In Q3 2022, live cattle gained 8.07%, the feeders were 0.33% higher, and lean hogs fell 18.24%. The trend continued in Q4 with gains in cattle and a decline in hog futures. However, the meats posted a gain in the year that ended on December 30, 2022.

Live cattle lead the way on the upside in Q4 and 2022

Live cattle futures posted a 10.21% gain in Q4 and were 13.03% higher in 2022. In 2021, the live cattle futures rose 21.45%. Nearby February futures settled at $1.5790 per pound on December 30.

The three-year chart highlights the steady rally from the April 2020 81.45 cents low to the December $1.58925 high on the continuous futures contract. Live cattle settled near the high at the end of 2022 as the bullish trend continues to make higher lows and higher highs.

Feeder cattle post gains but trail the fat cattle as feed prices increase

Feeder cattle futures posted a 5.47% gain in Q4 and were 10.08% higher in 2022. In 2021, the feeder cattle futures rose 20.10%. Nearby January futures settled at $1.8370 per pound on December 30.

The chart dating back to 2020 illustrates the bullish trend in feeder cattle that rose from $1.0395 in April 2020 to a high of $1.8530 on the continuous futures contract in September 2022. While the trajectory of the rally in the feeders was not as significant as in the fat cattle, they closed not far off the continuous contract high from September.

