While CO2 is the most common greenhouse gas, methane is second. Livestock such as cattle, goats, and deer produce methanol when their stomachs break down hard fibers like grass during digestion.

Coal and other fossil fuels have been the most popular environmentalist targets, but some have turned their attention to methane-expelling cattle. While cows are sacred in India, many other carnivorous people worldwide continue to feast on beef despite the rising objections. The move to reduce methane will likely limit beef production, which could lead to higher prices over the coming years. Cattle are already in a bull (no pun intended) market in early 2023, with the grilling season on the horizon. In my Q4 2022 report on Barchart on the animal protein sector, I wrote, “the 2023 peak grilling season will begin in late May and run through early September. The futures markets will start reflecting the prospects for rising demand in the late winter. We may see higher highs in cattle and hogs over the coming months.

I am heading into 2023 will a bullish stance on the animal protein sector, which posted a double-digit percentage gain in 2022.” The environmentalist trend against cows may only exacerbate higher beef prices.

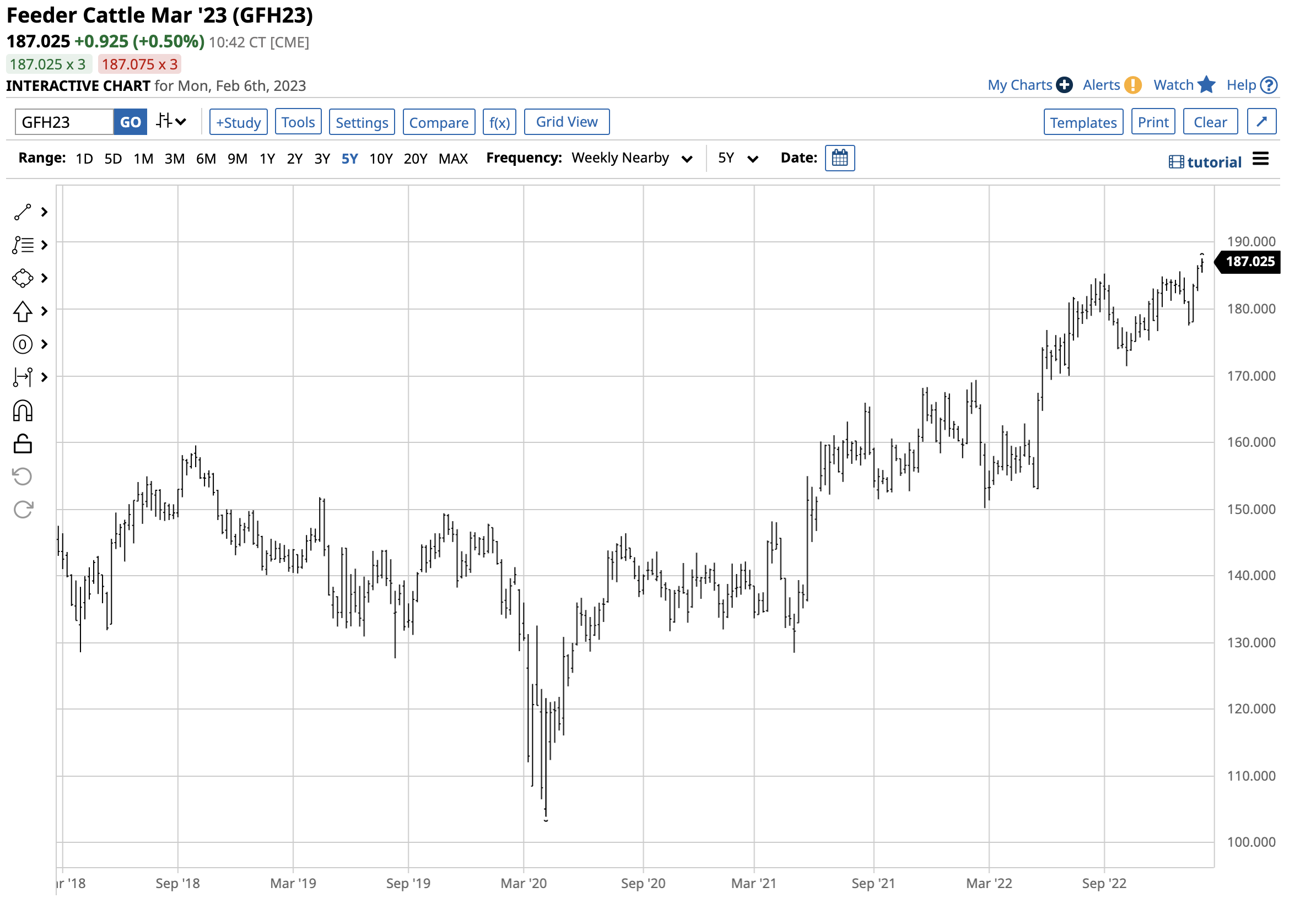

Live and feeder cattle futures trend higher

The continuous live and feeder cattle futures contracts on the Chicago Mercantile Exchange have been trending higher since the 2020 lows.

The chart highlights after trading to 81.45 cents per pound in April 20202, the lowest price since 2009, live cattle futures have made higher lows and higher highs, reaching the latest peak at over the $1.60 level in early February 2023.

The nearby feeder cattle futures fell to $1.0395 in April 2020, the lowest level since March 2010. Since then, a bullish trend has lifted the feeders to over the $1.85 per pound level. While live cattle display a more aggressive bullish path, the feeders have also experienced a significant rally.

Methane could be more severe than CO2 emissions

Environmentalists and scientists have warned that greenhouse gases are causing global warming.

