- Much of the chatter in ag markets these days is about the lowest water levels of the Mississippi River in a decade, raising barge freight rates and slowing the ability to get US supplies to port.

- Something else that needs to be considered, is the US basically ran out of available supplies of soybeans and corn over the spring and summer of 2022, with harvest slowly rebuilding those supplies.

- It's also interesting to note that according to USDA's latest weekly export sales and shipments numbers, the US is ahead of last year when it comes to total soybean sales.

It seems all the cool kids are writing about low water levels along the Mississippi River slowing US grain exports these days. So, me being me, I’m not going to write about that particular issue. Instead, I’m going to focus on some other issues that we have to consider before we conclude there is no demand for US soybeans this marketing year. And yes, I’ve heard arguments laid out along those lines. It seems a bit premature to me, but everyone wants to be as dramatic as the Weather Channel, so it is what it is.

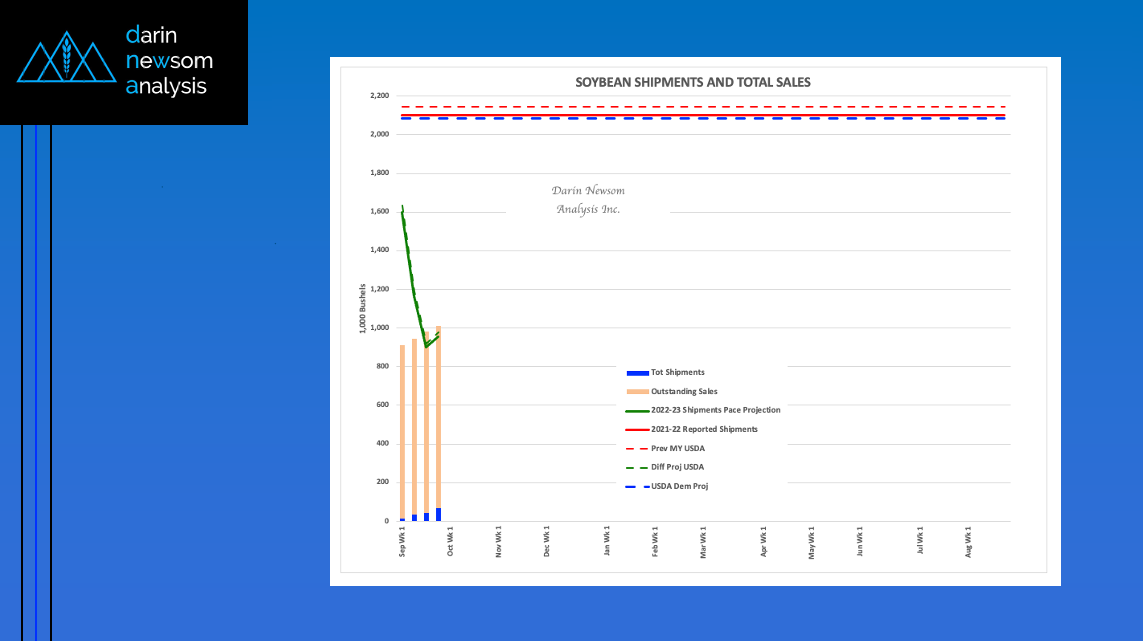

The latest weekly export sales and shipments update from USDA/FAS released this past Thursday, for the week ending Thursday, September 29, showed total US soybean exports for the 2022-2023 marketing year at 67 mb (1.831 mmt). This is marked by the blue column on the attached chart, tough to see as it is hiding near the bottom of the scale. If we use this number multiplied by the average percent shipped through roughly the end of September, reportedly 7%, then the 2022-2023 pace projection comes in at 957 mb (solid green line). This is a low number, and if all the data we had it would make the bearish argument for soybeans that much stronger. But it’s not the only piece of data at our disposal, so we can probably but the bear calls away for the time being.

Yes, US export shipments are off to a slow start this marketing year, but the interesting thing is, according to USDA, shipments through late September were only 1 mb behind last year’s pace. Reported shipments for 2021-2022 came in at 2.101 bb (note I’m talking about actual reported shipments rather than USDA’s Supply and Demand estimate of 2.145 bb). So there’s still a good chance we could see shipments pick up, if the Mighty Mississippi will allow it. Also in the latest set of export numbers, the world’s largest buyer – China – reportedly had 499 mb of 2022-2023 purchases on the books as compared to 429 mb the same time last year. This makes up a big part of all unshipped 2022-2023 sales reported at 670 mb versus 602 mb from a year ago.

