ChargePoint Holdings (CHPT) has had an unusually high put and call option volume ahead of its earnings release on Aug. 30 for the quarter ending July 31. After analyzing these trades it seems to imply a bullish run for CHPT in the next week when the call options (not the puts) expire on Aug. 19.

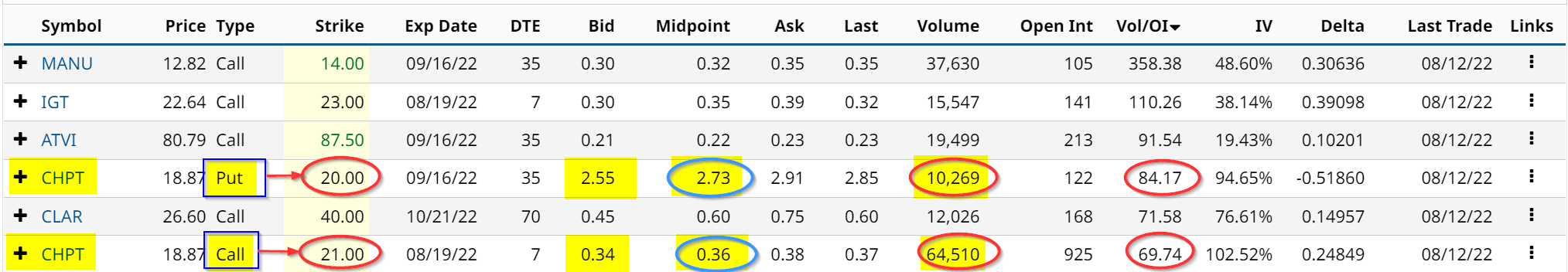

This activity can clearly be seen in the Unusual Options Activity Report by Barchart on Sunday, Aug. 14. Take a look at this report, and the two tranches of CHPT options I have highlighted.

This shows that some enterprising institutional investor likely sold 10,269 in-the-money put contracts at a $20 strike price (i.e, $1.13 over the present price of $18.87) and received $2.6 to $2.8 million dollars. This depends on whether they sold the contracts at the bid price of $2.55 (i.e, $2.55 x 100 x 10,269 = $2.618 million), or the midpoint price (i.e., $2.73 x 100 x 10,269 = $2.803 million). This contract expires on Sept. 16, so they still have 35 days before the long owners will exercise the puts.

How This Speculation Works

Why would they do this? After all it immediately implies that that the investor will have to pay $20 for CHPT stock, even though they could buy it now at $18.87. Well, first, they expect that after the earnings release on Aug. 30, the stock will have moved significantly higher. This might put it into out-of-the-money status.

Second, after receiving the $2.55 per share by selling at the bid price, the investor actually makes a profit, since $20 (strike price) minus $2.55, is $17.45. So the investors' all in net cost now is 7.5% cheaper than the existing price.

Third, and more importantly, it allows the investor to purchase a huge amount of call options that expire on Aug. 19 in just 7 days. For example, the 64,510 contracts in the chart above have a $21.00 strike price. The price at the midpoint is 36 cents, so the total cost of the venture is just $2.322 million (i.e., $0.36 x 100 x 64,510). In other words, the money from the put sales ($2.6 to $2.8 million) more than covers the $2.3 million cost of the short-dated call options. In fact, there is almost $500K left over as a profit.

In other words, the investor pays for his speculation that CHPT stock will spike this week by selling longer-dated puts. It's almost a “free” spin on CHPT stock rising this week, well in advance of the Aug. 30 earnings release. This will put huge pressure on CHPT to rise over $20 this week, a gain of 6%.

I highly suspect that the investor will likely repeat this speculation over the next several weeks. I found out last quarter that a group of investors did this trade in anticipation of the Q1 earnings and I wrote about it on May 23 and the results of the trade on May 30.

What Investors Can Do Now

The two simplest ways to play this expected spike in CHPT stock are this: buy the $20 call options for expiration on Aug. 19, just like the investor above, or sell covered calls for those same call options.

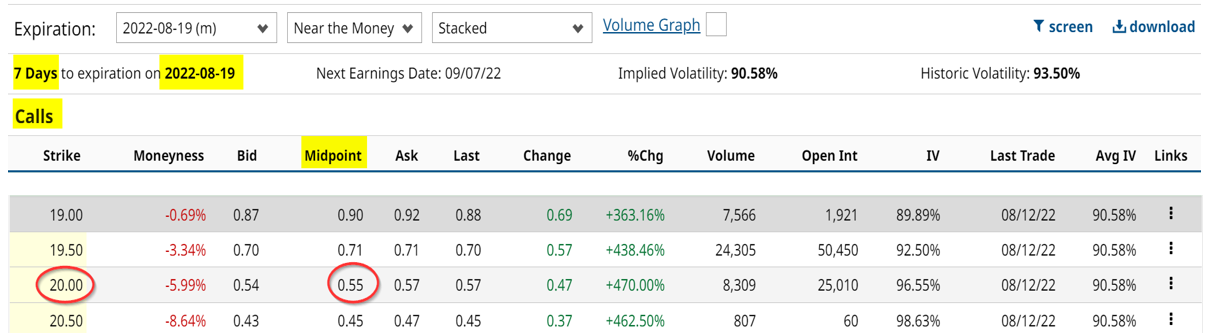

Let's look at these plays. First, the long call option play is highly speculative. The $20 call options are out-of-the-money. The chart below shows that they are now trading for 55 cents at the midpoint. In other words, the long call investor in this play above has already got a huge profit of 52% (i..e, $0.55/$0.36 paid for the calls).

This is a highly speculative play. If you have the margin and credit in your account you can try to emulate the institutional investor's play by selling longer-dated in-the-money puts to pay for this call play. But I do not think most investors should do this since it could very easily require a huge outlay of cash to purchase the stock at the in-the-money price of $21 or something like that.

Another way to more conservatively play this would be to buy the stock on Monday, Aug. 15 at close to $18.87 and then sell covered calls at the $20 strike price for expiration of Aug. 19. That represents a return of 2.91% (i.e., $55/1,887 for 100 shares purchased). Moreover, if CHPT rises to $20 or higher by Aug. 19, the investor keeps the additional capital gain of $113 and makes a total return of $168 (i.e., $55 call income and $113 capital gain) or 8.90% in just one week. This is a more conservative way to play the expected spike in CHPT stock this week.

Either way, expect to see a lot of electricity in CHPT stock, and especially its call options this week and the next two and half weeks before ChargePoint announces its earnings on Aug. 30.

More Stock Market News from Barchart

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)