Fossil fuels, oil, gas, and coal have been in the environmental crosshairs as the greener policies support alternative and renewable fuels and inhibit hydrocarbon production and consumption to reduce CO2 emissions.

Meanwhile, methane is one of the most potent greenhouse gases, with more than eighty times the warming potential of carbon dioxide over a twenty-year period. A Global Methane Pledge, launched in 2021, set a target to reduce worldwide methane output by 30% by 2030, compared to 2020 levels. When it comes to methane, it is not the emissions from motor vehicles but rather the emissions from cattle that eat and digest grass that comes out into the atmosphere as methane.

Taxing cattle to reduce methane- Bill Gates backs a start-up targeting cow gas

While many environmentalists favor reducing the cattle population by taxation and regulation, Bill Gates, co-founder of Microsoft (MSFT), has invested $12 million in an Australian company that plans to feed seaweed to cows to reduce the planet-heating emissions that come from cattle burps and flatulence. The Perth, Australian-based start-up is Rumin8. Bill Gates created Breakthrough Energy Ventures in 2015, funding the seaweed feed company. Jeff Bezos, the Amazon (AMZN) founder, and Jack Ma, Alibaba (BABA) founder, are investors in Gates’ Breakthrough Energy Ventures fund.

The days of grass-fed beef could fade into history if environmentalists have their way, and the cattle population could decline if the world rejects methane sources.

Seasonal rallies are on the horizon

In early February 2023, the annual grilling season is on the horizon. The futures market will begin to reflect the rising demand that starts on the Memorial Day weekend holiday in late May and runs through the Labor Day holiday in early September. As barbeque grills roll out of storage, beef demand tends to soar as the aroma of sizzling steaks, burgers, and hot dogs fill the warm air. The live and feeder cattle futures market tends to rally in the months leading up to the annual peak demand season.

Meanwhile, cattle futures prices have already established bullish trends as inflation has caused production costs to increase. Higher energy, labor, and, most of all, the highest feed prices in years have caused beef prices to move toward record peaks.

