Chesapeake Energy (CHK), a major natural gas producer, pays base and variable dividends that total $2.32 per quarter or $9.28 annually. This huge dividend gives CHK stock, trading at $97.66 on Oct. 3, an attractive 9.5% yield. This is attracting value buyers to the stock.

Chesapeake Energy is following the trend of many high-yield energy companies now by dividing their quarterly dividends into two components. The base dividend will be paid consistently and this past quarter it rose 10% from $2.00 annually to $2.20.

The variable portion, which is most of the total dividend, is paid out of 50% of the adjusted free cash flow (FCF) that the company produces each quarter. That means the amount could be marginally higher or lower each quarter.

Last quarter it actually fell from $1.84 per share to $1.75, a decline of 9 cents or 4.89% lower. Nevertheless, the total quarterly dividend of $2.32 was only 2 cents lower than the prior quarter's $2.34 dividend.

Why This Dividend Payment Method Matters

Investors benefit from this because they can more reliably determine the potential dividend payment going forward. The company benefits from this because they know that only 50% of the adjusted FCF will be spent on dividends. This leaves room for debt payments and other uses of cash.

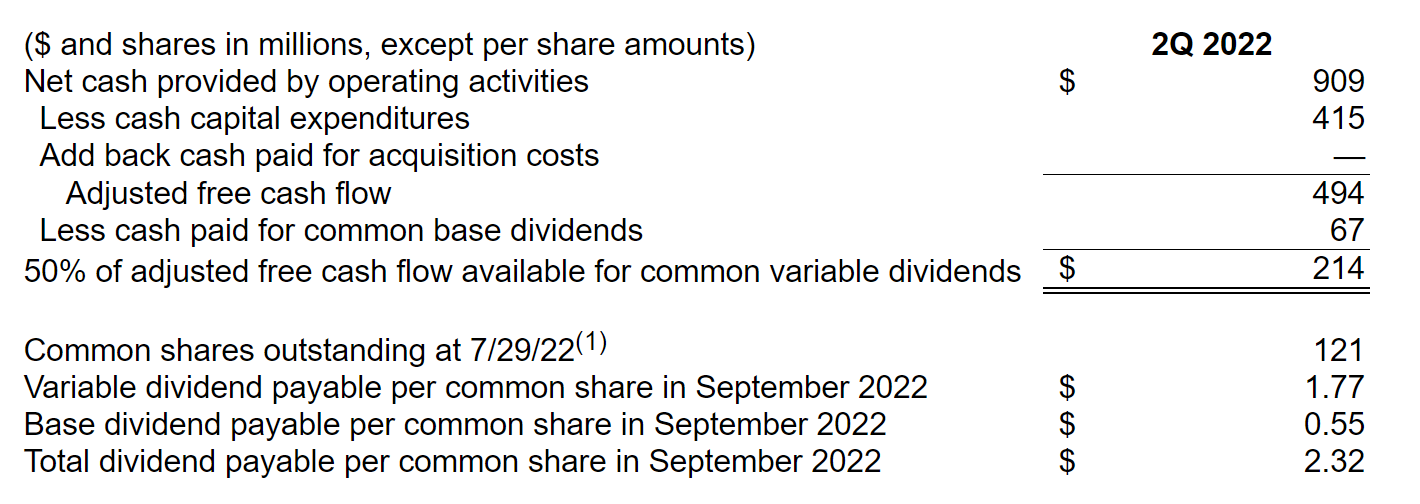

Moreover, Chesapeake does a very good job of showing how it calculates its dividend payment. The table below shows it came up with the Q2 payment that it announced on Aug. 2.

This shows that the variable portion is covered by $494 million in adj. FCF, and after deducting the base dividend payment and taking 50% of the remainder, or $214 million, the variable dividend works out to $1.77. This is because if you dividend $214 million by 121 million shares, it equals $1.77 per share.

On top of this, the company spent $475 million on share buybacks. That reduces the total number of shares outstanding and hence allows the variable dividend to be higher even if the adj. FCF stays level.

For example, if Chesapeake spends $475 million every quarter on buybacks, that works out to $1.9 billion annually. This works out to 16% of its $11.9 billion market value. In other words, the variable dividend could easily rise by 15% or more just from the share buybacks.

Where This Leaves Investors in CHK Stock

So far this year CHK stock is up 60% from $61.01 where it closed last year. Investors are still making money on the stock though given its huge dividend yield. In the last month, the stock has been more or less flat.

Even if the US enters into a recession it is not clear that natural gas prices will decline. For one, the international situation with the Ukraine war could keep the prices high.

Moreover, investors can rely on a huge amount of free cash flow from Chesapeake's major holdings in two major fields in the Marcellus (Appalachian basin) and Haynesville (East Texas) fields.

Bottom line: value investors are taking advantage of CHK stock's ample dividend yield and the company's powerful free cash flow which supports the ample dividend.

More Stock Market News from Barchart

/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)