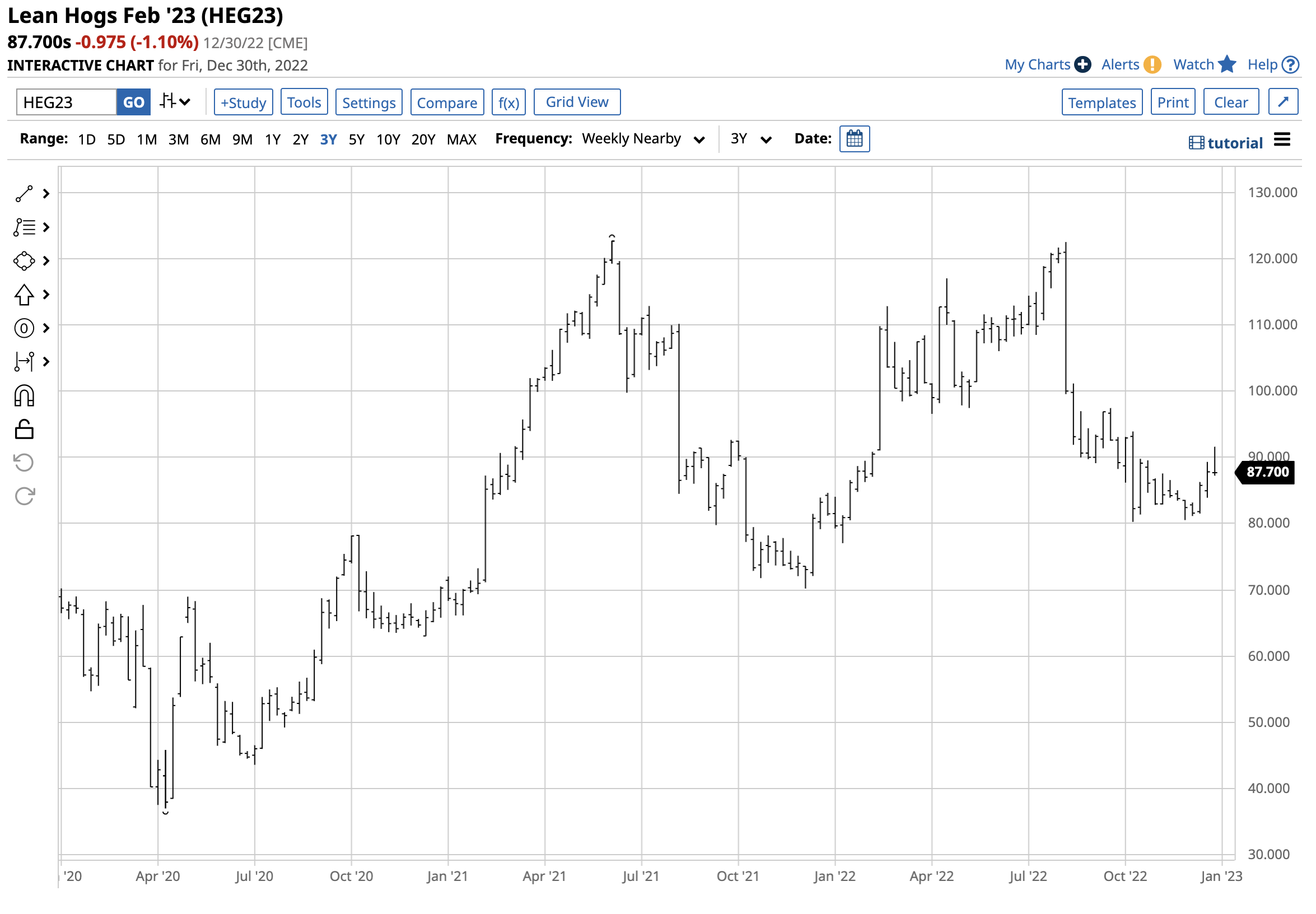

Lean hogs were down in Q4 but moved higher in 2022

Lean hog futures posted a 1.71% loss in Q4 but were 7.64% higher in 2022. In 2021, lean hog futures rose 15.94%. Nearby February futures settled at 87.70 cents per pound on December 30.

The three-year chart shows the pork market’s choppy but bullish price action since the hog futures fell to a 37.0 cents per pound low in April 2020. Seasonality in hogs took prices to lows during the fall and winter and highs in spring and summer.

Inflation pushed prices higher- COW posted gains in 2022

Inflation supported most commodities in 2022, and meats were no exception. The primary ingredient in feed prices is grains. Soybeans moved 14.34% higher in 2022, and soybean meal, found in most feeds, was 16.23% higher on the year. Corn prices gained 14.37%, and CBOT soft red winter wheat rallied 2.76% from the end of 2021.

Meanwhile, higher energy prices also increased animal protein production costs. NYMEX crude oil gained 6.71%, but heating oil futures, the proxy for diesel fuels, was 41.7% higher, and gasoline rose 11.40% from the end of 2021. Natural gas fell sharply after reaching its highest price since 2008 at over $10 per MMBtu, but at $4.475 per MMBtu on the nearby NYMEX futures contract on December 30 was still 19.97% higher for the year. The bottom line is that rising input costs and wages pushed meat prices higher.

