Change is constant. As traders, we are responsible for keeping abreast of market changes and adapting. The markets are ever-changing, and a trader must be a student of the markets for life to survive the challenges.

We've all noticed that interest rates are on the rise. The interest rate futures products have been experiencing excessive volume as commercial entities find ways of hedging against rising interest rates.

Eurodollar markets

One of the most popular markets to hedge interest rates is the Eurodollar futures market. In 1981 the Chicago Mercantile Exchange (CME) launched the Eurodollar futures (GE) contract. Before this launch, all futures contracts had been physically settled; Eurodollar futures became the first cash-settled futures contract.

Eurodollars are US dollars deposited in banks outside the United States. Originally these deposits were in European banks, but over time dollars were being deposited in other foreign countries' banks looking to get a better return on their money. The term Eurodollar stayed with all US dollars deposited outside the US, regardless of the country. Eurodollar deposits were similar to US Treasury Bills, except they did not have the protection of their principal like a Treasury Bill. Due to this risk, Eurodollar investors received higher returns on their deposits.

When the Federal Reserve changes interest rates (raising or lower), they only impact short-term maturities treasury yields like Fed Funds, T-Bills, Eurodollar, and 2-year and 5-year T-Notes. Interest rate cycles are usually long, meaning the Federal Reserve can keep easing or increasing interest rates for long periods. The long end of the interest rate curve, 10-year, and 30-year maturities, are driven by market participants' perception of a weakening or strengthening economy. When the Federal Reserve is actively changing interest rates, the short end of the curve becomes very active and can create opportunities for traders. Notice on the following chart how the Eurodollar futures market has very long-term trends due to the duration of the Federal Reserves activity; a trend followers delight during these trends.

The upcoming change will occur in June 2023 when the CMEGroup exchange will convert all Eurodollar futures positions to the Secured Overnight Financing Rate (SOFR) futures contract.

Secured Overnight Financing Rate (SOFR) futures contract

For years the London Interbank Offered Rate (LIBOR) was the benchmark for setting yields of overnight lending between large banks. In November 2014, the Federal Reserve convened the Alternative Reference Rates Committee (ARRC). In June 2017, the ARRC endorsed the SOFR as its preferred alternative reference rate, basically replacing the LIBOR. Because LIBOR and SOFR have similar interest rates, the SOFR futures will closely track the expiring Eurodollar futures prices, making long-term historical analysis possible.

Since 2018, the SOFR futures and the Eurodollar futures have been trading on the CMEGroup exchange. Slowly, the volume is becoming more prominent in the SOFR contract as we get closer to June 2023, when Eurodollar futures cease trading.

Market participants have well received the SOFR futures contract. The CMEGroup reports 2,200+ global participants with volumes exceeding $1.5 trillion notional value per day. SOFR has an exceptional centralized liquidity pool, price discovery, and risk management.

SOFR specifications

| Contract: 3-month SOFR | Exchange: CMEGroup |

| Tick Size: 0.005 = $12.50 | Point Value: $2,500 |

| Initial margin: $825 | Maintenance Margin: $750 |

| Trading Hours: 17:00-16:00 CT (Sun-Fri) | Settlement: Financial |

| Quarterly Contracts: (Mar, June, Sep, Dec) | CME Symbol: SR3 |

| Asset: Interest Rates | Barchart Symbol: SQ |

SOFR futures specifications are very similar to the Eurodollar futures specifications. The CMEGroup is doing a great job making this transition seamless.

Unfortunately, there is not enough history of the SOFR futures contract to create seasonal patterns. The proxy will be the Eurodollar futures for this analysis until we have sufficient data for SOFR.

Source: CMEGroup

Hedgers and speculators can trade contacts of SOFR as far out into the future as ten years. The table above shows the volume depth providing liquidity for years out on the curve.

Spread Trading

SOFR futures intra-market spread trading has deep liquidity for managing spread trade risk. The Eurodollar contract had this same liquidity making it the go-to-market for yield curve traders looking to trade along different parts of the yield curve.

Affordable trading during these volatile times

As the volatility has increased in interest rates, the margin to trade has increased considerably. It forces smaller trading accounts out of the interest rate market during a superb trending environment.

Currently, the 30-year Bond (ZB) margin is $4,180 per contract with intra-day price movements of $1,625 per contract. At the same time, the SOFR margin is $825 per contract with intra-day price movements of $265 per contract.

The SOFR contract could be day traded or swing traded—plenty of opportunities without the excessive risk as in the Bond (ZB) contract.

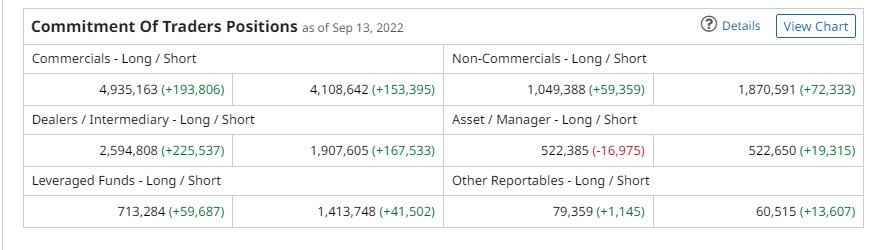

The Commitment of Traders Positions (COT report)

All the major participants have significant positions showing the acceptance of this relatively new futures contract.

Front-month contract of SOFR

As interest rates continue to increase, prices of interest-rate products will decline. Imagine if you had been aware of SOFR a year ago. A good trend-following strategy would be enjoying this ride down.

In Summary…..

Change is coming to the interest rate markets in June 2023. Since you read this far in the article, I'm assuming you're a student of the markets regardless of your experience. Congratulations!

Knowing you can participate in the SOFR market now creates another active market you can trade. And with the low margin requirements and reduced dollar moves per day, you may have more staying power to remain in your trade longer.

Many traders are discouraged from trading interest rate products because they trade in 32nds, causing frustration in calculating their profit and losses. The SOFR trades in a typical decimal format, much like most other markets do.

The key to interest rate trading opportunities is having an active Federal Reserve, and we can all agree they are incredibly busy now.

/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)