at a premium of 40 cents per contract.

This implies that the covered call investor can buy 100 shares for $3,349 and sell one contract at the $35.00 price and then receive $40. That works out to an immediate return of 1.19%. In addition, unless the stock rises to $35 or more by Oct. 21, the investor can reap the monthly dividend. A less risky investment would be the $40 strike price call trading at $0.13, a return of 0.39% for two weeks. That works out to an annualized 4.65% return.

Investors can also sell cash-secured puts at the $30 strike price and receive 15 cents per contract. That means that if the investor puts up $3,000 in cash to purchase 100 shares at $30.00, and then sells the $30 strike puts he can receive $15. This is equal to an immediate return of 0.50% for 2 weeks' investment, or 6% annually if done each month for a year.

This shows that investors can make additional income on MAIN stock using option income plays on top of its 7.88% annual yield, paid monthly.

More Stock Market News from Barchart

- Recent Chip-Stock Rally Ends on Signs of Weakening Global Demand

- Stocks Sink as Hot U.S. Labor Market Keeps Fed Hawkish

- Markets Today: Stocks Slide on Strong U.S. Payrolls and Chip Stock Weakness

- 2 Bear Call Spread Trade Ideas For This Friday

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)