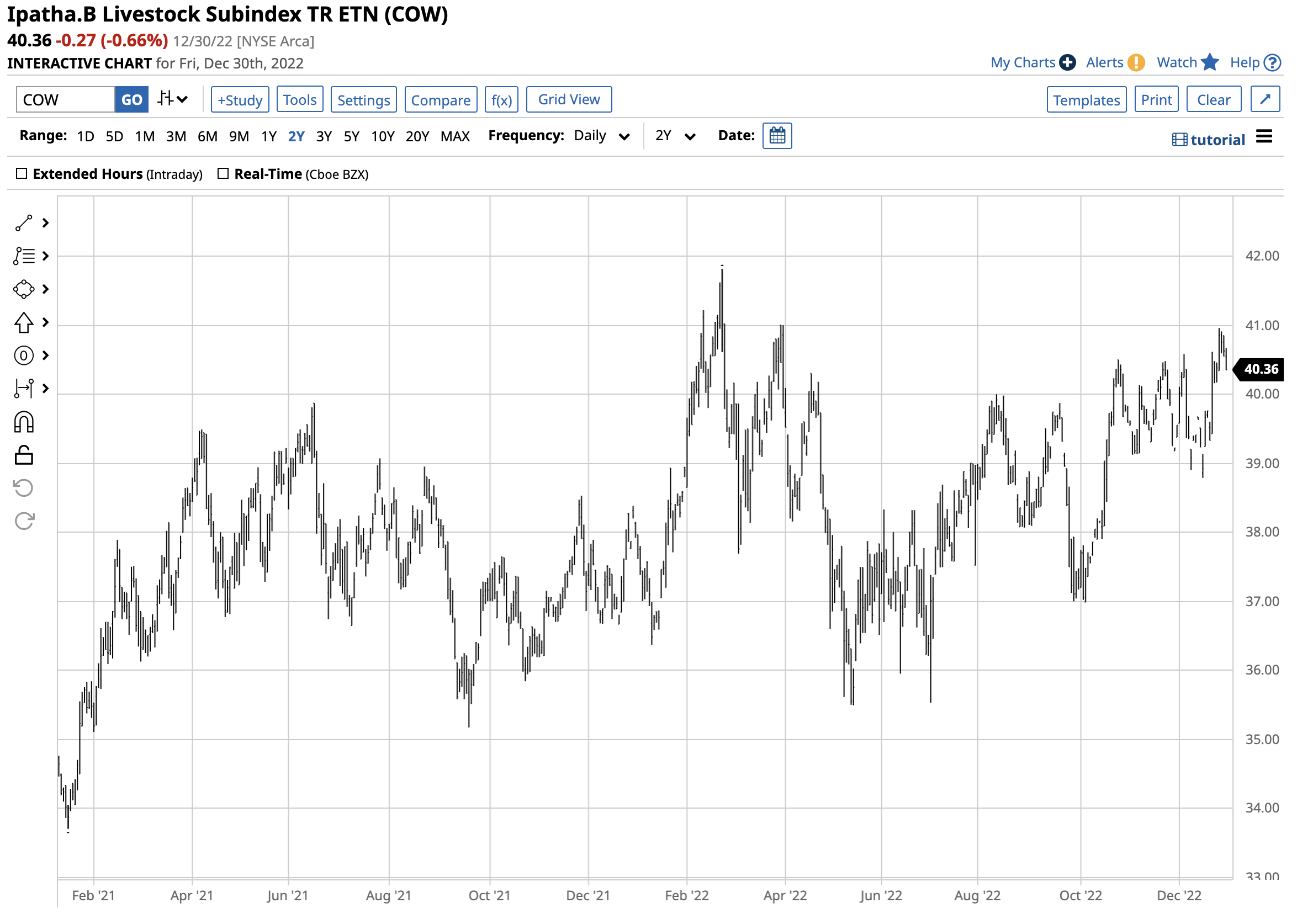

The iPath Series B Bloomberg Livestock Subindex Total Return ETF product (COW) increased with cattle and hog prices in 2022.

The chart shows the bullish path that took COW from $37.67 on December 31, 2021, to $40.36 per share on December 30, 2022, a 7.14% gain. The animal protein composite was 10.25% higher in 2022, so COW slightly underperformed the average gains in the live and feeder cattle and lean hog futures markets in 2022.

Looking forward to 2023 in the animal protein sector

As the meat futures move into 2023, the primary factor that will impact prices is the path of inflation. Grain and energy prices will play a leading role in the direction of beef and pork prices.

Meanwhile, the 2023 peak grilling season will begin in late May and run through early September. The futures markets will start reflecting the prospects for rising demand in the late winter. We may see higher highs in cattle and hogs over the coming months.

I am heading into 2023 will a bullish stance on the animal protein sector, which posted a double-digit percentage gain in 2022.

More Livestock News from Barchart

- Hog Futures Closed Mixed into the 3-Day Weekend

- Dec Cattle Drop on Last Trade Day

- Mixed Midday for Hogs

- Cattle Fade as Grains Rally Back

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)