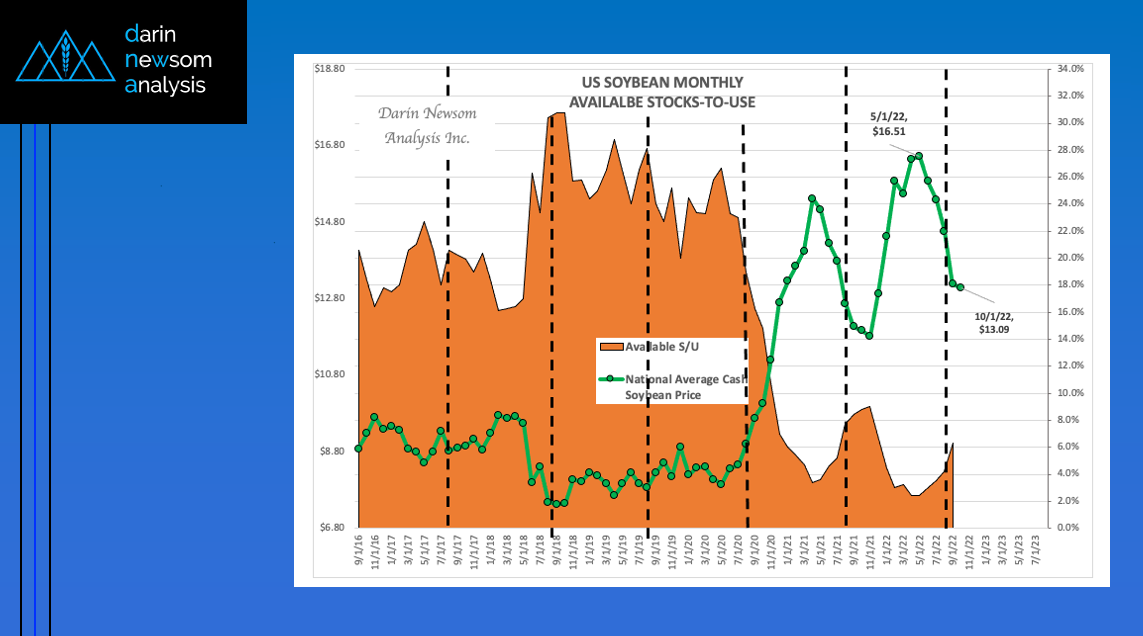

So why did US shipments fall off over the summer and early fall of 2022? It’s easy: The US basically ran out of soybeans. Those of you who have been following along with my monthly Supply and Demand commentary will recall real US soybean supply and demand dropped to a stocks-to-use calculation of 2.4% at the end April based the national average cash price (ZSPAUS.CM) of $16.51. The only time the US soybean available stocks-to-use situation has been tighter was back in July and August 2012 when the average cash price came in at $16.84 and $17.32 respectively. Based on the idea the US was out of soybeans, it isn’t surprising exports have been slow to get rolling in September and October, again with the added nuisance of low river levels.

Looking at the same available stocks-to-use chart, it’s interesting to note the soybean market looks similar to the previous year when it dropped from an April high of $15.41 to a November low of $11.81 before staging a persistent rally through the spring of 2022. What jumps out at me is the similar differences between the highs ($1.10) and lows ($1.28), with the latter telling us there could be a bit more downside to the cash market this month. After that it comes down to weather, meaning late spring conditions across South America.

And of course, some rain for Old Man River here in the US would help.

More Grain News from Barchart

- Bean Prices Holding onto Overnight Gains

- Recovery into Friday for Wheat Market

- Corn Gaining for the Start of Friday

- Wheat Futures Gave Back Double Digits

/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Microsoft%20France%20headquarters%20by%20JeanLuclchard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/International%20Business%20Machines%20Corp_%20logo%20on%20storage%20rack-by%20Nick%20N%20A%20via%20Shutterstock.jpg)