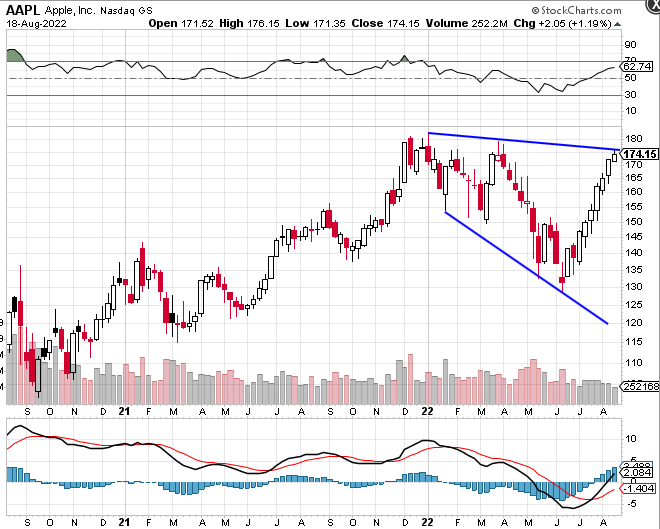

Carter Worth of Worth Charting appeared on CNBC’s Fast Money on Wednesday with a big warning about AAPL stock.

According to Worth, “My thinking is that it’s just too steep, uncorrected, almost unnatural.”

And that “Some analysts have price targets as high as $220 and others that are as low as $140.”

Clearly, we can see there is a potential level of resistance here, or at least an area where the stock might need to take a pause.

Let’s look at a couple of option trades that might benefit from a potential Apple stock correction.

AAPL BEAR CALL SPREAD

A bear call spread is a type of vertical spread, meaning that two options within the same expiry month are being traded.

One call option is being sold, which generates a credit for the trader. Another call option is bought to provide protection against an adverse move.

The sold call is always closer to the stock price than the bought call.

As the name suggests, this trade does best when the stock declines after the trade is open.

However, there can be many cases where this trade can make a profit if the stock stays flat and even if it rises slightly.

Traders that think Apple (AAPL) will stay below 185 between now and mid-September could look at a bear call spread.

Using the September 16 expiry, the trade would involve selling the 185 call and buying the 190 call. That spread could be sold for around $0.60 which means the trader would receive $60 into their account. The maximum risk is $440 for a total profit potential of 13.63%

The breakeven price is 185.60. This can be calculated by taking the short call strike and adding the premium received.

As the spread is $5 wide, the maximum risk in the trade is 5 – 0.60 x 100 = $440.

AAPL BEAR PUT SPREAD

More aggressively bearish option traders might look at a bear put spread.

A bear put spread is a vertical spread that aims to profit from a stock declining in price. It has a bearish directional bias as hinted in the name. Unlike the bear call spread, it suffers from time decay so traders need to be correct on the direction of the underlying and also the timing.

A bear put spread is created through buying an out-of-the-money put and selling a further out-of-the-money put.

The maximum profit is equal to the distance between the strikes, less the premium paid. The loss is limited to the premium paid.

Traders could look to buy the September 16 put with a strike price of 165 and sell the 160-strike put.

The cost of the trade would be around $75 which is also the maximum loss with the maximum possible gain being $425. The maximum gain would occur if Apple stock fell below 160 on the expiration date.

The breakeven price is 159.25.

BEARISH CALENDAR SPREAD

Assuming a trader had a price target for AAPL of $150 in the next month. In that case a bearish calendar spread could make sense.

The trade would involve selling the September 16, 150-strike put for around $45 and buying the October 21, 150-strike put for around $165.

The net cost of the trade would be $120 which is also the maximum possible loss.

The maximum profit is estimated at around $510, although this can change depending on changes in implied volatility.

Best of luck traders.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in some of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, August 18, 2022.

More Stock Market News from Barchart

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)