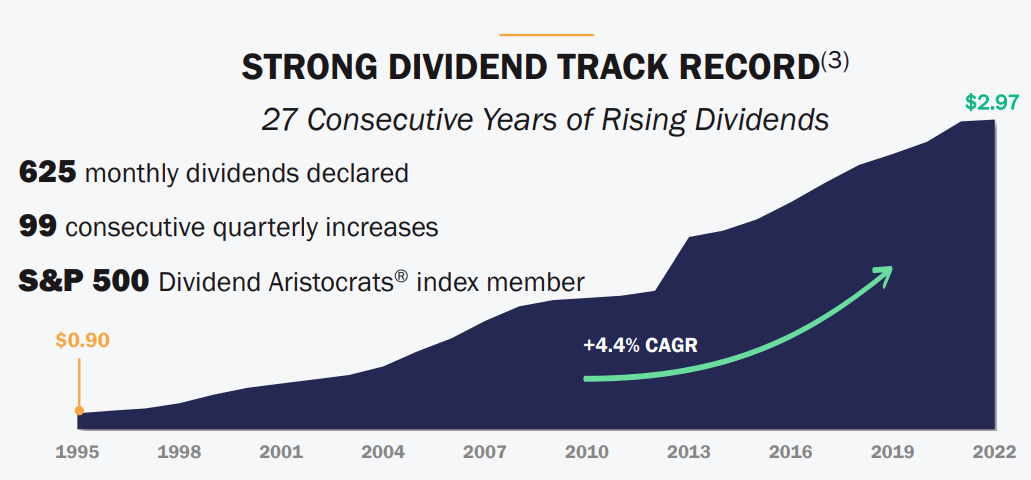

Realty Income Corp. (O), a large monthly pay REIT, is now in clear buy territory for many value investors. It trades with an annualized 4.45% dividend yield given its monthly dividend payment of 24.75 cents per share ($2.97 annually) and its price on Sept. 13 of $66.77.

The stock also provides attractive options income plays with covered calls and cash-secured puts can give extra income. This article will look into these opportunities.

Monthly Pay REIT

Realty Income is a very large, San Diego-based real estate investment trust (REIT) with a market capitalization of over $41 billion. It reported on Aug. 3 that the Q2 net income was 37 cents and its adjusted funds from operations (AFFO), a standard industry metric for cash flow, rose 10.2% to 97 cents for the quarter.

This shows that the 24.75 cents monthly dividend, or 74.25 cents quarterly, is still more than covered by the 97 cents AFFO cash flow figure. In other words, the company can afford this monthly dividend payment.

Attractive Entry Point

As the above table shows, the REIT stock has had a very stable and growing dividend. Nevertheless, as interest rates are still rising, investors have become less enamored with REIT stocks. For example, inflation came in at 8.3% for the twelve months ending August, according to the Bureau of Labor Statistics. This implies that the Federal Reserve will continue to raise rates by 75 basis points this month.

As a result, O stock has dropped over 10.5% in the past month. In fact, This provides an attractive entry point for value investors.

For example, in the last 4 years, the stock has had an average dividend yield of 4.16%. This implies that the stock has a target price of $71.39 (i.e., $2.97 dividend/4.16%). That represents a potential 6.9% upside in the stock.

This also helps investors who want to use short-income options plays that can provide additional income to enterprising investors.

Covered Call Income and Cash-Secured Put Income Plays

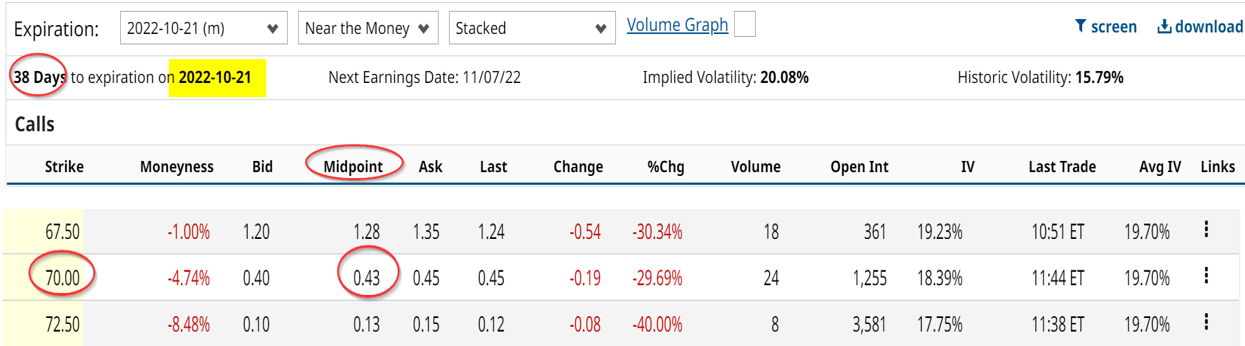

The table below shows that the $70 strike price for call options expiring Oct. 21 has an attractive mid-point price of 43 cents.

This implies that the covered call investor can make an additional 0.64% for the next month (i.e., $43 per covered call /$6,677 per 100 shares purchased at $66.77). That represents an annualized 7.7% yield. This is on top of the 4.45% monthly pay dividend yield. It also could potentially bring in an additional 4.8% in capital gains.

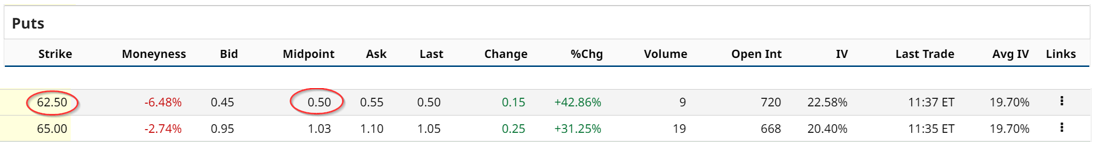

Moreover, a cash-secured put play can provide an even more attractive income play. For example, the put options chain below for Oct.21 shows that investor can earn 50 cents by shorting the $62.50 put strike price.

This implies that an investor can make $50 by agreeing to buy the stock at $62.50 if the stock falls by over 6% to that strike price or lower by Oct. 21. This effectively represents a 0.8% monthly return or an annualized rate of 9.6%.

However, investors with this cash-secured put play will not earn any of the monthly income as the covered call investors can. As a result, often investors will do both the covered call and the cash-secured put at the same time.

Either way, even without this additional option income, investors in O stock stand to make a very solid return with its attractive dividend yield now.

More Stock Market News from Barchart

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)