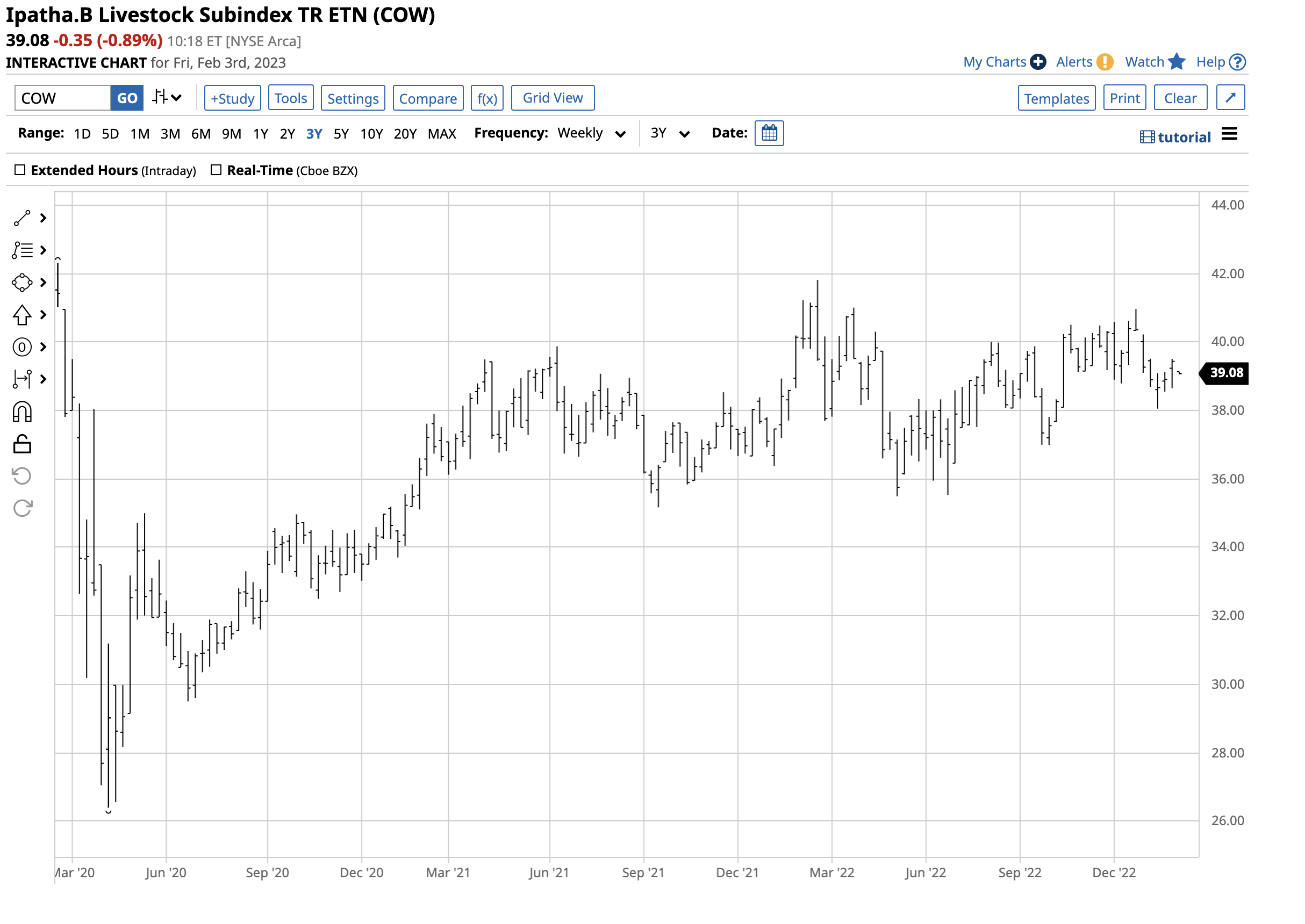

Burping and farting are bullish for the COW ETN product

Addressing climate change by limiting production or using more expensive feeds will only increase wholesale and retail beef prices. Few carnivorous consumers who enjoy an occasional steak, burger, dog, or other beef delicacies think about cattle burps and farts when they tuck into hearty meals. According to CHD Expert, a Chicago-based food service data analytics firm, “among the 12% of fund dining restaurants that are classified as chains, steakhouses reign supreme.”

The bottom line is addressing climate change makes cattle leading offenders, alongside the traditional energy sector. The battle against cattle stands to push prices higher and keep the bullish trend going, with new record highs on the horizon.

The most direct route for a risk position in cattle is via the CME’s live and feeder cattle futures. The iPath Series B Livestock Subindex TR ETN product (COW) tends to move higher and lower with cattle prices. At $39.08 per share on February 6, COW had $27.995 in assets under management. COW trades an average of 5,128 shares daily and charges a 0.45% management fee.

The chart highlights COW’s rise from the April 2020 $26.40 low to $39.23 on February 6, or 48.6%, as the ETN moved higher with live and feeder cattle prices.

With the 2023 grilling season on the horizon and cattle in the crosshairs of environmentalists, the odds favor a continuation of the bullish beef trend over the coming months.

More Livestock News from Barchart

- Hogs Close in Black on Friday

- New Week in Cattle Trade

- Hogs Close in Black on Friday

- Cattle Prices Close with Gains on Friday

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)